2.2 Business development

Segment reporting changed from “controlling view” to “accounting view”

In the course of preparing the Interim Financial Statements as at March 31, 2023, the Management Board decided to make a significant adjustment to its internal reporting system. As a consequence, this change also led to a revision of segment reporting with a shift in focus from the previous “controlling view” to the “accounting view”. This decision was intended to strengthen the harmonization of the Company’s internal controlling and external reporting. The change resulted in reconciliation effects/shifts in key sales and earnings figures among the segments.

- Reconciliation effects on sales: certain intercompany sales are no longer consolidated at segment level (as previously in the controlling view), but only at Group level (accounting view).

- Reconciliation effects on EBITDA and EBIT: depreciation allocations and profit margins for intercompany services are no longer “netted” between segments (as was previously the case for internal service charging in the controlling view) but are disclosed (accounting view) – as if “booked” at segment level.

Overall, the change has no effect on the Group’s sales and earnings figures, as reporting at Group level was already based on the “accounting view”.

By making this change at segment level, United Internet is also taking account of the increasing independence of its segments (subgroups) and aligning segment reporting with the reporting of its listed and thus also reportable subgroups 1&1 AG (Consumer Access segment) and IONOS Group SE (Business Applications segment).

A reconciliation of sales, as well as operating EBITDA and EBIT, for the preceding quarters Q1 2022 - Q4 2022 and the fiscal years 2019 - 2022 is presented in the Notes on the Interim Statement Q1 2023 (page 28 et seq.).

Use and definition of relevant financial performance measures

In order to ensure the clear and transparent presentation of United Internet’s business trend, the Group’s Annual Financial Statements and Interim Financial Statements include key financial performance measures – in addition to the disclosures required by International Financial Reporting Standards (IFRS) – such as EBITDA, the EBITDA margin, EBIT, the EBIT margin, and free cash flow.

United Internet defines these measures as follows:

- EBIT: Earnings before interest and taxes represents the operating result disclosed in the statement of comprehensive income.

- EBIT margin: Presents the ratio of EBIT to sales.

- EBITDA: Earnings before interest, taxes, depreciation, and amortization are calculated as EBIT/operating result plus the depreciation and amortization (disclosed in the Consolidated Financial Statements) of intangible assets and property, plant, and equipment, as well as assets capitalized in the course of company acquisitions.

- EBITDA margin: Presents the ratio of EBITDA to sales.

- Free cash flow: Calculated as cash flow from operating activities (disclosed in the consolidated financial statement), less capital expenditure for intangible assets and property, plant, and equipment, plus payments from the disposal of intangible assets and property, plant, and equipment.

Insofar as necessary for a clear and transparent presentation, these indicators are adjusted for special items and disclosed as “key operating figures” (e.g., operating EBITDA, operating EBIT, and operating EPS). A reconciliation of EBITDA, EBIT, EBT, net income, and EPS (according to the consolidated statement of comprehensive income) with figures adjusted for special items can be found in chapter 2.3 “Position of the Group”.

Such special items usually refer solely to those effects capable of restricting the validity of the key financial performance measures with regard to the Group’s financial and earnings performance – due to their nature, frequency, and/or magnitude. All special items are presented and explained for the purpose of reconciliation from the unadjusted key financial figures to the key operating figures in the relevant section of the financial statements.

By contrast, expenses for the 1&1 network rollout or start-up costs for new business fields of 1&1 Versatel are not adjusted but disclosed – should there be any – in the respective sections.

Currency-adjusted sales and earnings figures are calculated by converting sales and earnings figures with the average exchange rates of the comparative period, instead of the current period.

The most important key financial figures for managing the Group are sales and operating EBITDA according to IFRS.

Actual and forecast development 2023

United Internet AG maintained its growth trajectory in the fiscal year 2023 and reached its guidance for the fiscal year 2023, as issued in March 2023 and updated in November 2023.

Forecast development

In an ad-hoc announcement on March 29, 2023, United Internet published its guidance for the fiscal year 2023 and updated it during the year as follows:

Sales | approx. € 6.2 billion (2022: € 5.915 billion) | approx. € 6.2 billion (2022: € 5.915 billion) |

EBITDA | at the previous year's level (1) (2022: € 1.272 billion) | slight increase (1) (2022: € 1.272 billion) |

Forecast 2023 (March 2023) | Specification (November 2023) |

(1) This includes around € -120 million (2022: € -52.4 million) for the expansion of the 1&1 mobile network

Actual development

In the fiscal year 2023, consolidated sales rose by 5.0%, from € 5.915 billion in the previous year to € 6.213 billion and were thus slightly above the sales forecast (March 2023: approx. € 6.2 billion).

Without consideration of non-cash valuation effects from derivatives (€ -0.5 million in the previous year; € -6.3 million in 2023) and additionally adjusted for IPO costs in connection with the IPO of Group subsidiary IONOS Group SE (€ -8.8 million in the previous year; € -1.7 million in 2023), operating EBITDA for the Group in the fiscal year 2023 amounted to € 1.300 billion and was thus 2.2% above the comparable prior-year figure (€ 1.272 billion). As a result, EBITDA was above the original EBITDA forecast (“on a par with the previous year”) and within the range of the EBITDA update (“slight increase”) – despite higher expenses (€ -132.4 million) for the rollout of 1&1’s mobile network than originally anticipated (approx. € -120 million).

Summary: actual and forecast development of business in 2023

Sales | approx. € 6.2 billion (2022: € 5.915 billion) | approx. € 6.2 billion (2022: € 5.915 billion) | € 6.213 billion |

EBITDA | at the previous year's level (1) (2022: € 1.272 billion) | slight increase (1) (2022: € 1.272 billion) | € 1.300 billion (2) |

Forecast 2023 (March 2023) | Specification (November 2023) | Actual 2023 |

(1) This includes around € -120 million (2022: € -52.4 million) for the expansion of the 1&1 mobile network

(2) This includes € -132.4 million (2022: € -52.4 million) for the expansion of the 1&1 mobile network

Net income of United Internet AG (parent company) for the fiscal year 2023 amounted to € 274.0 million (including a special item of € 219.1 million from income from the disposal of financial assets as a result of the sale of shares in Group subsidiary IONOS Group SE as part of the IONOS IPO). Without this special item, the parent company’s net income for the year was “in the mid-double-digit million range” as forecast.

Development of divisions and segments

The Group’s operating activities are divided into the business divisions Access and Applications, which in turn are divided into the segments Consumer Access and Business Access, as well as Consumer Applications and Business Applications.

Details on the business models of the individual segments are presented in chapter 1.1 “Business model”.

Consumer Access segment

In addition to preparations for the launch of mobile services in the 1&1 mobile network, the Consumer Access segment once again focused on adding further valuable broadband and mobile internet contracts in the fiscal year 2023.

The total number of fee-based contracts in the Consumer Access segment rose by 480,000 contracts to 16.26 million in 2023. As expected, the number of broadband connections decreased by -90,000 to 4.01 million, but stabilized in the fourth quarter of 2023. In the reporting period, mobile internet contracts increased by 570,000 to 12.25 million.

Development of Consumer Access contracts in the fiscal year 2023

Consumer Access, total contracts | 16.26 | 15.78 | + 0.48 |

thereof Mobile Internet | 12.25 | 11.68 | + 0.57 |

thereof broadband connections | 4.01 | 4.10 | - 0.09 |

in million | Dec. 31, 2023 | Dec. 31, 2022 | Change |

Development of Consumer Access contracts in the fourth quarter of 2023

Consumer Access, total contracts | 16.26 | 16.11 | + 0.15 |

thereof Mobile Internet | 12.25 | 12.10 | + 0.15 |

thereof broadband connections | 4.01 | 4.01 | 0.00 |

in million | Dec. 31, 2023 | Sept. 30, 2023 | Change |

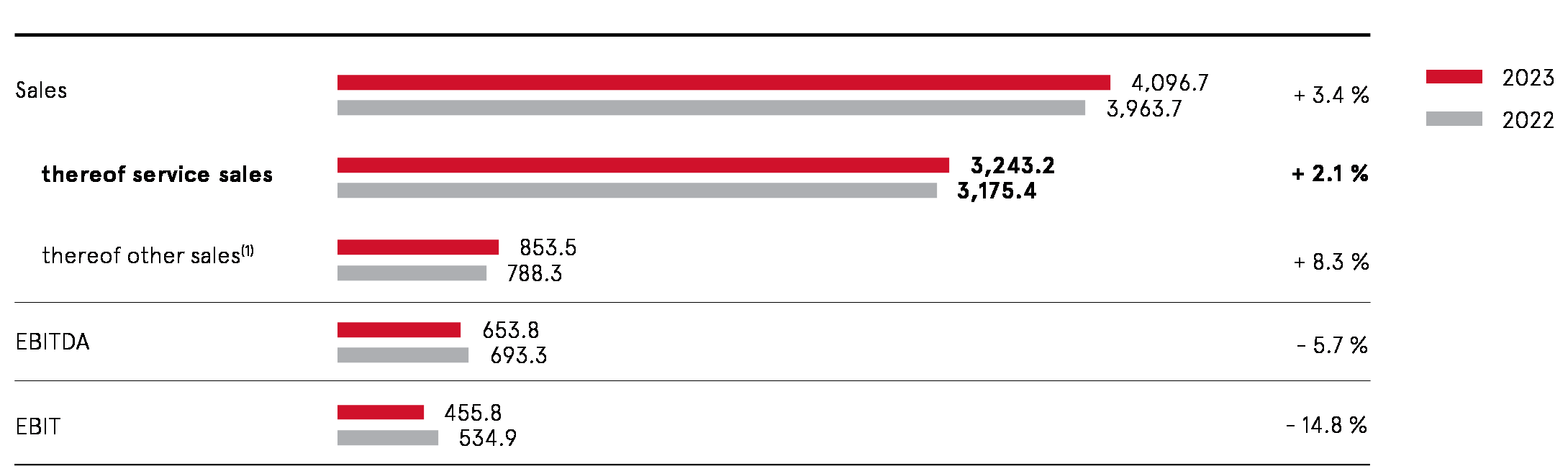

Sales of the Consumer Access segment rose by 3.4% in the fiscal year 2023, from € 3,963.7 million in the previous year to € 4,096.7 million.

Due to good contract growth on the whole, high-margin service revenues – which represent the core business of the segment – rose by 2.1% from € 3,175.4 million in the previous year to € 3,243.2 million in 2023. Low-margin hardware sales rose by 8.3%, or € 65.2 million, from € 788.3 million to € 853.5 million. Hardware sales are subject to seasonal effects and also depend strongly on the appeal of new devices and the model cycles of hardware manufacturers. Consequently, this effect may be reversed in the coming quarters. If this is the case, however, it would have no significant impact on the segment’s EBITDA trend.

Mainly as a result of the planned increase in costs for the rollout of 1&1’s mobile communications network, segment EBITDA of € 653.8 million was 5.7% or € 39.5 million down on the previous year (€ 693.3 million). The expenses for network rollout included in this calculation amounted to € -132.4 million, compared to € -52.4 million in the previous year – corresponding to a year-on-year increase of € -80.0 million.

In addition, segment EBIT was impacted by increased depreciation due to investments in the rollout of the 1&1 mobile network (€ -46.2 million). On the whole, segment EBIT of € 455.8 million was 14.8%, or € 79.1 million, below the prior-year figure (€ 534.9 million). Since the beginning of 2024, t he increase in depreciation on investments – mainly due to the operational launch of 1&1’s mobile network – is being offset by steadily increasing cost savings on advance services.

There was a corresponding decline in the EBITDA margin and EBIT margin from 17.5% in the previous year to 16.0% and from 13.5% in the previous year to 11.1%, respectively.

The number of employees increased by 5.0% in 2023 to 3,320 (prior year: 3,163).

Key sales and earnings figures in the Consumer Access segment (in € million)

(1) Mainly hardware sales

Quarterly development ; change over prior-year quarter (1)

Sales | 1,021.0 | 972.1 | 1,038.7 | 1,064.9 | 1,013.4 | + 5.1% |

thereof service sales | 788.9 | 795.7 | 834.3 | 824.3 | 788.7 | + 4.5% |

thereof other sales (2) | 232.1 | 176.4 | 204.4 | 240.6 | 224.7 | + 7.1% |

EBITDA | 182.1 | 169.9 | 159.1 | 142.7 | 144.3 | - 1.1% |

EBIT | 133.4 | 120.7 | 109.6 | 92.1 | 106.1 | - 13.2% |

in € million | Q1 2023 | Q2 2023 | Q3 2023 | Q4 2023 | Q4 2022 | Change |

(1) Unaudited; see note “unaudited disclosures” on page 3

(2) Mainly hardware sales

Multi-period overview : Development of key sales and earnings figures

Sales | 3,674.9 | 3,786.8 | 3,909.7 | 3,963.7 | 4,096.7 |

thereof service sales | 2,943.0 | 3,020.0 | 3,123.4 | 3,175.4 | 3,243.2 |

thereof other sales (1) | 731.9 | 766.8 | 786.3 | 788.3 | 853.5 |

EBITDA | 683.5 | 637.8 (2) | 671.9 (3) | 693.3 | 653.8 |

EBITDA margin | 18.6% | 16.8% | 17.2% | 17.5% | 16.0% |

EBIT | 528.5 | 482.4 (2) | 507.3 (3) | 534.9 | 455.8 |

EBIT margin | 14.4% | 12.7% | 13.0% | 13.5% | 11.1% |

in € million | 2019 | 2020 | 2021 | 2022 | 2023 |

(1) Mainly hardware sales

(2) Including the non-period positive effect on earnings in 2021 attributable to the second half of 2020 (EBITDA and EBIT effect: € +39.4 million); excluding write-off of VDSL contingents that are still available (EBITDA and EBIT effect: € -129.9 million)

(3) Excluding the non-period positive effect on earnings attributable to the second half of 2020 (EBITDA and EBIT effect: € +39.4 million)

Besides the segment’s operating business, the main focus during the year was on preparations for the launch of mobile services in the 1&1 network in December 2023. Among other things, the network was connected with all national and international networks and the functionality of mobile services was checked with external customer groups.

In August 2023, 1&1 also agreed a long-term national roaming partnership with Vodafone. On the basis of this agreement, the national roaming services currently provided by Telefónica are to be gradually replaced from summer 2024. National roaming is required to provide coverage for over twelve million 1&1 mobile customers during the construction phase of the network in those areas where 1&1 does not yet have its own network coverage.

The 1&1 network is based on innovative OpenRAN technology. Hardware, software and services from a variety of partner companies are used in the 1&1 O-RAN. This makes 1&1 independent of dominant manufacturers such as Huawei. And unlike conventional networks, the 1&1 network is operated in a private cloud that is spread across hundreds of far edge data centers throughout Germany. 112 regional far edge data centers are already in operation, as are 23 decentralized edge data centers and two core data centers. All network functions are controlled by software running on market-standard servers. Gigabit antennas are used at all locations and connected to the regional far edge data centers via fiber-optic cable. This architecture enables minimal latency, which is essential for future real-time applications.

1&1 is also making good progress with the construction of its antenna locations: the initial backlog caused by delivery shortfalls of its main supplier is now being gradually made up in cooperation with additionally commissioned expansion partners. At the end of 2023, 1&1 had 1,062 antenna locations (passive architecture). By the end of 2024, this figure is set to rise to approx. 3,000 locations for the installation of 5G high-performance antennas and connection to fiber-optic cable.

Business Access segment

Sales in the Business Access segment rose by 3.8% from € 543.4 million in the previous year to € 564.0 million in the fiscal year 2023. Despite start-up costs for new business fields, segment EBITDA improved by 5.7% from € 154.1 million in the previous year to € 162.9 million in 2023. As a result, the EBITDA margin rose from 28.4% to 28.9%.

In the new “5G” business field, 1&1 Versatel is responsible for setting up data centers and fiber-optic connections for the antenna locations of 1&1’s mobile network and providing them to 1&1 on a rental basis as part of an intercompany agreement. In its second new business field “Expansion of business parks”, 1&1 Versatel uses newly constructed regional expansion clusters to provide fiber-optic connections for companies in business parks. In the fiscal year 2023, total start-up costs for the new business fields amounted to € -21.5 million (prior year: € -10.8 million) for EBITDA and € -65.2 million (prior year: € -20.6 million) for EBIT.

As a result of the aforementioned start-up costs for new business fields, as well as increased depreciation for the associated investments in network infrastructure, segment EBIT decreased from € -39.5 million in the previous year to € -51.5 million. Without consideration of the new business fields, segment EBIT improved from € -18.9 million in the previous year to € 13.7 million in 2023.

The number of employees increased by 13.9 % in 2023 to 1,522 (prior year: 1,336).

Key sales and earnings figures in the Business Access segment

Quarterly development ; change over prior-year quarter (1)

Sales | 136.1 | 134.7 | 142.6 | 150.6 | 144.2 | + 4.4% |

EBITDA | 34.8 | 42.4 | 41.0 | 44.7 | 41.9 | + 6.7% |

EBIT | -15.4 | -8.8 | -12.7 | -14.6 | -8.1 | |

in € million | Q1 2023 | Q2 2023 | Q3 2023 | Q4 2023 | Q4 2022 | Change |

(1) Unaudited; see note “unaudited disclosures” on page 3

Multi-period overview : Development of key sales and earnings figures

Sales | 476.6 | 493.3 | 514.4 | 543.4 | 564.0 |

EBITDA | 146.5 | 148.6 | 158.8 | 154.1 | 162.9 |

EBITDA margin | 30.7% | 30.1% | 30.9% | 28.4% | 28.9% |

EBIT | -51.3 | -48.2 | -22.9 | -39.5 | -51.5 |

EBIT margin | - | - | - | - | - |

in € million | 2019 | 2020 | 2021 | 2022 | 2023 |

In addition to its operating business, 1&1 Versatel acquired four fiber-optic city networks from BT in early July 2023 – in Munich, Frankfurt, Düsseldorf, and Stuttgart – with a total length of 1,590 km. The acquisition of these city networks is in line with 1&1 Versatel’s strategy of steadily expanding its own fiber-optic network. The purchase price amounted to around € 42 million.

Consumer Applications segment

The number of fee-based pay accounts (contracts) rose by 200,000 to 2.84 million in the fiscal year 2023. Ad-financed free accounts were 0.9% or 380,000 accounts down on December 31, 2022, due in particular to the successful conversion to fee-based customer relationships (200,000). As a result, the total number of Consumer Applications accounts decreased slightly by 0.4% or 180,000 accounts to 42.77 million in 2023.

Development of Consumer Applications accounts in the fiscal year 2023

Consumer Applications, total accounts | 42.77 | 42.95 | - 0.18 |

thereof with Premium Mail subscription (contracts) | 2.05 | 1.89 | + 0.16 |

thereof with Value-Added subscription (contracts) | 0.79 | 0.75 | + 0.04 |

thereof free accounts | 39.93 | 40.31 | - 0.38 |

in million | Dec. 31, 2023 | Dec. 31, 2022 | Change |

Development of Consumer Applications accounts in the fourth quarter of 2023

Consumer Applications, total accounts | 42.77 | 42.55 | + 0.22 |

thereof with Premium Mail subscription (contracts) | 2.05 | 2.00 | + 0.05 |

thereof with Value-Added subscription (contracts) | 0.79 | 0.78 | + 0.01 |

thereof free accounts | 39.93 | 39.77 | + 0.16 |

in million | Dec. 31, 2023 | Sept. 30, 2023 | Change |

Rising advertising revenue and the growth in pay contracts led to a year-on-year increase in sales of the Consumer Applications segment of 5.4% to € 304.3 million (prior year: € 288.6 million).

There was also growth in the segment’s key earnings figures: adjusted for non-cash valuation effects from derivatives of € -0.5 million in the previous year and € -6.3 million in 2023, operating segment EBITDA rose by 5.2% from € 104.4 million in the previous year to € 109.8 million in 2023 and operating segment EBIT by 5.8% from € 94.6 million to € 100.1 million.

The operating EBITDA margin and operating EBIT margin remained largely unchanged at 36.1% (prior year: 36.2%) and 32.9% (prior year: 32.8%), respectively.

The number of employees increased by 3.5% in 2023 to 1,072 (prior year: 1,036).

Key sales and earnings figures in the Consumer Applications segment (in € million)

(1) Excluding a non-cash valuation effect from derivatives (EBITDA and EBIT effect: € -6.3 million)

(2) Excluding a non-cash valuation effect from derivatives (EBITDA and EBIT effect: € -0.5 million)

Quarterly development ; change over prior-year quarter (1)

Sales | 70.0 | 71.0 | 74.3 | 89.0 | 77.0 | + 15.6% |

EBITDA | 20.1 (2) | 27.6 (2) | 26.1 (2) | 36.0 (2) | 34.0 (2) | + 5.9% |

EBIT | 17.8 (2) | 25.1 (2) | 23.6 (2) | 33.6 (2) | 31.7 (2) | + 6.0% |

in € million | Q1 2023 | Q2 2023 | Q3 2023 | Q4 2023 | Q4 2022 | Change |

(1) Unaudited; see note “unaudited disclosures” on page 3

(2) Excluding a non-cash valuation effect from derivatives (EBITDA and EBIT effect: € -12.7 million in Q4 2022; € -4.5 million in Q1 2023; € +0.1 million in Q2 2023; € -0.9 million in Q3 2023; € -1.0 million in Q4 2023)

Multi-period overview : Development of key sales and earnings figures

Sales | 260.3 | 257.5 | 285.2 | 288.6 | 304.3 |

EBITDA | 89.4 | 85.5 | 102.4 (1) | 104.4 (2) | 109.8 (3) |

EBITDA margin | 34.3% | 33.2% | 35.9% | 36.2% | 36.1% |

EBIT | 83.9 | 77.8 | 93.3 (1) | 94.6 (2) | 100.1 (3) |

EBIT margin | 32.2% | 30.2% | 32.7% | 32.8% | 32.9% |

in € million | 2019 | 2020 | 2021 | 2022 | 2023 |

(1) Excluding a non-cash valuation effect from derivatives (EBITDA and EBIT effect: € +4.9 million) and the intercompany disposal of AWIN AG (EBITDA and EBIT effect: € +50.1 million)

(2) Excluding a non-cash valuation effect from derivatives (EBITDA and EBIT effect: € -0.5 million)

(3) Excluding a non-cash valuation effect from derivatives (EBITDA and EBIT effect: € -6.3 million)

Business Applications segment

Fee-based Business Applications contracts grew by 350,000 in the fiscal year 2023. This growth resulted from 160,000 contracts in Germany and 190,000 contracts abroad. As a result, the total number of contracts rose to 9.39 million.

Development of Business Applications contracts in the fiscal year 2023

Business Applications, total contracts | 9.39 | 9.04 | + 0.35 |

thereof in Germany | 4.59 | 4.43 | + 0.16 |

thereof abroad | 4.80 | 4.61 | + 0.19 |

in million | Dec. 31, 2023 | Dec. 31, 2022 | Change |

Development of Business Applications contracts in the fourth quarter of 2023

Business Applications, total contracts | 9.39 | 9.30 | + 0.09 |

thereof in Germany | 4.59 | 4.56 | + 0.03 |

thereof abroad | 4.80 | 4.74 | + 0.06 |

in million | Dec. 31, 2023 | Sept. 30, 2023 | Change |

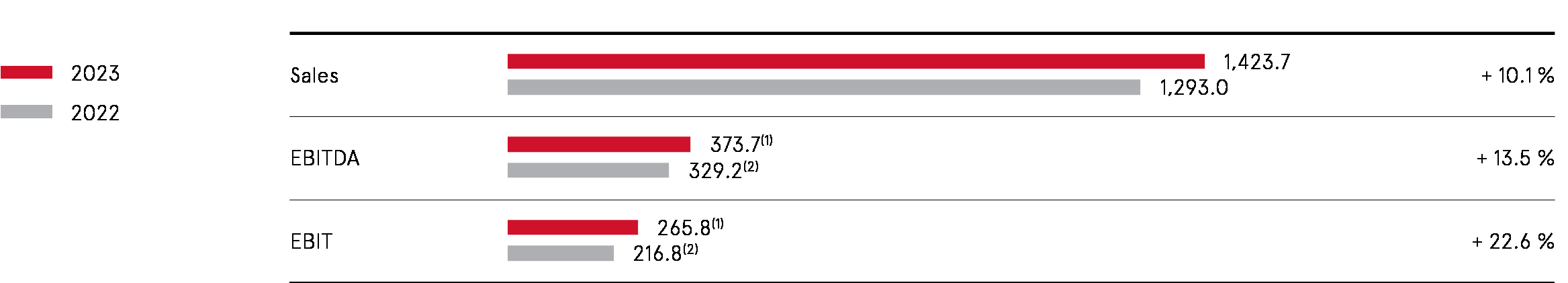

As a result of customer growth, successful up- and cross-selling, and good after-market business, sales of the Business Applications segment rose by 10.1% in the fiscal year 2023, from € 1,293.0 million in the previous year to € 1,423.7 million.

Segment earnings in both 2022 and 2023 were impacted by special items in connection with the IPO of IONOS Group SE. Whereas IPO costs of € -8.8 million were incurred by the segment in the previous year, there was total net income of € +11.7 million in 2023. IPO costs in the reporting period 2023 were offset by income from the contractually agreed assumption of total IPO costs by the IONOS shareholders United Internet and Warburg Pincus.

Adjusted for these special items, operating segment EBITDA increased by 13.5% from € 329.2 million in the previous year to € 373.7 million in 2023. Due to lower PPA writedowns, there was an even stronger increase in operating segment EBIT of 22.6%, from € 216.8 million to € 265.8 million.

The operating EBITDA margin improved accordingly from 25.5% to 26.2% and the operating EBIT margin from 16.8% to 18.7%.

The number of employees increased by 2.8% in 2023 to 4,364 (prior year: 4,247).

Key sales and earnings figures in the Business Applications segment (in € million)

(1) Excluding IPO costs (EBITDA and EBIT effect: € +11.7 million net (IPO costs and offsetting assumption of costs by IONOS shareholders) )

(2) Excluding IPO costs (EBITDA and EBIT effect: € -8.8 million)

Quarterly development ; change over prior-year quarter (1)

Sales | 353.8 | 354.8 | 350.1 | 365.0 | 339.3 | + 7.6% |

EBITDA | 81.5 (2) | 110.8 (2) | 101.4 | 80.0 | 67.1 (2) | + 19.2% |

EBIT | 54.6 (2) | 84.1 (2) | 74.5 | 52.6 | 39.5 (2) | + 33.2% |

in € million | Q1 2023 | Q2 2023 | Q3 2023 | Q4 2023 | Q4 2022 | Change |

(1) Unaudited; see note “unaudited disclosures” on page 3

(2) Excluding IPO costs (EBITDA and EBIT effect: € -5.6 million in Q4 2022; € +11.3 million net (IPO costs and offsetting assumption of costs by IONOS shareholders) in Q1 2023; € +0.4 million net in Q2 2023)

Multi-period overview : Development of key sales and earnings figures

Sales | 924.1 | 988.2 | 1,103.3 | 1,293.0 | 1,423.7 |

EBITDA | 319.5 | 340.4 | 329.3 (2) | 329.2 (3) | 373.7 (4) |

EBITDA margin | 34.6% | 34.4% | 29.8% | 25.5% | 26.2% |

EBIT | 202.3 (1) | 229.5 | 216.7 (2) | 216.8 (3) | 265.8 (4) |

EBIT margin | 21.9% | 23.2% | 19.6% | 16.8% | 18.7% |

in € million | 2019 | 2020 | 2021 | 2022 | 2023 |

(1) Excluding trademark writeups Strato (EBIT effect: € +19.4 million)

(2) Excluding IPO costs (EBITDA and EBIT effect: € -3.0 million)

(3) Excluding IPO costs (EBITDA and EBIT effect: € -8.8 million)

(4) Excluding IPO costs (EBITDA and EBIT effect: € +11.7 million net (IPO costs and offsetting assumption of costs by IONOS shareholders) )

Concrete plans for the IONOS IPO were announced on January 17, 2023 as part of an “intention to float” (ITF) and the IPO was completed on February 8, 2023.

The shares of IONOS Group SE have since been listed on the regulated market of the Frankfurt Stock Exchange (Prime Standard) under ISIN: DE000A3E00M1, WKN: A3E00M, ticker symbol: IOS.

United Internet received gross proceeds of around € 292 million from the sale of shares, while the entire placement volume amounted to around € 389 million.

Following the IPO of IONOS Group SE, United Internet holds 63.8% and Warburg Pincus 21.2% of IONOS shares. 15.0% of shares are in free float.

Group investments

Significant changes in investments

Investment in Kublai

As the former anchor investor in Tele Columbus AG, United Internet AG announced on December 21, 2020 that, together with Morgan Stanley Infrastructure Partners, it would provide sustained support for the implementation of Tele Columbus’s Fiber Champion strategy.

In a first step, Kublai GmbH (a bidding company backed by Morgan Stanley) submitted a voluntary public takeover offer for Tele Columbus shares. After the successful completion of the takeover bid, United Internet contributed its Tele Columbus shares to Kublai in April 2021 and raised its stake in Kublai to 40%. The remaining 60% of shares are held by Morgan Stanley Infrastructure Partners.

Kublai currently holds 95.39% of Tele Columbus shares.

In addition to Kublai GmbH and its other (fully consolidated) core operating companies, United Internet held the following other minority shareholdings as of December 31, 2023, which are included in its result from associated companies.

Minority holdings in partner companies

In July 2013, United Internet acquired a stake in Open-Xchange AG (main activity: e-mail and collaboration solutions). United Internet has already been working successfully with the company for many years in its Applications business. As of December 31, 2023, United Internet’s share of voting rights amounted to 25.39%. United Internet expects Open-Xchange to post increased revenues and a slightly negative EBITDA for the fiscal year 2023.

In April 2014, United Internet acquired a stake in uberall GmbH (main activity: online listings). In addition, uberall and IONOS agreed a long-term cooperation contract for the use of uberall solutions. As of December 31, 2023, the share of voting rights held by United Internet amounted to 25.10%. For 2023, United Internet anticipates increased sales of uberall with a slightly positive EBITDA result.

In April 2017, United Internet acquired a stake in rankingCoach International GmbH (main activity: online marketing solutions). In addition to the equity stake, rankingCoach and IONOS signed a long-term cooperation agreement for IONOS SE to use the online marketing solutions of rankingCoach as part of its hosting and cloud products marketed in Europe and North America. As of December 31, 2023, the share of voting rights amounted to 31.52%. United Internet expects rankingCoach to achieve sales growth in 2023 and a slightly positive EBITDA result.

Following the contribution of affilinet GmbH to AWIN in October 2017, United Internet also holds a stake in AWIN AG (main activity: affiliate marketing). Several United Internet subsidiaries are currently working together with AWIN and using the company’s affiliate network as part of their marketing mix. As of December 31, 2023, United Internet’s share of voting rights amounted to 20.00%. United Internet expects further strong sales growth for AWIN in its fiscal year 2023 and a strongly positive EBITDA result.

Share and dividend

Share

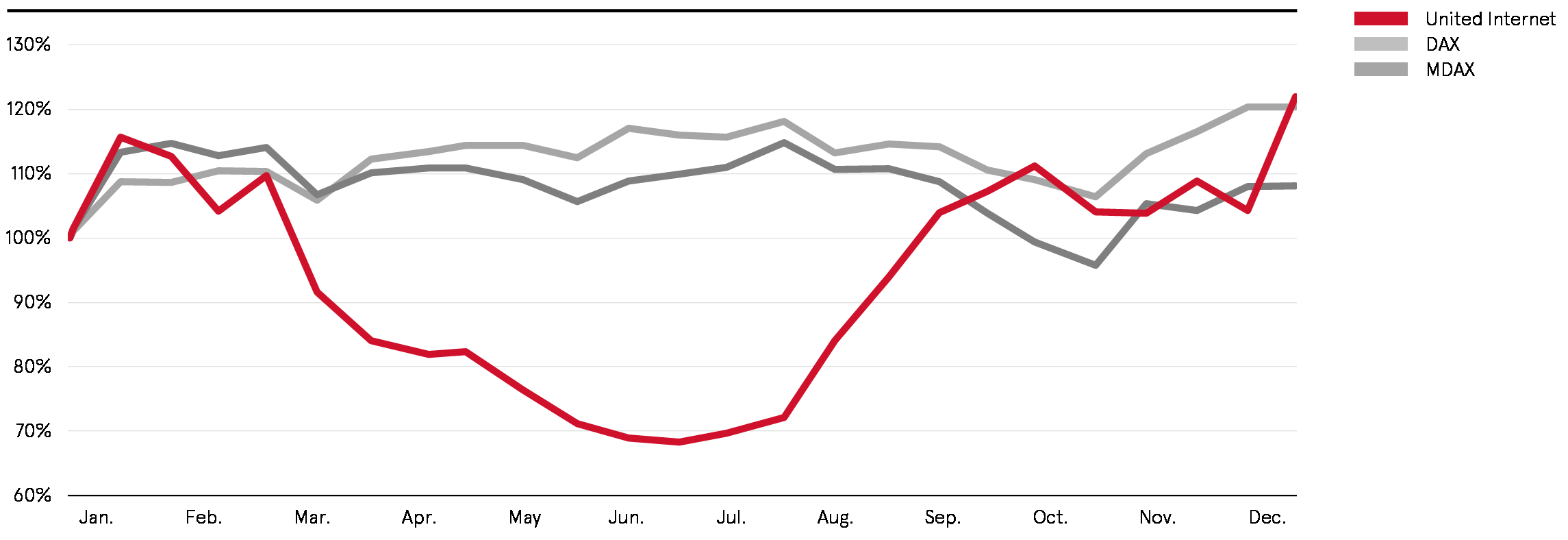

In the fiscal year 2023, the United Internet share price rose strongly by 22.0% to € 23.04 as of December 31, 2023 (December 31, 2022: € 18.89). The share thus outperformed its comparative indices, which also rose year on year (DAX 20.3%; MDAX 8.0%).

Share performance 2023, indexed

There was a corresponding increase in the market capitalization of United Internet AG from around € 3.66 billion in the previous year to around € 4.42 billion as of December 31, 2023.

In the fiscal year 2023, average daily trading via the XETRA electronic computer trading system amounted to around 410,000 shares (prior year: around 220,000) with an average value of € 7.1 million (prior year: € 5.8 million).

Multi-period overview: share performance (as of: December 31, 2023; in €; all stock exchange figures based on Xetra trading)

Closing price | 29.28 | 34.43 | 34.94 | 18.89 | 23.04 |

Performance | -23.4% | + 17.6% | + 1.5% | -45.9% | + 22.0% |

Year-high | 40.42 | 43.88 | 39.34 | 35.45 | 23.06 |

Year-low | 24.21 | 20.76 | 31.63 | 18.14 | 12.54 |

Average daily turnover | 16,415,087 | 13,355,218 | 8,149,290 | 5,777,474 | 7,078,087 |

Average daily turnover (units) | 522,809 | 414,786 | 233,717 | 221,596 | 413,556 |

Number of shares (units) | 205 million | 194 million | 194 million | 194 million | 192 million |

Market value | 6.00 billion | 6.68 billion | 6.78 billion | 3.66 billion | 4.42 billion |

EPS (1) | 2.13 | 1.55 | 2.23 | 1.97 | 1.35 |

Adjusted EPS (2) | 1.88 | 1.87 | 2.11 | 2.00 | 1.41 |

2019 | 2020 | 2021 | 2022 | 2023 |

(1) EPS from continued operations

(2) EPS from continued operations and without special items

Share data

Notional share of capital stock | € 1.00 |

German Securities Identification Number (WKN) | 508903 |

International Securities Identification Number (ISIN) | DE0005089031 |

Ticker symbol Xetra | UTDI |

Reuters ticker symbol | UTDI.DE |

Bloomberg ticker symbol | UTDI.GR |

Segment | Prime Standard |

Index | MDAX, TecDAX |

Sector | Software |

Share type | Registered common stock |

Shareholder structure (as of: December 31, 2023)

Ralph Dommermuth - Ralph Dommermuth GmbH & Co. KG Beteiligungsgesellschaft (45.91%) - Ralph Dommermuth GmbH (1.98%) - RD Holding GmbH & Co. KG (1.04%) | 48.94% |

United Internet (treasury stock) | 9.99% |

Bank of America | 4.93% |

Wellington | 3.01% |

Free float | 33.13% |

Shareholder | Shareholding |

Presentation of the total positions shown above based on the most recent notification of voting rights in accordance with sections 33 et seq. of the German Securities Trading Act. Accordingly, only voting rights notifications that have reached at least the first notification threshold of 3% are taken into account. In addition, any directors' dealings announcements available to the Company have been taken into account accordingly.

The treasury shares held by United Internet do not carry voting or dividend rights. Due to the non-voting nature of treasury shares, the proportion of shares with voting rights held by companies controlled by Mr. Dommermuth in relation to the total number of voting rights of United Internet AG amounts to 54.37%, the proportion of shares with voting rights held by Bank of America to 5.48%, the proportion of shares with voting rights held by Wellington to 3.35%, and the proportion of shares with voting rights in free float to 36.80%.

Dividend

United Internet’s dividend policy aims to pay a dividend to shareholders of approx. 20-40% of adjusted consolidated net income after minority interests (adjusted consolidated net income attributable to the “shareholders of United Internet AG” – according to the consolidated statement of comprehensive income), provided that funds are not needed for further Company development.

At the Annual Shareholders' Meeting of United Internet AG held on May 17, 2023, the proposal of the Management Board and Supervisory Board to pay a dividend of € 0.50 per share (prior year: € 0.50) for the fiscal year 2022, was approved with a majority of 99.93% of votes cast. As a consequence, a total of € 86.4 million (prior year: € 93.4 million) was distributed on May 23, 2023. The payout ratio was thus 23.5% of the adjusted consolidated net income after minority interests for 2022 (€ 374.1 million) and – in view of the investments already made and still due to be made in the Company’s own mobile communications network and in the expansion of its own fiber-optic network – therefore within the range targeted by the dividend policy.

For the fiscal year 2023, the Management Board of United Internet AG will propose to the Supervisory Board a dividend of € 0.50 per share (prior year: € 0.50). The Management Board and Supervisory Board will discuss this dividend proposal at the Supervisory Board meeting on March 20, 2024 (and thus after the preparation deadline for this Management Report). The Annual Shareholders' Meeting of United Internet AG on May 17, 2024 will then vote on whether to adopt the joint proposal of the Management Board and Supervisory Board.

On the basis of around 172.8 million shares with dividend entitlement (as of December 31, 2023 ), the total dividend payment for fiscal year 2023 would amount to € 86.4 million. The dividend payout ratio would therefore be 35.6% of adjusted consolidated net income after minority interests for 2023 (€ 243.0 million) and thus lie – despite the investments already made and still due to be made in the Company’s own mobile communications network and in the expansion of its own fiber-optic network – within the upper range of the dividend policy. Based on the closing price of the United Internet share on December 31, 2023, the dividend yield would be 2.2%.

Multi-period overview: dividend development

Dividend per share (in €) | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 |

Dividend payment (in € million) | 93.9 | 93.6 | 93.4 | 86.4 | 86.4 |

Payout ratio | 22.2% | 32.2% | 22.4% | 23.5% | 37.1% |

Adjusted payout ratio (2) | 23.6% | 26.7% | 23.7% | 23.1% | 35.6% |

Dividend yield (3) | 1.7% | 1.5% | 1.4% | 2.6% | 2.2% |

For 2019 | For 2020 | For 2021 | For 2022 | For 2023 (1) |

(1) Subject to approval of Supervisory Board and Annual Shareholders' Meeting 2024

(2) Without special items

(3) As of: December 31

Annual Shareholders' Meeting 2023

The Annual Shareholders' Meeting of United Internet AG was held in Frankfurt am Main on May 17, 2023.

Of the Company’s registered capital stock of € 192,000,000.00, divided into192,000,000 no-par value shares, of which 19,183,705 treasury shares without voting rights, a total of 135,921,273 no-par value shares with the same number of voting rights were represented. Including the postal votes received for 956,726 no-par value shares, this corresponded to a total of 136,877,999 no-par value shares or 71.29% of the registered capital stock, or 79.20% of the registered capital stock less treasury shares.

The shareholders adopted all resolutions on the agenda requiring voting with large majorities.

Capital stock and treasury shares

As at the balance sheet date of December 31, 2022, United Internet AG held 7,284,109 treasury shares . This corresponded to approx. 3.75% of the capital stock at the time of 194,000,000 shares.

On February 14, 2023, the Management Board of United Internet AG decided, with the approval of the Supervisory Board and on the basis of the authorization granted by the Annual Shareholders' Meeting of May 20, 2020 regarding the acquisition and use of treasury shares, to initially cancel two million treasury shares and to reduce the capital stock of United Internet AG by € 2 million from € 194 million to € 192 million. The number of shares issued decreased accordingly by two million shares, from 194 million shares to 192 million shares. The pro-rata amount of capital stock per issued share remained unchanged at € 1 per share. The cancellation of the treasury shares serves to increase the proportionate participation of United Internet shareholders. Following the cancellation of the aforementioned two million shares, United Internet AG initially held 5,284,109 treasury shares. This corresponded to approx. 2.75% of the Company’s current capital stock.

Furthermore, the Management Board of United Internet AG also decided on February 14, 2023, with the approval of the Supervisory Board, to make a public share buyback offer to the shareholders of United Internet AG for a total of up to 13.9 million shares at a price of € 21.00 per share. The total volume of the share buyback offer therefore amounted to up to € 291.9 million. With the public share buyback offer, United Internet AG made use of the authorization granted by the Annual Shareholders' Meeting of the Company on May 20, 2020, under which up to 10% of the Company’s capital stock could be bought back by August 31, 2023. The shares bought back may be used for all of the purposes permitted under the authorization granted by the Annual Shareholders' Meeting of May 20, 2020. The shares may also be canceled.

In the course of the public share buyback offer, a total of 27,553,147 shares were tendered to the Company by the end of the offer period. The offer was based on the buyback of up to 13.9 million shares in total. As the total number of shares for which the offer was accepted exceeded this maximum amount, the declarations of acceptance were considered on a pro rata basis, i.e., corresponding to the ratio of the maximum number of United Internet shares to be purchased pursuant to this offer, i.e., 13.9 million United Internet shares, to the aggregate number of United Internet shares tendered by United Internet shareholders for buyback.

Upon completion of the above mentioned capital reduction by cancellation of 2 million treasury shares and the buyback of 13,899,596 shares (without fractional amounts) as part of the public share buyback offer to the shareholders of United Internet AG, United Internet holds 19,183,705 treasury shares as of December 31, 2023, corresponding to 9.99% of the current capital stock of 192 million shares. In view of the offer price of € 21.00 per United Internet share, the purchase price for the buyback of 13,899,596 shares in total amounted to € 291.9 million. For further details, please refer to note 39 of the Notes to the Consolidated Financial Statements.

Investor Relations

Continuous and transparent corporate communication with all capital market participants is important for United Internet. The Company aims to provide all target groups with timely information without discrimination. To this end, the Management Board and the Investor Relations department continued their regular discussions with institutional and private investors in the fiscal year 2023. The capital market was informed via the quarterly statements, half-year financial report and annual report, press and analyst conferences, as well as via various webcasts. The Company’s management and Investor Relations department explained the Company’s strategy and financial results in numerous one-on-one discussions at the Company’s offices in Montabaur, as well as at roadshows and conferences in Europe and North America. In addition, over 15 national and international investment banks are in contact with the Company’s Investor Relations department and regularly publish studies and comments on the Company’s progress and share performance.

Apart from one-on-one meetings, shareholders and potential future investors can also receive the latest news around the clock via the Company’s extensive and bilingual website (www.united-internet.de). In addition to the publication dates of financial reports, the dates and venues of investor conferences and roadshows are made publicly available at https://www.united-internet.de/investor-relations/finanzkalender.html. Online versions of the Annual Report and Sustainability Report are also provided on the corporate website.

Personnel report

As a telecommunications and internet company, United Internet is subject to the defining characteristics of the industry: rapid change, short innovation cycles, and fierce competition. United Internet AG has risen to these challenges with great success over many years now. One of the key factors for the success and growth of the United Internet Group are its dedicated and highly competent employees and executives with their entrepreneurial and autonomous approach to work. The Company therefore attaches great importance to a sustainable and balanced strategy across all aspects of its HR activities: from employee recruitment, to targeted entry-level and vocational training formats, tailored skills training programs, support with individual career paths, through to sustainable management development programs, and the long-term retention of executives, high potentials, and top performers.

United Internet AG was once again recognized as a top employer in 2023. Based on an independent study of the “Top Employers Institute”, United Internet received the “TOP Employers Germany” award – as in the preceding years. Certification is only awarded to organizations which offer staff attractive working conditions. Assessment is based on career opportunities, employer benefits, and working conditions, as well as training and development opportunities.

Headcount and personnel expenses

In the highly competitive market for skilled workers in the ICT sector, United Internet once again succeeded in recruiting top staff for its key positions and thus meeting the needs of its growing business. In addition to targeted employer branding, partnerships with education and training providers, and the positive impact of the Company’s product brands, our successful recruitment efforts center around a candidate-friendly, highly competitive acquisition and selection process.

In the fiscal year 2023, the number of employees increased year on year by 4.7%, or 488 employees, to 10,962 (prior year: 10,474). This increase was in line with the development of business and resulted mainly from the Consumer Access and Business Access segments due to the strong increase in headcount for the rollout of 1&1’s mobile network and the expansion of 1&1 Versatel’s fiber-optic network.

Headcount in Germany rose by 5.0% or 431 employees, to 8,981 as of December 31, 2023 (prior year: 8,550). The number of employees at the Group’s non-German subsidiaries grew by 3.0%, or 57 employees, to 1,981 (prior year: 1,924).

Multi-period overview: headcount development by location (1) ; year-on-year change

Employees, total | 9,374 | 9,638 | 9,975 | 10,474 | 10,962 | + 4.7% |

thereof in Germany | 7,761 | 7,929 | 8,199 | 8,550 | 8,981 | + 5.0% |

thereof abroad | 1,613 | 1,709 | 1,776 | 1,924 | 1,981 | + 3.0% |

2019 | 2020 | 2021 | 2022 | 2023 | Change |

(1) Active employees as December 31 of the respective fiscal year

From the segment perspective, there were 3,320 employees in the Consumer Access segment (prior year: 3,163), 1,522 in the Business Access segment (prior year: 1,336), 1,072 in the Consumer Applications segment (prior year: 1,036), and 4,364 in the Business Applications segment (prior year: 4,247). A further 684 people (prior year: 692) were employed at the Group’s headquarters (Corporate/HQ).

Multi-period overview: headcount development by segment (1) ; year-on-year change

Employees, total | 9,374 | 9,638 | 9,975 | 10,474 | 10,962 | + 4.7% |

thereof Consumer Access | 3,163 | 3,191 | 3,167 | 3,163 | 3,320 | + 5.0% |

thereof Business Access | 1,184 | 1,188 | 1,238 | 1,336 | 1,522 | + 13.9% |

thereof Consumer Applications | 1,007 | 1,005 | 1,004 | 1,036 | 1,072 | + 3.5% |

thereof Business Applications | 3,416 | 3,631 | 3,998 | 4,247 | 4,364 | + 2.8% |

thereof Corporate/Shared Services | 604 | 623 | 568 | 692 | 684 | - 1.2% |

2019 | 2020 | 2021 | 2022 | 2023 | Change |

(1) Active employees as December 31 of the respective fiscal year

Due to the rise in headcount, as well as salary adjustments to compensate for high inflation, personnel expenses rose by 12.5 % to € 760.0 million in the fiscal year 2023 (prior year: € 675.5 million). As a result, the personnel expense ratio increased to 12.2%.

Multi-period overview: development of personnel expenses ; year-on-year change

Personnel expenses | 552.8 | 592.3 | 645.4 | 675.5 | 760.0 | + 12.5% |

Personnel expense ratio | 10.6% | 11.0% | 11.4% | 11.4% | 12.2% | |

in € million | 2019 | 2020 | 2021 | 2022 | 2023 | Change |

Sales per employee, based on annual average headcount, amounted to approx. € 580k in fiscal year 2023 (prior year: approx. € 579k).

Diversity

Respect for diversity is a core aspect of United Internet’s corporate culture. The reason for this is simple: only a workforce that mirrors the many different facets of society offers the best possible conditions for creativity and productivity, and makes employees – and the organization itself – unique. This unique diversity creates an incomparable wealth of potential ideas and innovations, increasing the Company’s competitiveness and providing opportunities for all.

All United Internet employees are to be treated with respect and should receive the same opportunities, regardless of their nationality, ethnic origin, religion, ideological beliefs, gender and gender identity, age, disability, or sexual orientation and identity. Each employee should be able to find the area of activity and function in which they can make the most of their individual potential and talents.

Multi-period overview: employees by gender (1)

Women | 32% | 32% | 33% | 32% | 33% |

Men | 68% | 68% | 67% | 68% | 67% |

2019 | 2020 | 2021 | 2022 | 2023 |

(1) Active employees as December 31 of the respective fiscal year

The average age of the United Internet Group’s employees at the end of fiscal year 2023 was around 40 (prior year: 39).

Multi-period overview: employee age profile (1)

< 30 | 23% | 23% | 22% | 23% | 20% |

30 – 39 | 34% | 33% | 33% | 31% | 32% |

40 – 49 | 27% | 27% | 27% | 27% | 28% |

≥ 50 | 16% | 17% | 18% | 19% | 20% |

2019 | 2020 | 2021 | 2022 | 2023 |

(1) Active employees as December 31 of the respective fiscal year

Employees of United Internet AG work in an international environment at around 40 sites around the world.

Multi-period overview: employees by country (1)

Employees, total | 9,374 | 9,638 | 9,975 | 10,474 | 10,962 |

thereof Germany | 7,761 | 7,929 | 8,199 | 8,550 | 8,981 |

thereof France | 3 | 3 | 4 | 7 | 8 |

thereof UK | 233 | 251 | 251 | 246 | 273 |

thereof Austria | 43 | 44 | 65 | 67 | 72 |

thereof Philippines | 360 | 395 | 392 | 468 | 464 |

thereof Poland | 309 | 299 | 333 | 352 | 339 |

thereof Romania | 195 | 217 | 229 | 242 | 261 |

thereof Spain | 330 | 340 | 381 | 422 | 445 |

thereof USA | 140 | 160 | 121 | 120 | 119 |

2019 | 2020 | 2021 | 2022 | 2023 |

(1) Active employees as December 31 of the respective fiscal year

For further information on topics such as “Working Conditions and HR Strategy”, “Training and Education”, “Recruiting and Retaining Young Talent”, “Diversity and Equal Opportunities”, and “Occupational Health and Safety, and Health Management”, please refer to the chapter “Social Responsibility” in the Sustainability Report 2023 of United Internet AG, which will be published in late March 2024 (at https://www.united-internet.de/en/investor-relations/publications/reports.html ).

Liquidity and finance

The Group’s financial strategy is primarily geared to the strategic business plans of its operating business units. In order to provide sufficient flexibility for further growth, United Internet therefore constantly monitors trends in funding opportunities arising on the financial markets. Various options for funding and potential for optimizing existing financial instruments are regularly reviewed. The main focus is on ensuring sufficient liquidity and the financial independence of the Group at all times. In addition to its own financial strength, the Group maintains sufficient liquidity reserves with core banks. The flexible use of these liquidity reserves enables efficient management of Group liquidity, as well as optimal debt management to reduce interest costs.

A euro cash pooling agreement (zero balancing) has been in place between United Internet AG and certain subsidiaries since July 2012. Under the agreement, credit and debit balances of the participating Group subsidiaries are pooled and netted via several cascades in a central bank account of United Internet AG and available each banking day.

At the end of the reporting period on December 31, 2023, the Group’s bank liabilities amounted to € 2,464.3 million (prior year: € 2,155.5 million) and mainly comprise promissory note loans, syndicated loans, and bilateral credit agreements / credit facilities.

Promissory note loans

In the fiscal year 2023, United Internet AG successfully placed a promissory note loan (“Schuldscheindarlehen”) – as in the years 2017 and 2021 – with an amount of € 300 million. The proceeds from this transaction are used for general company funding. There are no covenants attached to the new promissory note loan.

Moreover, two promissory note loan tranches totaling € 238.0 million were redeemed on schedule in the fiscal year 2023.

At the end of the reporting period on December 31, 2023, total liabilities from the promissory note loans 2017, 2021, and 2023 with maximum terms until May 2030 therefore amounted to € 1,162.0 million (prior year: € 1,100.0 million).

Partial repayment of the shareholder loan by IONOS Group SE

In December 2023, IONOS Group SE concluded a loan of € 800 million with a banking syndicate to partially refinance its existing shareholder loan with United Internet AG. The refinancing is at a fixed annual interest rate of 4.67%. The syndicated loan has a term until December 15, 2026 and is due at maturity.

Following the partial repayment, the shareholder loan with United Internet amounts to € 350 million and is subordinated. The shareholder loan continues to have a fixed annual interest rate of 6.75%, a term until December 15, 2026, and is to be gradually repaid before this date.

Syndicated loan facilities & syndicated loans

On December 21, 2018, a banking syndicate granted United Internet AG a revolving syndicated loan facility totaling € 810 million until January 2025. In the fiscal year 2020, the Company made use of a contractually agreed prolongation option and extended the term of the revolving syndicated loan facility for the period from January 2025 to January 2026. A credit facility of € 690 million was agreed for this prolongation period.

As of the balance sheet date on December 31, 2023, € 150 million of the revolving syndicated loan facility had been drawn (prior year: € 550 million). As a result, funds of € 660 million (prior year: € 260 million) were still available to be drawn from the credit facility as at the balance sheet date.

Bilateral credit agreements / bilateral credit facilities

The Company also has bilateral credit agreements with several banks totaling € 50 million (prior year: € 200 million). The term expires at the latest on August 12, 2024. As of the balance sheet date on December 31, 2023, these bilateral credit agreements were used in full (as in the previous year).

In addition, various bilateral credit facilities amounting to € 475 million (prior year: € 400 million) are available to the Company. These have been granted in part until further notice and in part have terms until March 31, 2025. Drawings of € 295 million (prior year: € 300 million) had been made from these credit facilities as at the end of the reporting period on December 31, 2023.

United Internet therefore had free credit lines from syndicated loan facilities and bilateral credit agreements totaling € 840 million (prior year: € 360 million) as at the end of the reporting period on December 31, 2023.

In addition to the above mentioned credit lines, the Group has guaranty credit facilities of € 105.0 million (prior year: € 105.0 million) as at the end of the reporting period, which in some cases can also be used by other Group companies. The guaranty credit facilities are available in particular for the provision of operational bank guarantees.

Further disclosures on the various financial instruments, drawings, interest rates, and maturities are provided under note 31 of the Notes to the Consolidated Financial Statements .

As of the reporting date, there are purchase obligations for property, plant and equipment (especially for network infrastructure) totaling € 591.4 million (prior year: € 370.8 million). In addition, there are purchase commitments for intangible assets (especially software) totaling € 68.0 million (prior year: € 143.9 million).

For further details on significant investment obligations, please refer to notes 26 and 27 of the Notes to the Consolidated Financial Statements.