Growth opportunities

In view of the dynamic market development of fiber-optic connections, mobile internet, and cloud applications, our growth opportunities are clearly apparent: universally accessible, increasingly powerful broadband connections are enabling new and more sophisticated cloud applications. These internet-based programs for end users and companies will remain our growth drivers over the coming years – both as stand-alone products in our Applications division as well as in combination with landline and mobile access products in our Access division.

With our many years of experience as an access and applications provider, our expertise in software development, the operation of networks and data centers, marketing, sales, and customer support, as well as our strong and well-known brands, and our customer relationships with millions of private users, freelancers, and small companies in Germany and abroad, we are well placed to exploit the further market growth in our business fields.

Access division

In the Access division, our operations are pooled in the segments Consumer Access and Business Access.

Consumer Access segment

The Consumer Access segment comprises landline-based broadband products (including the respective applications, such as home networks, online storage, Smart Home, IPTV, and video-on-demand), as well as mobile internet products for private users.

These internet access products are offered to our customers as subscription contracts with fixed monthly fees (and variable, volume-based charges).

With the broadband products of the 1&1 brand (especially VDSL/vectoring and fiber-optic connections), we are one of Germany’s leading suppliers.

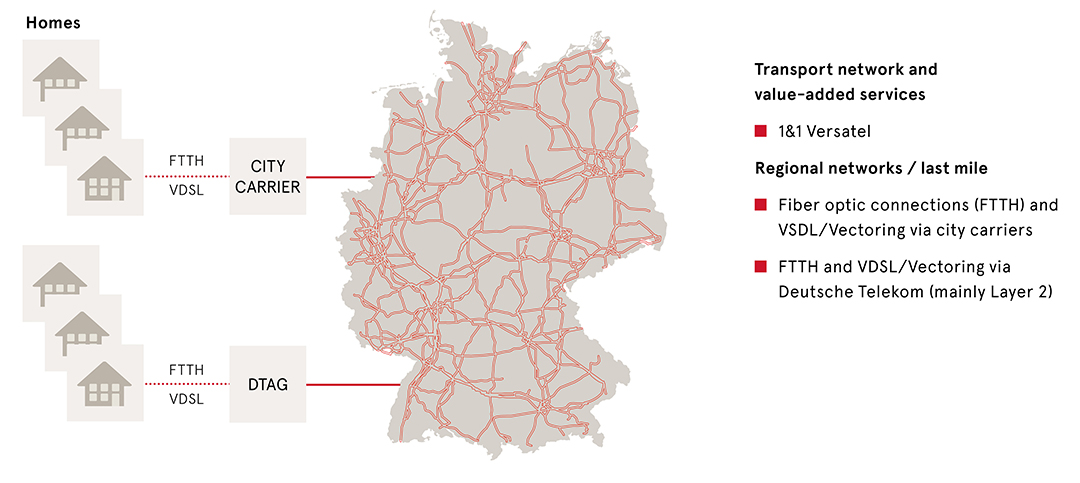

We use 1&1 Versatel’s own fiber-optic network as the transport network, and for both VDSL/vectoring connections and direct fiber-optic connections (FTTH) we use city carriers and Deutsche Telekom (mainly Layer-2) for the “last mile”. In the case of business with ADSL connections (currently being phased out), further advance service providers are used.

Landline infrastructure for private customers

We are also one of the leading providers of mobile internet products in Germany.

1&1’s mobile communications network has been fully functional since December 8, 2023. Wherever we do not yet have sufficient mobile coverage during the years of network expansion, we use national roaming. This is currently provided by Telefónica and as of summer 2024 national roaming services will be procured from Vodafone. National roaming is a standard procedure used in the rollout of new mobile networks that enables customers to surf and make calls without interruption in areas not yet covered. This is achieved by automatically using the roaming partner’s antennas in these areas.

Until our more than 12 million existing customers have been migrated to the 1&1 mobile network, we will also use the Telefónica mobile network as a so-called Mobile Virtual Network Operator (MVNO), as well as MVNO capacities of Vodafone. As of the beginning of 2024, our existing MVNO customers are being gradually migrated to the 1&1 mobile network.

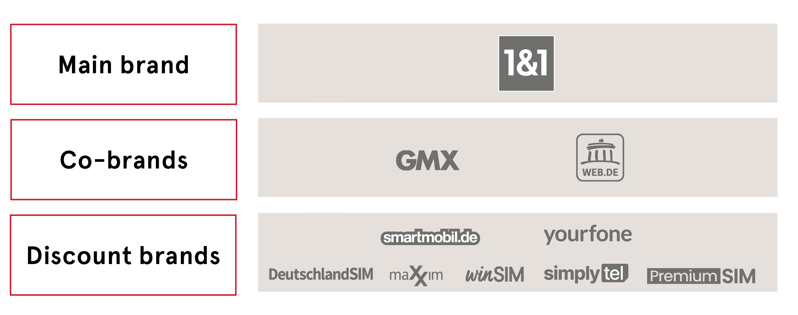

Our mobile internet products are marketed via the premium brand 1&1 as well as via discount brands, such as winSIM and yourfone, which enable us to target a wide range of specific user groups in the mobile communications market.

Our brands

In addition to preparations for the launch of mobile services in the 1&1 mobile network in December 2023, the Consumer Access segment once again focused on adding further valuable broadband and mobile internet contracts in the fiscal year 2023.

The total number of fee-based contracts in the Consumer Access segment rose by 480,000 contracts to 16.26 million in 2023. As expected, the number of broadband connections decreased by -90,000 to 4.01 million, but stabilized in the fourth quarter of 2023. In the reporting period, mobile internet contracts increased by 570,000 to 12.25 million.

Development of Consumer Access contracts in the fiscal year 2023

Consumer Access, total contracts | 16.26 | 15.78 | + 0.48 |

thereof Mobile Internet | 12.25 | 11.68 | + 0.57 |

thereof broadband connections | 4.01 | 4.10 | - 0.09 |

in million | Dec. 31, 2023 | Dec. 31, 2022 | Change |

In view of our strong brands, innovative products, customer-oriented services, flexible pricing policy, and our excellent value for money, we believe the Consumer Access segment is also very well positioned for the future. In addition to the rollout of the 1&1 mobile communications network, the Consumer Access segment will focus in particular on marketing mobile internet products and winning high-quality customer relationships in the fiscal year 2024.

Business Access segment

In the Business Access segment, 1&1 Versatel offers a wide range of telecommunication products and solutions for business customers.

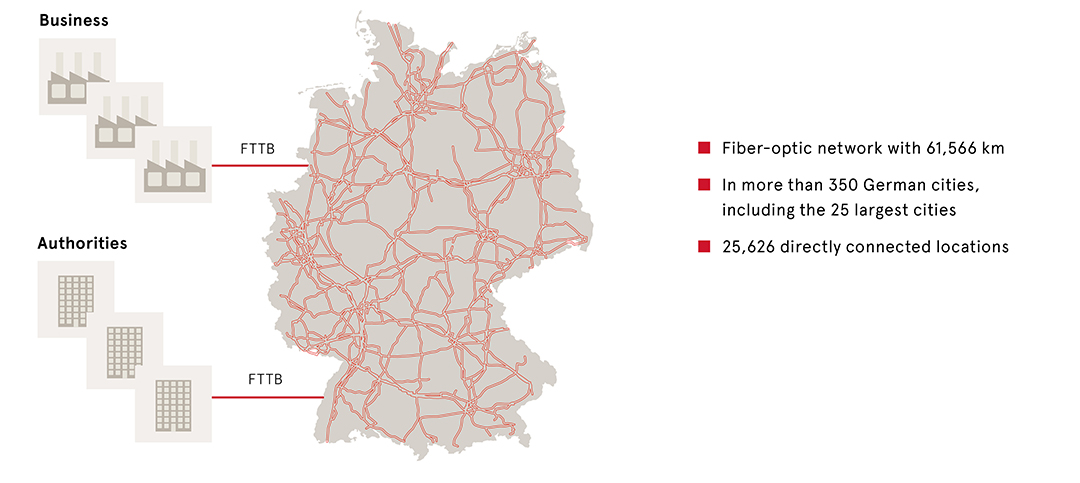

The core of 1&1 Versatel’s business model is a modern fiber-optic network with a length of over 61,000 km, which is one of the largest networks in Germany a nd is constantly being expanded.

1&1 Versatel uses this network to offer telecommunication products – from standardized fiber-optic direct connections to tailored ICT solutions (voice, data and network solutions) – to companies and local authorities. In addition, the 1&1 fiber-optic network is offered for infrastructure services (wholesale) to national and international carriers.

The fiber-optic network directly connects commercial buildings and local authority sites.

Fiber-optic infrastructure for business customers

In the fiscal year 2023, the key topics in the Business Access segment were the expansion of the fiber-optic network and the addition of further sites. In total, the network was expanded from 55,459 km in the previous year to a length of 61,566 km. In line with our strategy of steadily expanding network coverage, we acquired four fiber-optic networks from BT in early July 2023. The city networks in Munich, Frankfurt, Düsseldorf, and Stuttgart have a total length of 1,590 km. In 2023, the number of sites connected to the fiber-optic network increased from 23,464 to 25,626.

In 2024, the Business Access segment will continue to expand its fiber-optic network and connect further locations. In addition, the commercial customer and wholesale business is to be further developed.

The development of the German telecommunications market is of particular importance for the Access division. The industry association Bitkom forecasts that the market’s moderate growth of the previous year will continue. Specifically, the total market is likely to grow by 1.0% (prior year: 1.7%) to € 72.8 billion in 2024.

The strongest growth in this segment is expected to come from business with telecommunications services, which is set to grow by 1.6% (prior year: 1.9%) to € 52.6 billion. Total spending on telecommunications infrastructure is expected to decrease slightly by -1.0% (prior year: 4.4%) to € 8.4 billion. Sales of end-user devices are likely to be on a par with the previous year with a slight decline of -0.2% (prior year: -0.7%) to € 11.8 billion.

Market forecast: telecommunications market in Germany

Sales | 72.8 | 72.1 | + 1.0% |

in € billion | 2024e | 2023 | Change |

Source: Bitkom, January 2024

Applications division

The Applications division comprises United Internet’s activities in the segments Consumer Applications and Business Applications.

Consumer Applications segment

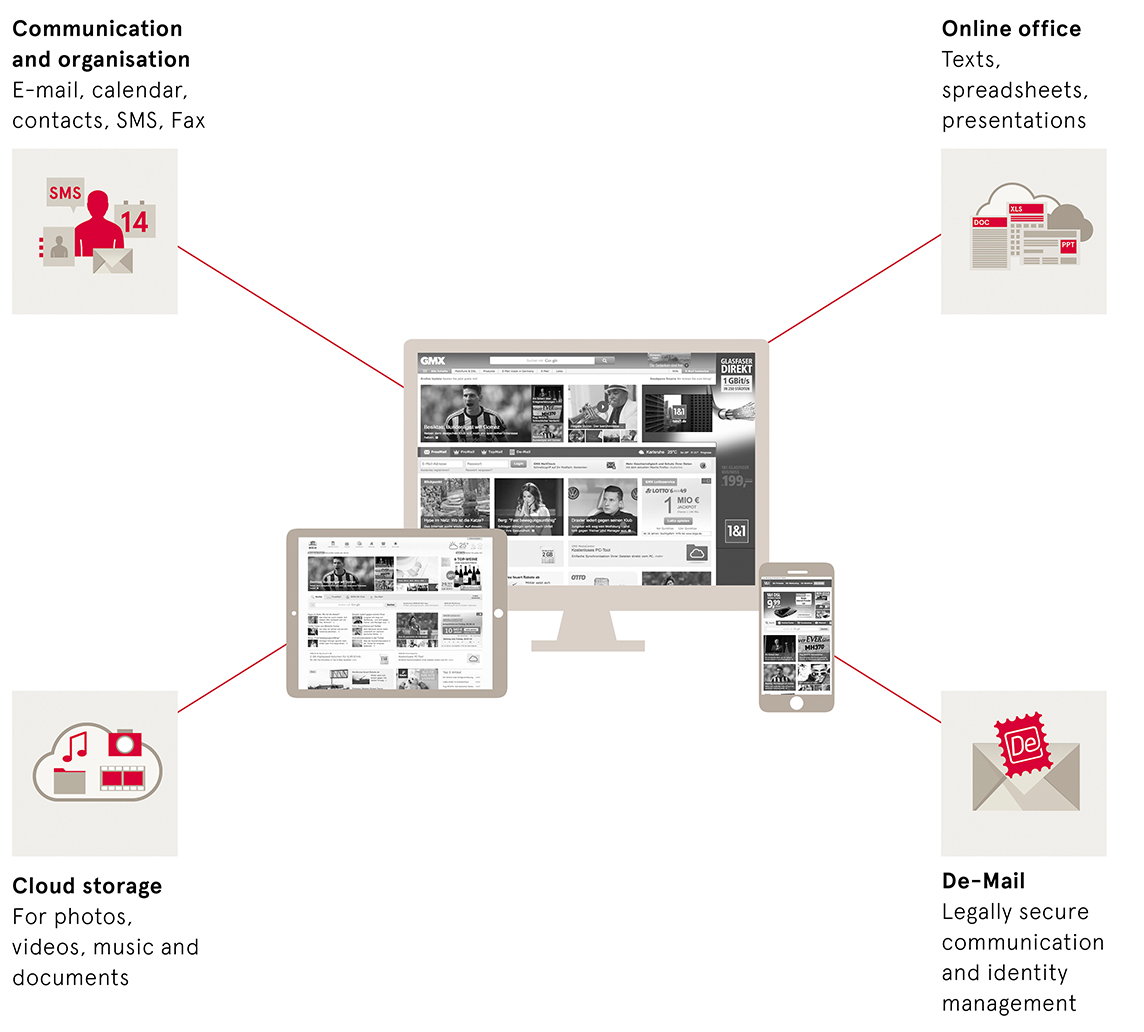

Our applications for home users are pooled in the Consumer Applications segment. These mainly comprise Personal Information Management applications (e-mail, to-do lists, appointments, addresses) and online storage (cloud) , as well as domains, website solutions tailored to consumer needs, and office software.

By steadily expanding our portfolio, we have developed the GMX and WEB.DE brands – the most widely used e-mail providers in Germany for many years now – from pure e-mail service providers into complete command centers for communication, information, and identity management.

From e-mail service to command center for communication, information, and identity management

Our consumer applications are nearly all developed in-house and run at the Group’s own data centers. The products are offered as fee-based subscriptions (pay accounts) or in the form of ad-financed accounts (free accounts). These free accounts are monetized via classic – but increasingly also via data-driven – online advertising, which is marketed by United Internet Media.

With their ad-financed applications and fee-based consumer applications, GMX and WEB.DE are primarily active in Germany, Austria, and Switzerland, where they are among the leading players.

We are driving our international expansion with mail.com. In addition to the USA, mail.com targets countries such as the UK, France, and Spain.

Activities in the Consumer Applications segment focused on the establishment of data-driven business models and expansion of customer relationships in 2023. The number of fee-based pay accounts (contracts) rose by 200,000 to 2.84 million in the fiscal year 2023. Ad-financed free accounts were 0.9% or 380,000 accounts down on December 31, 2022, due in particular to the successful conversion to fee-based customer relationships (200,000).

Development of Consumer Applications accounts in the fiscal year 2023

Consumer Applications, total accounts | 42.77 | 42.95 | - 0.18 |

thereof with Premium Mail subscription (contracts) | 2.05 | 1.89 | + 0.16 |

thereof with Value-Added subscription (contracts) | 0.79 | 0.75 | + 0.04 |

thereof free accounts | 39.93 | 40.31 | - 0.38 |

in million | Dec. 31, 2023 | Dec. 31, 2022 | Change |

With its strong and specialized brands, constantly growing portfolio of cloud applications, and already established business relationships with millions of home users, our Consumer Applications segment is well positioned to exploit emerging opportunities in the cloud computing market for home users, as well as in the advertising-oriented big data business.

In the fiscal year 2024, the key topics will be the further expansion of data-driven business models and a focus on fee-based premium products.

Business Applications segment

In the Business Applications segment, IONOS opens up online business opportunities for freelancers and SMEs, while also helping them to digitize their processes. It offers a comprehensive range of powerful applications, such as domains, websites, web hosting, servers, e-shops, group work, online storage (cloud), and office software, which can be used via subscription agreements. In addition, cloud solutions and cloud infrastructure are offered.

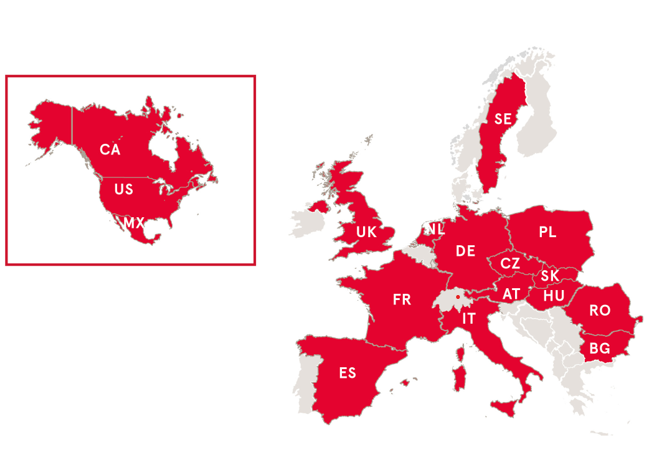

Our business applications are developed at in-house development centers or in cooperation with partner firm s. IONOS is also a leading global player in this segment with activities in various European countries (Germany, France, the UK, Spain, Portugal, Italy, the Netherlands, Austria, Poland, Hungary, Romania, Bulgaria, Czech Republic, Slovakia, and Sweden), as well as in North America (Canada, Mexico, USA).

IONOS footprint

Our business applications are marketed to specific target groups via the brands IONOS, Arsys, Fasthosts, home.pl, InterNetX, STRATO, united-domains, and World4You. In addition, Sedo offers professional services in the field of active domain management, while we22 offers other hosting suppliers a white-label website builder for the creation of high-quality websites.

In 2023, the Business Applications segment focused on up- and cross-selling measures for existing customers as well as the acquisition of new customer relationships. The total number of fee-based contracts for business applications increased by 350,000 contracts, resulting from 160,000 new contracts in Germany and 190,000 abroad. The total number of contracts therefore rose to 9.39 million.

Development of Business Applications contracts in the fiscal year 2023

Business Applications, total contracts | 9.39 | 9.04 | + 0.35 |

thereof in Germany | 4.59 | 4.43 | + 0.16 |

thereof abroad | 4.80 | 4.61 | + 0.19 |

in million | Dec. 31, 2023 | Dec. 31, 2022 | Change |

With our strong and specialized brands, a steadily growing portfolio of cloud applications, and existing relationships with millions of home users, freelancers, and small businesses, we are also well positioned in our Business Applications segment. We aim to further exploit the opportunities offered by the cloud computing market for business clients – in Germany and abroad. T he segment will continue to focus on expanding business with existing customers and gaining new high-quality customer relationships in 2024. It also aims to expand its cloud business in particular.

The trend toward the increasing use of cloud applications is working in favor of our Applications division – both for Consumer and Business Applications. Following very strong growth in 2023 (17.8%), Gartner forecasts global growth for public cloud services of 20.4% to USD 678.79 billion in 2024.

Market forecast: global cloud computing

Global sales of public cloud services | 678.79 | 563.59 | + 20.4% |

thereof Application Infrastructure Services (PaaS) | 176.49 | 145.32 | + 21.5% |

thereof Application Services (SaaS) | 243.99 | 205.22 | + 18.9% |

thereof Business Process Services (BPaaS) | 72.92 | 66.34 | + 9.9% |

thereof Desktop as a Service (DaaS) | 3.16 | 2.78 | + 13.5% |

thereof System Infrastructure Services (IaaS) | 182.22 | 143.93 | + 26.6% |

in $ billion | 2024e | 2023 | Change |

Source: Gartner, Public Cloud Services, Worldwide, 2021-2027, 3Q23 Update, November 2023

There are also opportunities for the refinancing of free applications via advertising. After a 7.0% increase in online advertising in 2023, PricewaterhouseCoopers expects further growth in 2024 with an increase in total market volume (mobile advertising and desktop advertising) of 5.3% to € 14.18 billion.

Market forecast: online advertising in Germany (mobile advertising & desktop advertising)

Online advertising revenues | 14.18 | 13.47 | + 5.3% |

in € billion | 2024e | 2023 | Change |

Source: PricewaterhouseCoopers, German Entertainment and Media Outlook 2023 – 2027, September 2023