Growth opportunities

In view of the dynamic market development of fiber-optic, mobile internet and cloud applications, our growth opportunities are clearly apparent: universally accessible, increasingly powerful broadband connections are enabling new and more sophisticated cloud applications. These internet-based programs for end users and companies will remain our growth drivers over the coming years – both as stand-alone products in our Applications division as well as in combination with landline and mobile access products in our Access division.

With our many years of experience as an access and applications provider, our expertise in software development, the operation of telecommunications networks and data centers, marketing, sales, and customer support, as well as our strong and well-known brands, and our customer relationships with millions of private users, freelancers, and small companies in Germany and abroad, we are well placed to fully exploit the expected market growth in our business fields.

Access division

The Access division, with its Consumer Access and Business Access segments, comprises our fee-based access products for consumers and business customers. In our consumer business, these include broadband and mobile access products with the respective applications (such as home networks, online storage, telephony, video-on-demand, or IPTV), while in the business segment these include data and network solutions for SMEs, as well as infrastructure services for large corporations. In our Access division, we operate exclusively in Germany and are one of the leading providers.

Consumer Access segment

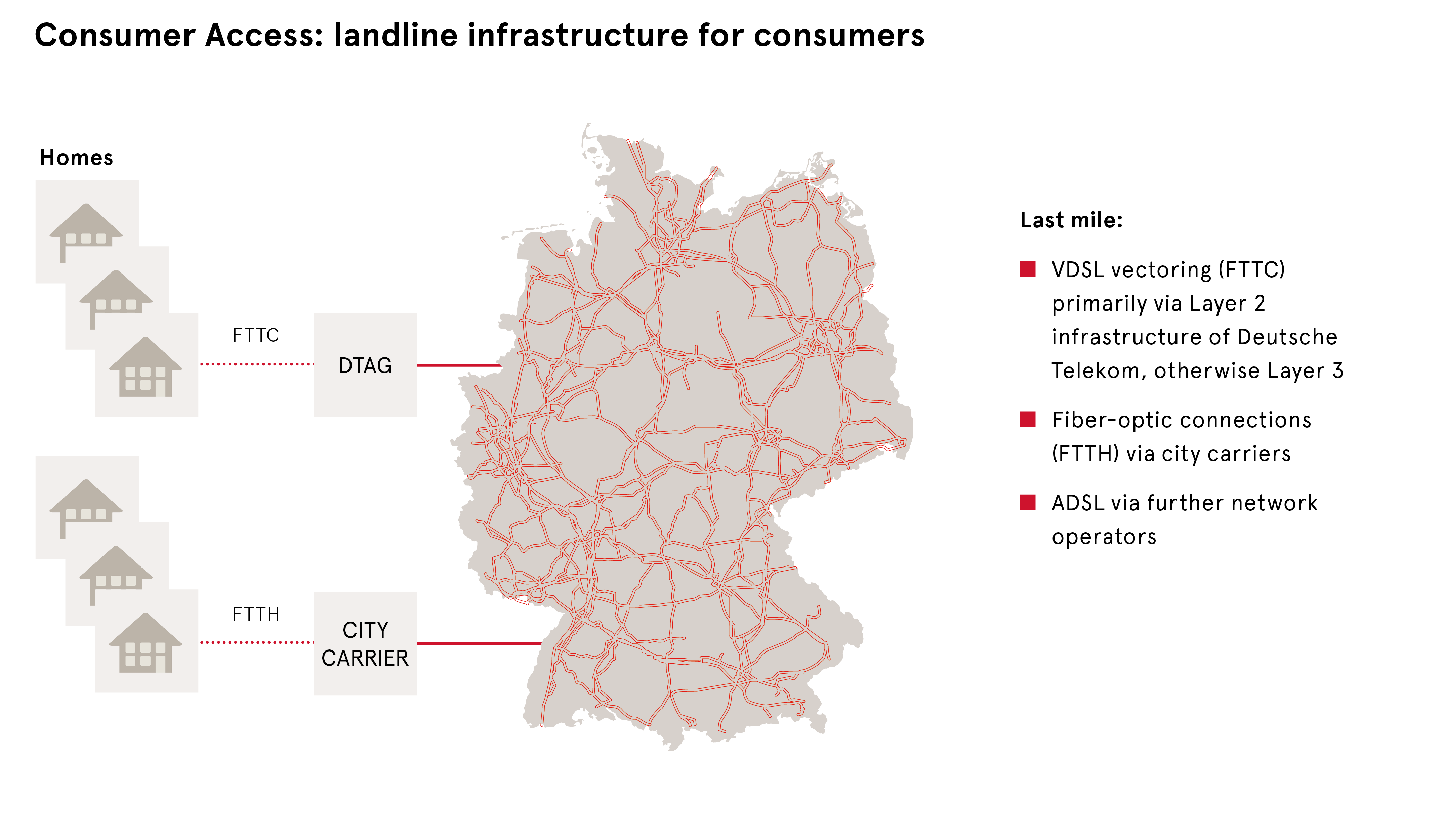

In the Consumer Access segment, we offer our customers both landline-based broadband products and Mobile Internet products.

With our broadband products under the 1&1 brand, we are one of the leading suppliers in Germany. We use our own fiber-optic network (1&1 Versatel) and connect the “last mile” of our VDSL/vectoring connections (FTTC = Fiber-to-the-Curb) mainly via the BNGs/Layer 2 infrastructure of Deutsche Telekom (or Layer 3 outside our own fiber-optic network). In the case of direct fiber-optic connections (FTTH = Fiber-to-the-Home), we connect the “last mile” via city carriers that are connected to our fiber-optic network via Open Access. In the case of ADSL, we use other network operators for the “last mile”.

With our Mobile Internet products, we are the leading MVNO in Germany.

We are the only MBA MVNO in Germany with long-term, guaranteed rights to up to 30% of the used network capacity of Telefónica Germany and thus to all future technologies, including 5G. In the fiscal year 2019, we also successfully participated in the 5G spectrum auction and purchased two frequency blocks of 2 x 5 MHz in the 2 GHz band and five frequency blocks of 10 MHz in the 3.6 GHz band. By acquiring these frequencies, we laid the foundation for the development of our own powerful mobile communications network.

Apart from this privileged access to the Telefónica network, we also purchase standardized network services from Vodafone. These wholesale services are enhanced with end-user devices, self-developed applications and services from our “Internet Factory” in order to differentiate ourselves from the competition.

With our main brand 1&1 and discount brands such as yourfone or smartmobil.de, we achieve broad market coverage in the German mobile communications market.

.png)

In the fiscal year 2019, our Consumer Access segment completed further integration measures in connection with the merger of Drillisch AG (acquired in 2017, now 1&1 Drillisch) with 1&1 Telecommunication SE.

In addition to these integration measures, the segment also focused on adding further valuable broadband and mobile internet contracts. The total number of fee-based contracts in the Consumer Access segment rose by 790,000 contracts to 14.33 million in the fiscal year 2019. A total of 790,000 customer contracts were added in the Mobile Internet business, thus raising the total number of contracts to 9.99 million. The number of broadband connections remained steady at 4.34 million.

Development of Consumer Access contracts in fiscal year 2019

in million | Dec. 31, 2019 | Dec. 31, 2018 | Change |

Consumer Access, total contracts | 14.33 | 13.54 | + 0.79 |

thereof Mobile Internet | 9.99 | 9.20 | + 0.79 |

thereof broadband connections | 4.34 | 4.34 | 0.00 |

In view of our strong brands, innovative products, customer-oriented services, flexible pricing policy, and our excellent value for money, we believe the Consumer Access segment is also very well positioned for the future. In 2020, the main focus will once again be on marketing mobile internet products.

Business Access segment

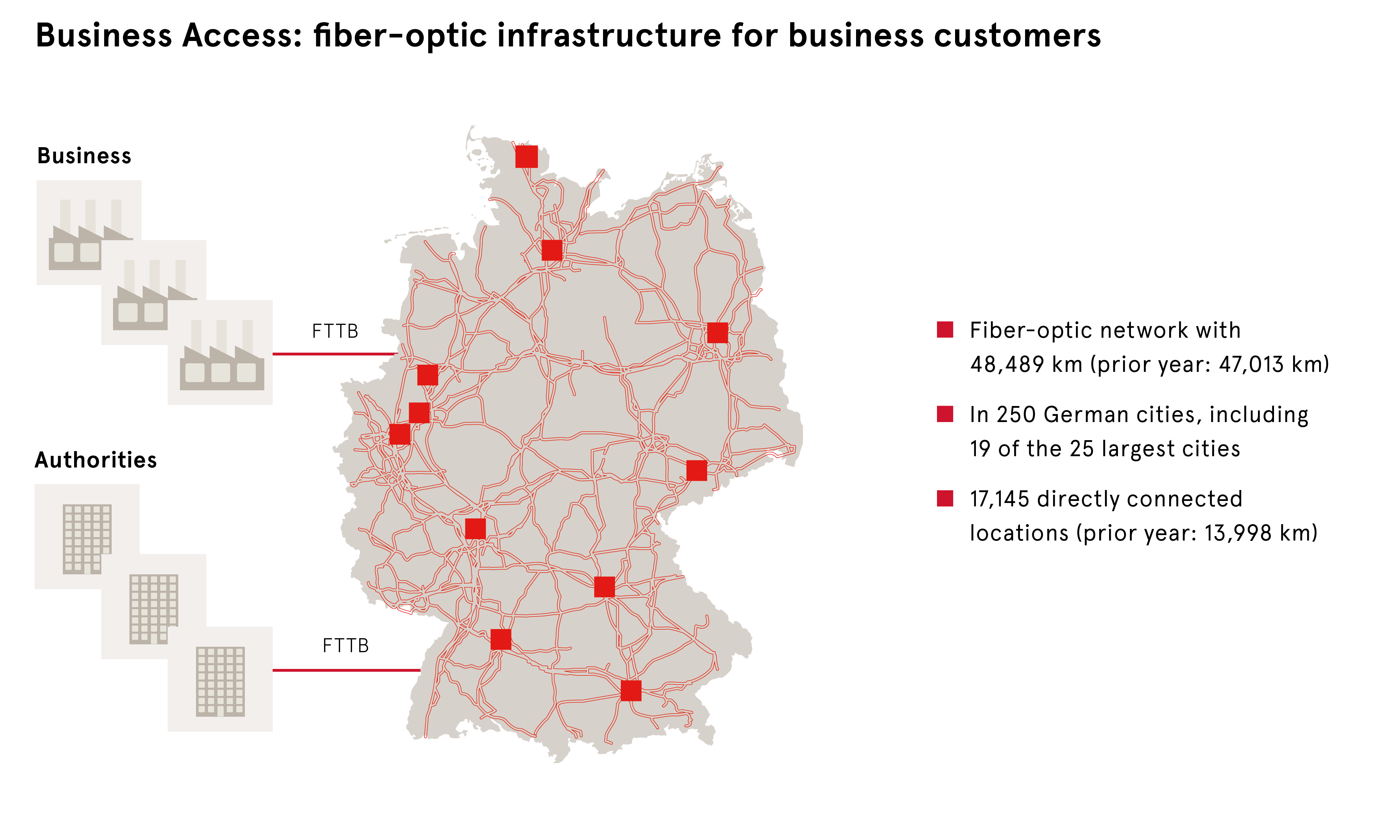

In the Business Access segment, we offer data and network solutions for SMEs, as well as infrastructure services for large corporations, via the 1&1 Versatel brand.

We operate one of Germany’s largest fiber-optic networks with a length of around 48,500 km – a figure that is constantly rising. Our fiber-optic network directly reaches mainly commercial buildings and local authority sites (FTTB).

In the fiscal year 2019, the key topics in the Business Access segment were the expansion of the fiber-optic network and the addition of further sites. The network was expanded from 47,013 km in the previous year to a length of 48,489 km, while the number of connected sites was increased from 13,998 to 17,145.

The focus in 2020 will lie on voice, data, and network solutions for SMEs, as well as infrastructure services for large corporations. In addition, our fiber-optic network is to be expanded further in order to gain new customers.

The industry association Bitkom forecasts further growth for the German telecommunications market in 2020. Sales are expected to grow by 1.0% (prior year: 2.0%) to € 68.8 billion.

Slight growth of 0.4% (prior year: 0.0%) to € 48.8 billion is anticipated for telecommunication services. Sales of TC devices are set to grow by 2.5% (prior year: 11.1%) to € 12.8 billion, while the telecommunication infrastructure business is forecast to grow by 2.0% (prior year: + 1.5%) to € 7.2 billion.

Market forecast: telecommunications market in Germany

in € billion | 2020e | 2019 | Change |

Sales | 68.8 | 68.1 | + 1.0% |

Source: Bitkom, Annual press conference, January 2020

Applications division

Our Applications division, with its two segments Consumer Applications and Business Applications, comprises our ad-financed and fee-based application products for consumers and business customers. These applications include domains, websites, web hosting, servers, and e-shops, Personal Information Management applications (e-mail, to-do lists, appointments, addresses), group work, online storage, and office software.

The applications are developed at our own “Internet Factory”, or in cooperation with partner firms, and operated on around 90,000 servers at our 10 data centers.

In the Applications division, we are also a leading global player with activities in Europe (Germany, France, the UK, Italy, the Netherlands, Austria, Poland, Switzerland, and Spain) and North America (Canada, Mexico, and the USA).

Our Applications business is broken down into ad-financed and fee-based applications, whereby the latter are in turn divided into Consumer and Business Applications.

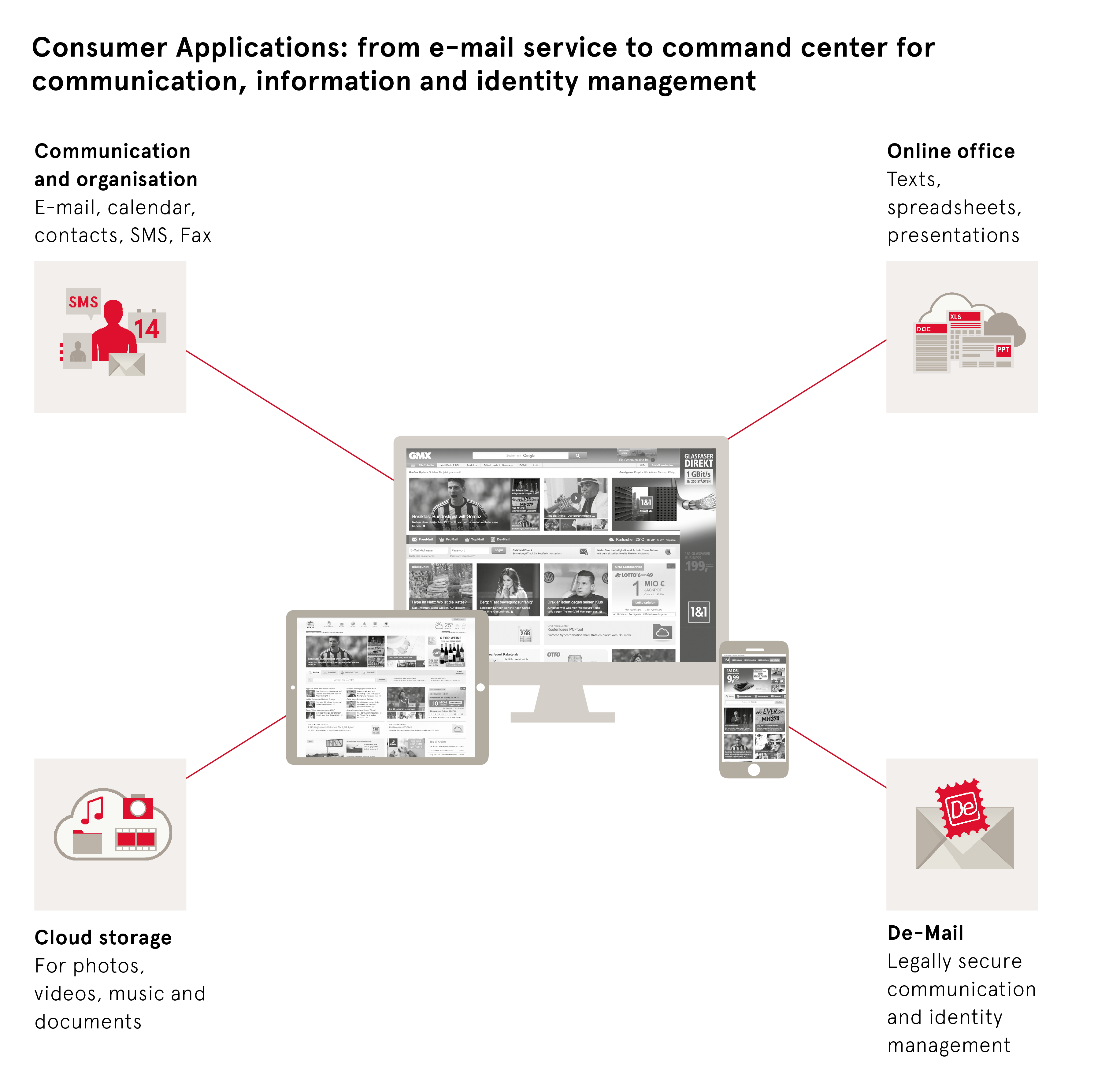

Consumer Applications segment

In the Consumer Applications segment, we offer a wide variety of ad-financed or fee-based applications. These include domains, website solutions tailored to consumer needs, Personal Information Management applications (e-mail, to-do lists, appointments, addresses), online storage, and office software.

By steadily developing our portfolio over the past few years, we have expanded our brands – GMX, WEB.DE, and mail.com – from pure e-mail service providers to complete command centers for the communication, information, and identity management needs of our users.

Our ad-financed applications (free accounts) and fee-based Consumer Applications are marketed actively via the GMX and WEB.DE brands primarily in Germany, Austria, and Switzerland, where we are among the leading players.

Since the acquisition of the US provider mail.com in late 2010, we have been driving our internationalization. In addition to the USA, we also target other countries, such as the UK, France, and Spain.

.png)

Our free accounts are monetized via online advertising, which is marketed by United Internet Media (UIM). UIM also exclusively markets certain third-party sites, like “Das Telefonbuch”, ”Das Örtliche”, and “Gelbe Seiten” (German telephone directories and yellow pages).

In the fiscal year 2019, activities in the Consumer Applications segment continued to focus on the repositioning and reconstruction of the GMX und WEB.DE portals (incl. the related reduction in ad space), as well as the simultaneous establishment of data-driven business models. Initial successes are already emerging from this transformation, as reflected by a return to more stable user numbers for fee-based Premium Mail accounts, and significant growth in free accounts.

Specifically, our ad-financed free accounts grew by 590,000 to 37.59 million in the fiscal year 2019. The number of our fee-based Consumer Applications contracts rose in total by 10,000 to 2.26 million in the reporting period. The total number of Consumer accounts therefore increased by 600,000 to 39.85 million.

Development of Consumer Applications accounts in fiscal year 2019

in million | Dec. 31, 2019 | Dec. 31, 2018 | Change |

Consumer Applications, total accounts | 39.85 | 39.25 | + 0.60 |

thereof with Premium Mail subscription | 1.54 | 1.54 | 0.00 |

thereof with Value-Added subscription | 0.72 | 0.71 | + 0.01 |

thereof free accounts | 37.59 | 37.00 | + 0.59 |

With our strong and specialized brands, constantly growing portfolio of cloud applications, and already established business relationships with millions of home users, the Consumer Applications segment is well positioned to exploit the emerging opportunities in the cloud computing market for home users, as well as in the advertising-oriented big data business.

In fiscal year 2020, the key topic in the Consumer Applications segment will again be the establishment of data-driven business models.

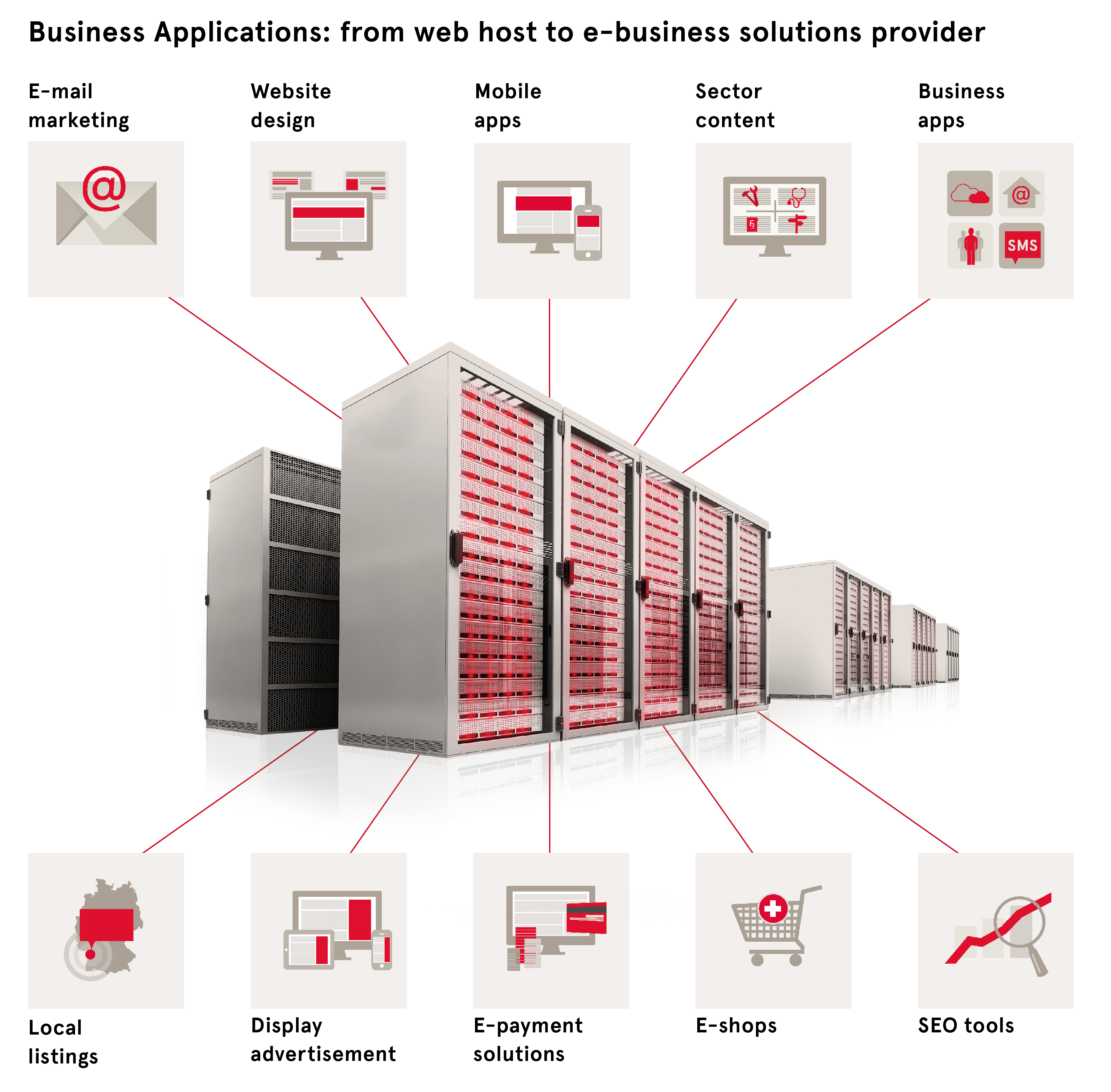

Business Applications segment

In our Business Applications segment, we offer a comprehensive range of powerful applications, such as domains, websites, web hosting, servers, and e-shops, group work, online storage, and office software. These applications open up business opportunities on the internet for our customers and help them digitize their processes. Based on our proven hosting packages, our product range has therefore been steadily expanded over the past few years with the addition of numerous cloud-based e-business solutions.

Our applications are developed at our own “Internet Factory” or in cooperation with partner firms and operated on around 90,000 servers at 10 data centers.

In the Business Applications segment, we are also a leading global player with activities in European countries (Germany, France, the UK, Italy, the Netherlands, Austria, Poland, Switzerland, and Spain) as well as in North America (Canada, Mexico, and the USA).

.png)

In addition to projects aimed at integrating Strato and ProfitBricks (both acquired in 2017), activities in the Business Applications segment during 2019 focused on driving the rebranding of “1&1 Internet” via the transitional brands “1&1 IONOS” and “IONOS by 1&1” – thus taking a further step toward the targeted IPO. Following a transition phase, the IPO is then to be held in future under the independent “IONOS” brand.

A further focus area in 2019 was once again the sale of additional features to existing customers (e.g., further domains, e-shops, and business apps), as well as the acquisition of high-value customer relationships. Nevertheless, the number of fee-based Business Applications contracts was also raised organically by 90,000 contracts in the fiscal year 2019 to a total of 8.15 million.

Development of Business Applications contracts in the fiscal year 2019

in million | Dec. 31, 2019 | Dec. 31, 2018 | Change |

Business Applications, total contracts | 8.15 | 8.06 | + 0.09 |

thereof in Germany | 3.90 | 3.82 | + 0.08 |

thereof abroad | 4.25 | 4.24 | + 0.01 |

With our strong and specialized brands, a steadily growing portfolio of cloud applications, and existing relations with millions of home users, freelancers, and small businesses, we are also well positioned in our Business Applications segment to further exploit the opportunities offered by the cloud computing market for business clients.

In the Business Applications segment, the focus will continue to be on expanding business with existing customers and gaining new high-quality customer relationships in 2020.

The trend toward the increasing use of cloud applications is working in our favor for all activities of our Applications division – both for Consumer and Business Applications.

In an update of its study “Forecast Analysis: Public Cloud Services, Worldwide”, Gartner forecasts global growth for public cloud services of 16.9% (prior year: 15.8%), from $ 227.80 billion to $ 266.36 billion in 2020.

Market forecast: global cloud computing

in $ billion | 2020e | 2019 | Change |

Global sales of public cloud services | 266.36 | 227.80 | + 16.9% |

thereof Application Infrastructure Services (PaaS) | 39.69 | 32.23 | + 23.1% |

thereof Application Services (SaaS) | 115.97 | 99.53 | + 16.5% |

thereof System Infrastructure Services (IaaS) | 49.99 | 40.32 | + 24.0% |

thereof Management and Security Services | 13.85 | 12.03 | + 15.1% |

thereof Business Process Services (BPaaS) | 46.86 | 43.69 | + 7.3% |

Source: Gartner, November 2019

The prospects for funding free applications via online advertising were also good – at least until the onset of the coronavirus crisis. For example, PricewaterhouseCoopers expected an increase of 6.6% (prior year: 6.9%) to € 9.07 billion. The strongest growth was expected for mobile online advertising and video advertising with increases of 22.7% and 10.1%, respectively. In view of the current uncertainty regarding the further development of macroeconomic conditions, it is impossible to predict to what extent these growth prospects will actually be fulfilled.

Market forecast: online advertising in Germany

in € billion | 2020e | 2019 | Change |

Online advertising revenues | 9.07 | 8.51 | + 6.6% |

thereof search marketing | 4.02 | 3.86 | + 4.1% |

thereof display advertising | 1.69 | 1.66 | + 1.8% |

thereof mobile online advertising | 1.57 | 1.28 | + 22.7% |

thereof affiliate / classifieds | 1.03 | 1.02 | + 1.0% |

thereof video advertising | 0.76 | 0.69 | + 10.1% |

Source: PricewaterhouseCoopers, German Entertainment and Media Outlook 2019 – 2023, October 2019