2.2 Business development

Initial application of IFRS 16

On January 13, 201 6, the International Accounting Standards Board (IASB) published IFRS 16, a new standard for lease accounting. The new standard is to be applied in fiscal years beginning on or after January 1, 2019 – and thus also for these Annual Financial Statements 2019.

In its lease agreements, United Internet is mainly in the role of lessee and only to a minor extent in the role of lessor. The majority of the Group’s leases are for renting network infrastructures, buildings, technical equipment, and vehicles.

According to IFRS 16, leases are no longer regarded as classic rental agreements but as financing transactions: the lessee acquires a right to use the leased asset and finances it via the lease installments. Consequently, the lessee must recognize an asset for the right to use the leased asset and a liability for the payments due for the leased asset in the balance sheet. In this way, every lease and rental relationship is stated in the balance sheet. Only lease or rental agreements with terms of up to twelve months and contracts with low-value assets are excluded from this obligation to be stated in the balance sheet.

On initial application of IFRS 16, United Internet opted to recognize the asset for the right of use granted at the value of the related lease liability as of January 1, 2019 and not to apply the standard retrospectively for each previous reporting period.

Specifically, the initial application of IFRS 16 in the fiscal year 2019 had a positive impact on consolidated EBITDA of around € 87.0 million. These EBITDA effects were mostly in the Business Access (€ +59.6 million) and Business Applications (€ +13.7 million) segments.

In order to provide comparability between the resulting EBITDA figures according to IFRS 16 in the fiscal year 2019 and the resulting EBITDA figures according to IFRS 15 in the fiscal year 2018, the most important effects are reported in the form of additional comments in the sections “Business development” and “Position of the Group”.

Use and definition of relevant financial performance measures

In order to ensure the clear and transparent presentation of United Internet’s business trend, the Group’s Annual Financial Statements and Interim Financial Statements include key financial performance measures – in addition to the disclosures required by International Financial Reporting Standards (IFRS) – such as EBITDA, the EBITDA margin, EBIT, the EBIT margin, and free cash flow.

United Internet defines these measures as follows:

- EBIT: Earnings before interest and taxes represents the operating result disclosed in the statement of comprehensive income.

- EBIT margin: Presents the ratio of EBIT to sales.

- EBITDA: Earnings before interest, taxes, depreciation, and amortization are calculated as EBIT/operating result plus the depreciation and amortization (disclosed in the Consolidated Financial Statements) of intangible assets and property, plant, and equipment, as well as assets capitalized in the course of company acquisitions.

- EBITDA margin: Presents the ratio of EBITDA to sales.

- Free cash flow: Calculated as cash flow from operating activities (disclosed in the consolidated financial statement), less capital expenditure for intangible assets and property, plant, and equipment, plus payments from the disposal of intangible assets and property, plant, and equipment.

Insofar as necessary for a clear and transparent presentation, these indicators are adjusted for special items. Such special items usually refer solely to those effects capable of restricting the validity of the key financial performance measures with regard to the Group’s financial and earnings performance – due to their nature, frequency, and/or magnitude. All special items are presented and explained for the purpose of reconciliation with the unadjusted financial figures in the relevant section of the financial statements. One-off amounts for integration and rebranding projects in the fiscal years 2018 and 2019 were not adjusted but are disclosed in the respective sections.

Currency-adjusted sales and earnings figures are calculated by converting sales and earnings figures with the average exchange rates of the comparative period, instead of the current period.

Actual and forecast development 2019

United Internet AG maintained its growth trajectory in fiscal year 2019. The Company improved its sales and earnings figures once again, and reached its forecast of October 2019.

In the course of its ongoing integration measures in the Consumer Access segment, United Internet adjusted the disclosed sales figures of a Group subsidiary of 1&1 Drillisch acquired in 2017, which previously recognized revenue-reducing effects as cost of sales, and brought it in line with standard Group disclosure methods in the fourth quarter of 2019. To aid comparability, revenue and cost of sales figures for the fiscal year 2018 were also adjusted. As a result, disclosed revenue and cost of sales figures for the previous year in the Consumer Access segment and at Group level were both reduced by € 27.9 million. This merely resulted in a reclassification between these two items in the statement of comprehensive income. The adjustment has no effect on the key earnings figures (EBITDA and EBIT) of the segment or the Group.

Forecast development

United Internet published its guidance for the fiscal year 2019 in its Annual Financial Statements 2018 and specified or adjusted them during 2019 as follows:

| Actual | Forecast 2019 | Specification(1) | Adjustment(2) |

Sales | € 5.103 billion(3) | approx. + 4% | approx. + 2% | approx. + 2% |

Sales excl. hardware revenues | € 4.359 billion |

| approx. + 3% | approx. + 3% |

EBITDA | € 1.201 billion | approx. + 12% (IFRS 16) | approx. + 11% (IFRS 16) | approx. € 1.250 billion |

(1) Specification of sales forecast due to weaker (low-margin) hardware business and increased demand for LTE mobile tariffs from existing customers during the year. At the same time, the EBITDA forecast has been specified in more detail due to the fact that subscriber line charges will not be newly regulated until after the 2019 plan is drawn up (increase from July 2019; approx. € -10 million expected impact in 2019) and initial costs in connection with planning and preparations for the 5G mobile communications network (approx. € -5 million expected impact in 2019).

(2) Correction of EBITDA forecast following receipt of the draft expert opinion in the first price adjustment procedure initiated with effect from September 2017 (Price Review 1). The application by 1&1 Drillisch for a retroactive reduction of wholesale prices as of this date was not granted. Moreover, a price increase due to the discontinuation of a contractual adjustment mechanism limited in time to the end of 2018 (approx. € -85 million expected effect in 2019) remained valid.

(3) After adjustment of 2018 sales figures for the Consumer Access segment and thus also for the Group as a whole

Actual development

In fiscal year 2019, consolidated sales rose by 1.8%, from € 5.103 billion in the previous year to € 5.194 billion and were thus within the target range of the last forecast (approx. + 2%).

The same applies to sales excluding hardware revenues, which rose by 3.0%, from € 4.359 billion in the previous year to € 4.491 billion and were thus also within the target range of the forecast (approx. + 3%).

Consolidated EBITDA increased by 5.4% in fiscal year 2019, from € 1.201 billion in the previous year (acc. to IFRS 15) to € 1.266 billion (acc. to IFRS 16) and was thus also within the anticipated target range (approx. € 1.250 billion).

Summary: actual and forecast development of business in 2019

| Actual 2018 | Forecast 2019 | Actual 2019 |

Sales | € 5.103 billion | approx. + 2% | + 1.8% |

Sales excl. hardware revenues | € 4.359 billion | approx. + 3% | + 3.0% |

EBITDA | € 1.201 billion | approx. € 1.250 billion | € 1.266 billion |

Development of divisions and segments

The Group’s operating activities are divided into the two business divisions Access and Applications, which in turn are divided into the segments Consumer Access and Business Access, as well as Consumer Applications and Business Applications.

Access division

The Access division, with its two segments Consumer Access and Business Access, comprises United Internet’s fee-based access products for its consumer and business customers. In its consumer business, these include broadband and mobile access products with the respective applications (such as home networks, online storage, telephony, video-on-demand, or IPTV), while in the business segment these include data and network solutions for SMEs, as well as infrastructure services for large corporations.

With a current length of around 48,500 km, United Internet operates one of Germany’s largest fiber-optic networks. Moreover, the Company – indirectly via 1&1 Drillisch AG acquired in 2017 – is the only MBA MVNO in Germany with long-term rights to a share of up to 30% of the used network capacity of Telefónica Germany and thus extensive access to one of Germany’s largest mobile networks. In the fiscal year 2019, United Internet also successfully participated in the 5G spectrum auction and purchased two frequency blocks of 2 x 5 MHz in the 2 GHz band and five frequency blocks of 10 MHz in the 3.6 GHz band. By acquiring these frequencies, the foundation was laid for the development of the Company’s own powerful mobile communications network. In addition to its own landline network and privileged access to the Telefónica network, the Company also purchases standardized network services from various pre-service providers. These wholesale services are enhanced with end-user devices, self-developed applications, and services from the Company’s own “Internet Factory” in order to differentiate them from the competition.

In its Access division, United Internet operates exclusively in Germany, where it is one of the leading providers – based on customer contracts and sales revenues.

Access products are marketed via well-known brands, such as 1&1, or the discount brands, such as yourfone and smartmobile.de, which enable the Company to offer a comprehensive range of products while also targeting specific customer groups.

Consumer Access segment

In its operating business in 2019, the Consumer Access segment focused on further integration measures in connection with the merger of Drillisch AG (acquired in 2017, now 1&1 Drillisch AG) with 1&1 Telecommunication SE. In so doing, United Internet also adjusted the disclosed sales figures of a Group subsidiary of 1&1 Drillisch acquired in 2017, which previously recognized revenue-reducing effects as cost of sales, and brought it in line with standard Group disclosure methods in the fourth quarter of 2019. To aid comparability, revenue and cost of sales figures for the fiscal year 2018 were also adjusted. As a result, disclosed revenue and cost of sales figures for the previous year in the Consumer Access segment were reduced by € 27.9 million. The adjustment has no effect on the key earnings figures (EBITDA and EBIT) of the segment.

In addition to these integration measures, the segment also focused on adding further valuable broadband and mobile internet contracts. The total number of fee-based contracts in the Consumer Access segment rose by 790,000 contracts to 14.33 million in the fiscal year 2019. A total of 790,000 customer contracts were added in the Mobile Internet business, thus raising the total number of contracts to 9.99 million. The number of broadband connections remained steady at 4.34 million.

Development of Consumer Access contracts in fiscal year 2019

in million | Dec. 31, 2019 | Dec. 31, 2018 | Change |

Consumer Access, total contracts | 14.33 | 13.54 | + 0.79 |

thereof Mobile Internet | 9.99 | 9.20 | + 0.79 |

thereof broadband connections | 4.34 | 4.34 | 0.00 |

Development of Consumer Access contracts in fiscal year in the fourth quarter of 2019

in million | Dec. 31, 2019 | Sept. 30, 2019 | Change |

Consumer Access, total contracts | 14.33 | 14.12 | + 0.21 |

thereof Mobile Internet | 9.99 | 9.78 | + 0.21 |

thereof broadband connections | 4.34 | 4.34 | 0.00 |

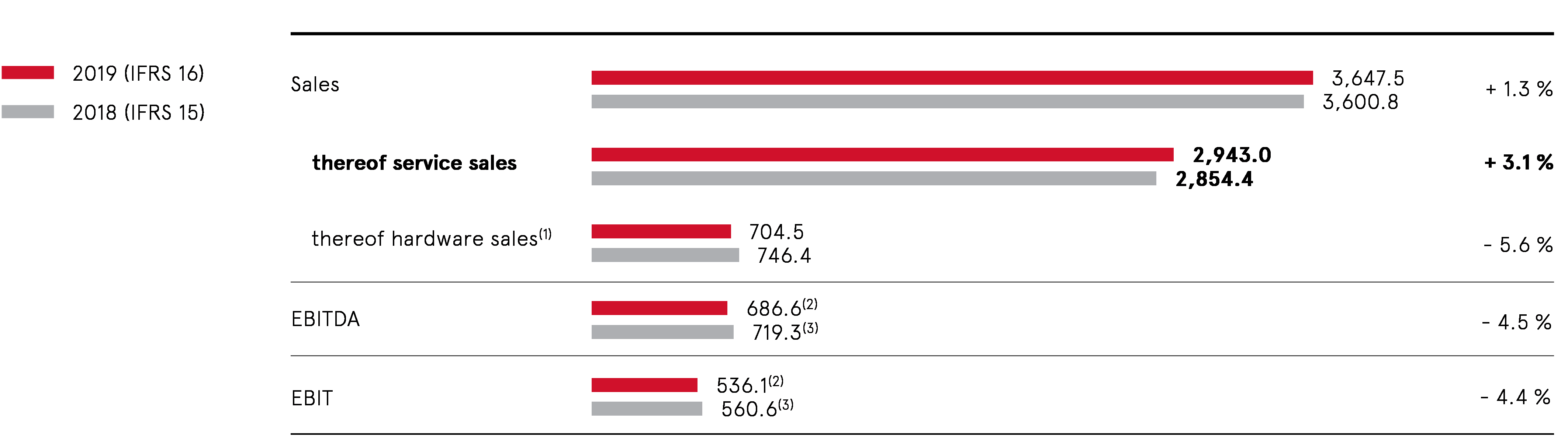

Sales of the Consumer Access segment rose moderately by 1.3% in the fiscal year 2019, from € 3,600.8 million in the previous year to € 3,647.5 million.

Despite a highly competitive environment, high-margin service revenues – which represent the core business of the segment – improved by 3.1%, from € 2,854.4 million to € 2,943.0 million.

This at first glance only moderate overall sales growth was due in particular to fluctuations during the year in (low-margin) hardware sales (€ -41.9 million compared to the previous year). Such hardware sales (especially from the use of smartphones which customers acquire for no or only small one-off charges on signing new contracts and which are paid for via higher tariff prices over the contractual term) fluctuate seasonally and depend on the appeal of new devices and the model cycles of hardware manufacturers. Consequently, this effect may be reversed in the future. If this is not the case, however, it would have no significant impact on the segment’s EBITDA trend.

At € 686.6 million, segment EBITDA fell short of the prior-year figure (€ 719.3 million). This decline is mainly due to additional costs for wholesale mobile telecommunications purchases (€ -83.1 million) after the time-limited adjustment mechanism of a wholesale agreement expired at the end of 2018. Contrary to original expectations, the expired arrangement could not be compensated for by a price reduction during the reporting period. However, the corresponding wholesale prices are the subject of several arbitration proceedings initiated by 1&1 Drillisch which it expects to result in binding decisions on the requested permanent price adjustments. On October 24, 2019, 1&1 Drillisch received the draft arbitration report on the first price adjustment proceedings (Price Review 1), initiated with effect from September 2017, which rejected 1&1 Drillisch’s application for the retroactive reduction of wholesale prices as of the aforementioned date. The consequence of the draft arbitration report was that the financial figures for 2017 and – at least for the time being – the 2018 and 2019 results of 1&1 Drillisch would not be improved by price reductions. Moreover, the aforementioned price increase remained valid – at least for the time being – due to the expiry of the time-limited contractual adjustment mechanism at the end of 2018. In the final expert opinion received on December 19, 2019, the decision announced in the draft version was confirmed.

EBITDA also contains one-off expenses (€ -3.2 million; prior year: € -25.1 million) for current integration projects, the reduction of regulated retail tariffs for calls and text messages to other EU countries since May 15, 2019 (€-5.6 million), the increase in regulated subscriber line charges as of July 1, 2019 (€ -8.8 million), and initial costs in connection with the planning and preparation of the 5G mobile communications network (€ -5.7 million). Without consideration of the above mentioned effects and an –opposing – positive IFRS 16 effect (€ +8.2 million), like-for-like EBITDA would have risen by 5.4% over the previous year.

Segment EBIT of € 536.1 million was virtually unaffected by IFRS 16 accounting and also fell short of the prior-year figure (€ 560.6 million). EBIT also includes the above mentioned burdens on earnings as well as one-off expenses.

The number of employees in this segment rose by 0.4% to 3,163 in 2019 (prior year: 3,150).

Key sales and earnings figures in the Consumer Access segment (in € million)

(1) Hardware sales incl. small amount of other sales

(2) Including one-off expenses for current integration projects (EBITDA and EBIT effect: €-3.2 million)

(3) Including one-off expenses for current integration projects (EBITDA and EBIT effect: € -25.1 million)

Quarterly development; change over prior-year quarter

in € million | Q1 2019 | Q2 2019 | Q3 2019 | Q4 2019 | Q4 2018 | Change |

Sales | 895.4 | 897.5 | 916.3 | 938.3 | 917.3 | + 2.3% |

thereof service sales | 720.8 | 731.0 | 748.5 | 742.7 | 718.0 | + 3.4% |

thereof hardware sales(1) | 174.6 | 166.5 | 167.8 | 195.6 | 199.3 | - 1.9% |

EBITDA | 168.5(2) | 171.9(3) | 168.2(4) | 178.0(5) | 197.5(6) | - 9.9% |

EBIT | 130.6(2) | 134.1(3) | 132.0(4) | 139.4(5) | 159.5(6) | - 12.6% |

(1) Hardware sales incl. small amount of other sales

(2) Including one-off expenses for integration projects (EBITDA and EBIT effect: € -2.1 million)

(3) Including one-off expenses for integration projects (EBITDA and EBIT effect: € -0.2 million)

(4) Including one-off expenses for integration projects (EBITDA and EBIT effect: € -1.5 million)

(5) Including one-off expenses for integration projects (EBITDA and EBIT effect: € +0.6 million from reversal of provisions)

(6) Including one-off expenses for integration projects (EBITDA and EBIT effect: € -12.7 million)

Multi-period overview(1): Development of key sales and earnings figures

in € million | 2016 | 2017 | 2018 | 2019 |

Sales | 2,414.0 | 2,781.6 | 3,600.8 | 3,647.5 |

thereof service sales | 2,317.9 | 2,631.0 | 2,854.4 | 2,943.0 |

thereof hardware sales(2) | 96.1 | 150.6 | 746.4 | 704.5 |

EBITDA | 395.2 | 541.2(3) | 719.3(4) | 686.6(5) |

EBITDA margin | 16.4% | 19.5% | 20.0% | 18.8% |

EBIT | 384.5 | 471.4(3) | 560.6(4) | 536.1(5) |

EBIT margin | 15.9% | 16.9% | 15.6% | 14.7% |

(1) As the new segmentation was only introduced in the course of preparing the annual financial statements for 2018, the usual 5-year multi-period overview is limited to the financial years 2016-2019

(2) Hardware sales incl. small amount of other sales

(3) Without extraordinary income from revaluation of Drillisch shares (EBITDA and EBIT effect: € +303.0 million) and without restructuring charges in offline sales (EBITDA and EBIT effect: € -28.3 million)

(4) Including one-off expenses for integration projects (EBITDA and EBIT effect: € -25.1 million)

(5) Including one-off expenses for integration projects (EBITDA and EBIT effect: € -3.2 million)

In addition to its operating business, United Internet successfully participated – via 1&1 Drillisch – in the 5G spectrum auction ending on June 12, 2019 and purchased two frequency blocks of 2 x 5 MHz in the 2 GHz band and five frequency blocks of 10 MHz in the 3.6 GHz band. The total auction price amounted to around € 1.07 billion. By acquiring these frequencies, the foundation was laid for a successful and permanent positioning of the 1&1 Drillisch Group as Germany’s fourth mobile network provider. The Company intends to use this basis to establish a powerful mobile communications network. While the 3.6 GHz spectrum is already available, the acquired frequency blocks in the 2 GHz band will only be usable from January 1, 2026. With this mind, 1&1 Drillisch has leased two frequency blocks of 10 MHz each in the 2.6 GHz band from Telefónica, which will be available until December 31, 2025. This agreement is based on the commitments given by Telefónica as part of the EU’s clearance of its merger with E-Plus in 2014. On September 5, 2019, 1&1 Drillisch also signed an agreement with the German Federal Ministry of Transport and Digital Infrastructure (BMVI) and the German Federal Ministry of Finance (BMF) regarding the construction of mobile communication sites in so-called “not-spots”. 1&1 Drillisch is thus helping to close existing supply gaps and improve the provision of mobile communications in rural regions by building hundreds of base stations. In return, 1&1 Drillisch benefits from an agreement allowing it to pay for the acquired 5G spectrum in installments. As a result, the license fees which were originally to be paid to the German government in 2019 and 2024 can now be spread over the period up to 2030. The credit line of originally € 2.8 billion arranged to finance the highest bids of the spectrum auction, among other things, was thus no longer required and has been “returned”. The agreement with the BMVI and BMF is in line with 1&1 Drillisch’s long-term financing strategy, which is geared toward paying the major share of expenses for the construction of its own mobile communications network from current revenue.

On December 31, 2019, 1&1 Drillisch finally exercised – as planned – the first prolongation option for the extension of the term of the MBA MVNO agreement with Telefónica Deutschland ending on June 30, 2020. As a result, the term of the agreement has now been extended until at least June 30, 2025. In combination with another prolongation option, 1&1 Drillisch has thus secured long-term access to the mobile communications network of Telefónica. In addition, Drillisch continues to pursue the build-up of its own high-performance 5G mobile communications network. In order to ensure continuous availability for its end customers during the build-up of its own nationwide network, Drillisch is also currently negotiating the conclusion of a national roaming agreement based on the voluntary commitment of Telefónica Deutschland in connection with the EU clearance decision in relation to the merger with E-Plus in 2014.

Business Access segment

In the fiscal year 2019, the key topics in the Business Access segment were the expansion of the fiber-optic network and the addition of further sites. The network was expanded from 47,013 km in the previous year to a length of 48,489 km while the number of connected sites was increased from 13,998 to 17,145.

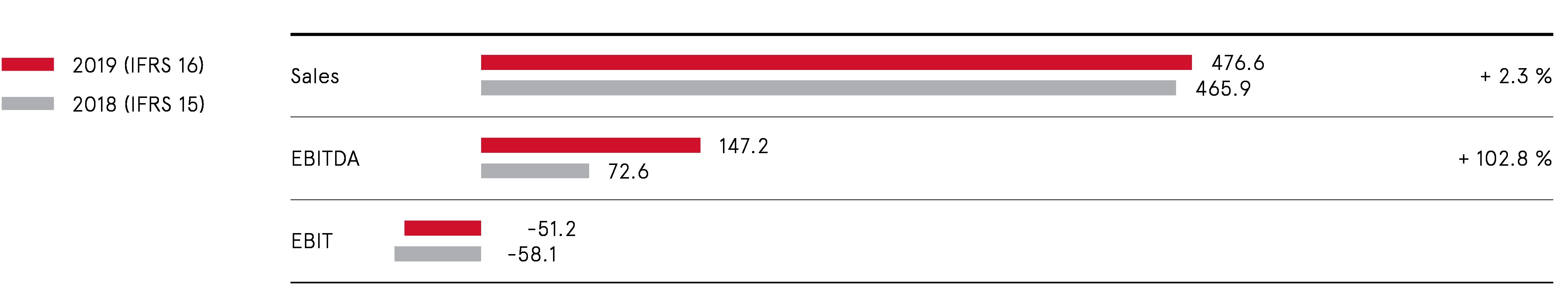

Sales of the Business Access segment rose by 2.3% in the fiscal year 2019, from € 465.9 million in the previous year to € 476.6 million.

Segment EBITDA improved by 102.8%, from € 72.6 million to € 147.2 million. This increase was also attributable to effects from the initial application of IFRS 16 (€ +59.6 million). Without consideration of these effects, like-for-like EBITDA rose by 20.7%.

The increases in sales and EBITDA demonstrate that 1&1 Versatel is increasingly succeeding in exploiting the potential of its fiber-optic network to an ever greater extent.

As a result of high depreciation charges in the field of network infrastructure due to customer growth and further Layer2 connections that will only be amortized in subsequent periods, segment EBIT amounted to € -51.2 million – compared to € -58.1 million in the previous year – and was virtually unaffected by IFRS 16 accounting.

The number of employees in this segment rose by 8.1% to 1,184 in 2019 (prior year: 1,095).

Key sales and earnings figures in the Business Access segment

Quarterly development; change over prior-year quarter

in € million | Q1 2019 | Q2 2019 | Q3 2019 | Q4 2019 | Q4 2018 | Change |

Sales | 119.3 | 115.0 | 118.2 | 124.1 | 131.3 | - 5.5% |

EBITDA | 35.7 | 34.4 | 34.9 | 42.2 | 29.0 | + 45.5% |

EBIT | -13.5 | -15.3 | -14.2 | -8.2 | -5.6 |

|

Multi-period overview (1): Development of key sales and earnings figures

in € million | 2016 | 2017 | 2018 | 2019 |

Sales | 513.7 | 447.9 | 465.9 | 476.6 |

EBITDA | 124.0 | 81.5 | 72.6 | 147.2 |

EBITDA margin | 24.1% | 18.2% | 15.6% | 30.9% |

EBIT | -1.0 | -40.2 | -58.1 | -51.2 |

EBIT margin | - | - | - | - |

(1) As the new segmentation was only introduced in the course of preparing the annual financial statements for 2018, the usual 5-year multi-period overview is limited to the financial years 2016-2019

Applications segment

The Applications division, with its two segments Consumer Applications and Business Applications, comprises ad-financed or fee-based application products for consumer and business customers. These applications include domains, home pages, web hosting, servers, and e-shops, Personal Information Management applications (e-mail, to-do lists, appointments, addresses), group work, online storage and office software.

The applications are developed at the Company’s own “Internet Factory” or in cooperation with partner firms and operated on around 90,000 servers at the Company’s 10 data centers.

In its Applications division, United Internet is also a leading global player – based on domains, customer contracts, and sales revenues – with activities in European countries (Germany, France, the UK, Italy, the Netherlands, Austria, Poland, Switzerland, and Spain) as well as in North America (Canada, Mexico, and the USA).

Applications are marketed to specific home-user and business-user target groups via the differently positioned brands GMX, mail.com, WEB.DE, IONOS, Arsys, Fasthosts, home.pl, InterNetX, STRATO, united-domains, and World4You. Via the Sedo brand, United Internet also offers customers professional services in the field of active domain management. Free apps are monetized via advertising run by United Internet Media.

Consumer Applications segment

In the Consumer Applications segment, ad-financed free accounts grew by 590,000 to 37.59 million in the fiscal year 2019. The number of fee-based Consumer Applications accounts (contracts) rose in total by 10,000 to 2.26 million. The total number of Consumer accounts therefore increased by 600,000 to 39.85 million accounts.

Development of Consumer Applications accounts in fiscal year 2019

in million | Dec. 31, 2019 | Dec. 31, 2018 | Change |

Consumer Applications, total accounts | 39.85 | 39.25 | + 0.60 |

thereof with Premium Mail subscription | 1.54 | 1.54 | 0.00 |

thereof with Value-Added subscription | 0.72 | 0.71 | + 0.01 |

thereof free accounts | 37.59 | 37.00 | + 0.59 |

Development of Consumer Applications accounts in the fourth quarter of 2019

in million | Dec. 31, 2019 | Sept. 30, 2019 | Change |

Consumer Applications, total accounts | 39.85 | 39.26 | + 0.59 |

thereof with Premium Mail subscription | 1.54 | 1.54 | 0.00 |

thereof with Value-Added subscription | 0.72 | 0.72 | 0.00 |

thereof free accounts | 37.59 | 37.00 | + 0.59 |

As already announced in the Annual Financial Statements 2018, activities in the Consumer Applications segment continued to focus on the repositioning and reconstruction of the GMX und WEB.DE portals (incl. the related reduction in ad space), as well as the simultaneous establishment of data-driven business models. Initial successes are already emerging from this transformation, as reflected by a return to more stable user numbers for fee-based Premium Mail accounts, and growth of 590,000 free accounts compared to December 31, 2018. In addition, over 4.1 million users (as of December 31, 2019) had already opted in for the Smart Inbox around nine months after launch. The first data-driven ad marketing products on this basis were presented at DMEXCO in September 2019. As expected, the above mentioned measures had a negative impact on sales and earnings figures in the fiscal year 2019 and are due to gradually have a positive effect as of fiscal year 2020. Nevertheless, there was slight year-on-year growth in sales and EBITDA again in the fourth quarter of 2019.

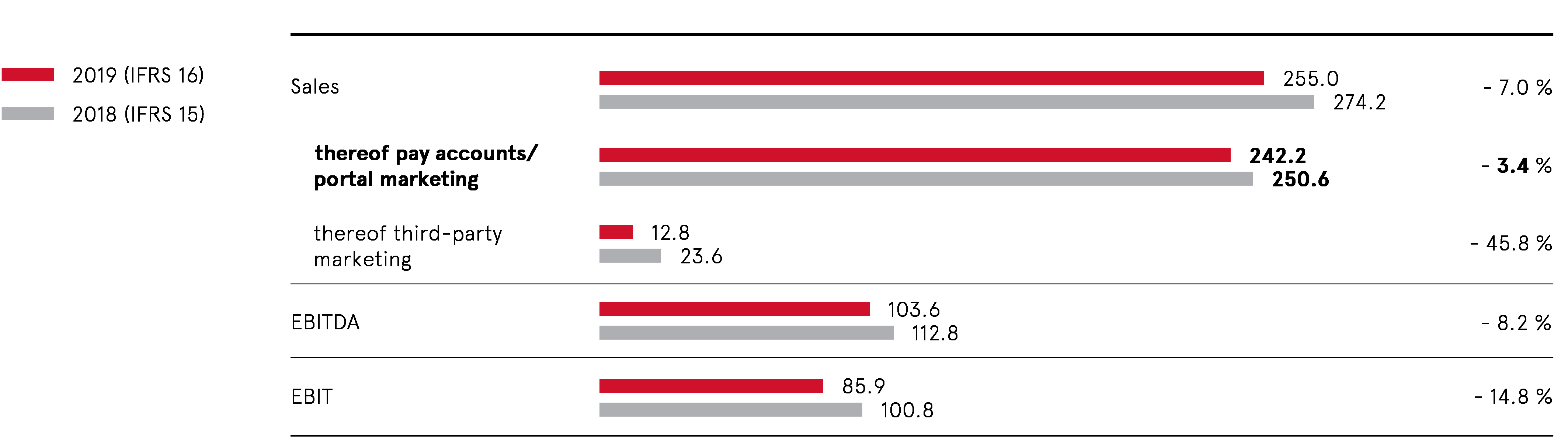

Against this backdrop, and as expected, sales in the segment’s core business of pay accounts and the marketing of ad space on its own portals amounted to € 242.2 million in the fiscal year 2019 and thus fell short of the prior-year figure (€ 250.6 million). This decline in sales is mainly attributable to the ongoing repositioning started in the second quarter of 2018 and the associated reduction in ad space (sales effect: € -25.4 million), which only affected sales in the previous year to a limited extent (€ -17.0 million).

At € 12.8 million, sales in the field of low-margin, third-party marketing were well below the prior-year figure (€ 23.6 million).

As a result, there was also an overall decline in total segment sales from € 274.2 million to € 255.0 million. Without consideration of the ad space reduction and the decline in third-party marketing, like-for-like sales remained constant.

Due to the reduction in ad space and investment in the expansion of data-driven business models (EBITDA and EBIT effect: € -24.3 million; prior year: € -15.9 million), segment EBITDA of € 103.6 million (prior year: € 112.8 million) was also down on the previous year. Without consideration of the ad space reduction and a positive IFRS 16 effect (€ +4.1 million), like-for-like EBITDA declined by -3.8%.

As a result, segment EBIT of € 85.9 million was also down on the previous year (prior year: € 100.8 million) and was virtually unaffected by IFRS 16 accounting.

The number of employees in this segment rose by 6.3% to 1,007 in 2019 (prior year: 947).

Key sales and earnings figures in the Consumer Applications segment (in € million)

Quarterly development; change over prior-year quarter

in € million | Q1 2019 | Q2 2019 | Q3 2019 | Q4 2019 | Q4 2018 | Change |

Sales | 60.4 | 63.4 | 60.7 | 70.6 | 70.3 | + 0.4% |

thereof pay accounts/portal marketing | 57.9 | 58.6 | 57.8 | 67.9 | 67.8 | + 0.1% |

thereof third-party marketing | 2.5 | 4.8 | 2.9 | 2.7 | 2.5 | + 8.0% |

EBITDA | 21.4 | 25.9 | 23.3 | 33.1 | 32.9 | + 0.6% |

EBIT | 18.3 | 20.9 | 19.0 | 27.7 | 30.0 | - 7.7% |

Multi-period overview(1): Development of key sales and earnings figures

in € million | 2016 | 2017 | 2018 | 2019 |

Sales | 283.6 | 284.2 | 274.2 | 255.0 |

thereof pay accounts/portal marketing | 269.3 | 264.6 | 250.6 | 242.2 |

thereof third-party marketing | 14.3 | 19.6 | 23.6 | 12.8 |

EBITDA | 127.6 | 124.0 | 112.8 | 103.6 |

EBITDA margin | 45.0% | 43.6% | 41.1% | 40.6% |

EBIT | 115.0 | 112.1 | 100.8 | 85.9 |

EBIT margin | 40.6% | 39.4% | 36.8% | 33.7% |

(1) As the new segmentation was only introduced in the course of preparing the annual financial statements for 2018, the usual 5-year multi-period overview is limited to the financial years 2016-2019

Business Applications segment

In addition to projects aimed at integrating STRATO and ProfitBricks (both acquired in 2017), activities in the Business Applications segment during 2019 focused on driving the rebranding of “1&1 Internet” via the transitional brands “1&1 IONOS” and “IONOS by 1&1” – thus taking a further step toward the targeted IPO. Following a transition phase, the IPO is then to be held in future under the independent “IONOS” brand.

A further focus area in 2019 was once again the sale of additional features to existing customers (e.g., further domains, e-shops, and business apps), as well as the acquisition of high-value customer relationships. Nevertheless, the number of fee-based Business Applications contracts was also raised organically by 90,000 contracts in the fiscal year 2019 to a total of 8.15 million.

Development of Business Applications contracts in the fiscal year 2019

in million | Dec. 31, 2019 | Dec. 31, 2018 | Change |

Business Applications, total contracts | 8.15 | 8.06 | + 0.09 |

thereof in Germany | 3.90 | 3.82 | + 0.08 |

thereof abroad | 4.25 | 4.24 | + 0.01 |

Development of Business Applications contracts in the fourth quarter of 2019

in million | Dec. 31, 2019 | Sept. 30, 2019 | Change |

Business Applications, total contracts | 8.15 | 8.13 | + 0.02 |

thereof in Germany | 3.90 | 3.88 | + 0.02 |

thereof abroad | 4.25 | 4.25 | 0.00 |

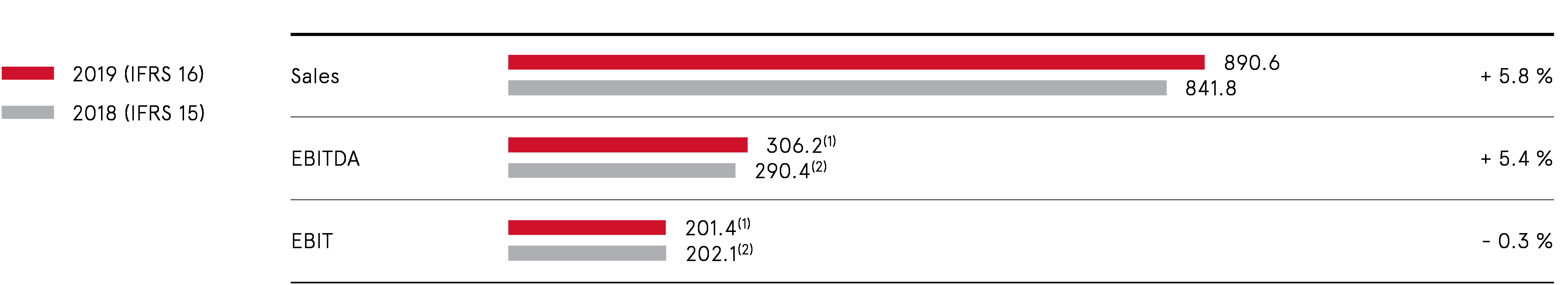

Sales of the Business Applications segment rose by 5.8% in the fiscal year 2019, from € 841.8 million in the previous year to € 890.6 million.

Despite increased marketing expenses (€ -26.7 million, including one-offs for rebranding measures of € -19.2 million (prior year: one-offs for integration projects of € -16.6 million)), segment EBITDA of € 306.2 million was 5.4% up on the previous year (€ 290.4 million). The strong increase in marketing expenses was opposed by positive effects from the initial application of IFRS 16 (€ +13.7 million). Without consideration of these effects, like-for-like EBITDA grew by 4.0%.

EBIT also includes the above mentioned burdens on earnings and one-offs. In addition, there was an increase in depreciation (due in part to the acquisition of World4You and the expansion of the server parks). Against this backdrop, segment EBIT of € 201.4 million was slightly below the prior-year figure (€ 202.1 million) and was virtually unaffected by IFRS 16 accounting. The above segment EBIT figure does not include a one-off effect from trademark writeups on the “STRATO” brand (€ +19.4 million).

The number of employees in this segment rose by 1.8% to 3,416 (prior year: 3,355).

Key sales and earnings figures in the Business Applications segment (in € million)

(1) Including one-off expenses for integration and rebranding projects (EBITDA and EBIT effect: € -19.2 million); excluding trademark writeups for STRATO (EBIT effect: € +19.4 million)

(2) Including one-off expenses for integration projects (EBITDA and EBIT effect: € -16.6 million)

Quarterly development; change over prior-year quarter

in € million | Q1 2019 | Q2 2019 | Q3 2019 | Q4 2019 | Q4 2018 | Change |

Sales | 220.2 | 223.1 | 222.4 | 224.9 | 207.1 | + 8.6% |

EBITDA | 73.7(1) | 74.6(2) | 88.5(3) | 69.4(4) | 56.5(5) | + 22.8% |

EBIT | 45.7(1) | 49.5(2) | 61.6(3) | 44.6(4) | 33.7(5) | + 32.3% |

(1) Including one-off expenses for integration and rebranding projects (EBITDA and EBIT effect: € -7.0 million)

(2) Including one-off expenses for integration and rebranding projects (EBITDA and EBIT effect: € -6.7 million)

(3) Including one-off expenses for integration and rebranding projects (EBITDA and EBIT effect: € -1.4 million)

(4) Including one-off expenses for integration and rebranding projects (EBITDA and EBIT effect: € -4.1 million); excluding trademark writeups STRATO (EBIT effect: € +19.4 million)

(5) Including one-off expenses for integration projects (EBITDA and EBIT effect: € -7.8 million)

Multi-period overview(1): Development of key sales and earnings figures

in € million | 2016 | 2017 | 2018 | 2019 |

Sales | 638.9 | 762.1 | 841.8 | 890.6 |

EBITDA | 202.5 | 247.3(2) | 290.4(3) | 306.2(4) |

EBITDA margin | 31.7% | 32.4% | 34.5% | 34.4% |

EBIT | 159.2 | 175.4(2) | 202.1(3) | 201.4(4) |

EBIT margin | 24.9% | 23.0% | 24.0% | 22.6% |

(1) As the new segmentation was only introduced in the course of preparing the annual financial statements for 2018, the usual 5-year multi-period overview is limited to the financial years 2016-2019

(2) Without extraordinary income from revaluation of ProfitBricks shares (EBITDA and EBIT effect: € +16.1 million), without internally allocated M&A costs (EBITDA and EBIT effect: € -8.7 million) and without trademark writedowns STRATO (EBIT effect: € -20.7 million)

(3) Including one-off expenses for integration projects (EBITDA and EBIT effect: € -16.6 million)

(4) Including one-off expenses for integration and rebranding projects (EBITDA and EBIT effect: € -19.2 million); excluding trademark writeups STRATO (EBIT effect: € +19.4 million)

Group investments

United Internet AG continued to optimize its investment portfolio in the fiscal year 2019. In the course of these optimization measures, shares in virtual minds and Rocket Internet were sold.

Significant changes in investments

Sale of shares in virtual minds

In the second quarter of 2019, United Internet sold its shares in virtual minds AG (share of voting rights as of December 31, 2018: 25.10%) as the company no longer played a role in the strategic investment portfolio. Already prepared in the fiscal year 2018, the sale returned an amount of € 21.5 million.

Sale of shares in Rocket Internet

In the fiscal year 2019, United Internet sold its shares in Rocket Internet SE in several steps (share of voting rights as of December 31, 2018: 9.0%). Specifically, United Internet Investments Holding AG & Co. KG sold 2,500,000 shares at a price of € 25.00 per share in July 2019 and, in the fourth quarter of 2019, accepted the public share buyback offer of Rocket Internet amounting to 15,076,729 shares for the remaining 11,219,841 Rocket Internet shares held against payment of the offer price of € 21.50 per share. Due to the oversubscription of its buyback offer, Rocket Internet was only able to consider the acceptance declaration of United Internet Investments Holding for a total of 8,764,483 shares. The 2,455,358 Rocket Internet shares still held after the completion of the share buyback offer were acquired by Mr. Oliver Samwer at the end of 2019 as agreed at the offer price.

In addition to its (fully consolidated) core operating companies, United Internet also held investments in the following companies as of December 31, 2019.

Minority holdings in listed companies

In February 2016, United Internet announced its investment in Tele Columbus AG. As of December 31, 2019, the share of voting rights amounted to 29.90% (prior year: 28.52%). The Company’s market capitalization as of December 31, 2019 was around € 357 million in total (prior year: € 370 million).

Minority holdings in partner companies

In July 2013, United Internet acquired a stake in Open-Xchange AG (main activity: e-mail and collaboration solutions). United Internet has already been working successfully with the company for many years in its Applications business. As of December 31, 2019, United Internet’s share of voting rights amounted to 25.39%. Open-Xchange closed its fiscal year 2019 with a negative result.

In February 2014, United Internet acquired a stake of 25.10% in ePages GmbH (main activity: e-shop solutions). In addition to the equity stake, ePages and Group subsidiary 1&1 IONOS SE cooperate in the field of e-shop solutions. As of December 31, 2019, United Internet’s share of voting rights amounted to 25.01%. ePages posted a positive result in its fiscal year 2019.

In April 2014, United Internet acquired a stake in uberall GmbH (main activity: online listings). In addition, uberall and 1&1 IONOS SE agreed a long-term cooperation contract for the use of uberall solutions. As of December 31, 2019, the share of voting rights held by United Internet amounted to 27.42%. uberall is still in the start-up phase and posted a negative result in its fiscal year 2019.

In April 2017, United Internet acquired a stake in rankingCoach International GmbH (main activity: online marketing solutions). In addition to the equity stake, rankingCoach and 1&1 IONOS SE signed a long-term cooperation agreement for 1&1 IONOS SE to use the online marketing solutions of rankingCoach as part of its hosting and cloud products marketed in Europe and North America. As of December 31, 2019, the share of voting rights amounted to 30.70%. rankingCoach is still in the start-up phase and posted a negative result in its fiscal year 2019.

Following the contribution of affilinet GmbH to AWIN in October 2017, United Internet also holds a stake in AWIN AG (main activity: affiliate marketing). Several United Internet subsidiaries are currently working together with AWIN and using the company’s affiliate network as part of their marketing mix. As of December 31, 2019, United Internet’s share of voting rights amounted to 20.00%. AWIN once again closed its fiscal year 2019 with a strongly positive result.

Share and dividend

Share

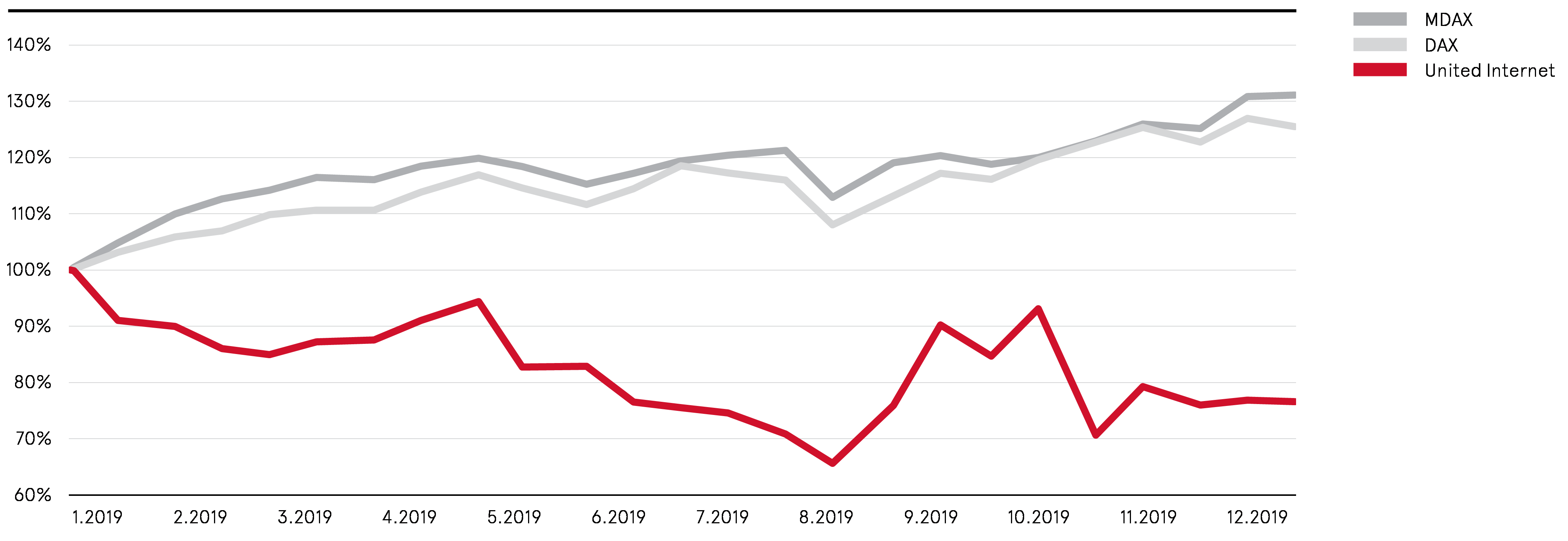

The United Internet share decreased in value during fiscal year 2019: the share price fell by 23.4% to € 29.28 as of December 31, 2019 (December 31, 2018: € 38.20). The share thus performed much worse than its comparative indices, which rose year on year (DAX + 25.5%; MDAX + 31.2%).

Share performance 2019, indexed

There was a corresponding decline in the market capitalization of United Internet AG from around € 7.83 billion in the previous year to around € 6.00 billion as of December 31, 2019.

In fiscal year 2019, average daily trading via the XETRA electronic computer trading system amounted to around 523,000 shares (prior year: 405,000) with an average value of € 16.4 million (prior year: € 19.3 million).

Multi-period overview: share performance (in €; all stock exchange figures are based on Xetra trading)

| 2015 | 2016 | 2017 | 2018 | 2019 |

Year-end | 50.91 | 37.10 | 57.34 | 38.20 | 29.28 |

Performance | + 35.8% | -27.1% | + 54.6% | -33.4% | -23.4% |

Year-high | 51.94 | 49.89 | 59.17 | 59.80 | 40.42 |

Year-low | 36.17 | 34.42 | 37.01 | 34.14 | 24.21 |

Average daily turnover | 15,279,407 | 16,301,156 | 19,666,155 | 19,261,114 | 16,415,087 |

Average daily turnover (units) | 354,904 | 407,372 | 418,771 | 404,956 | 522,809 |

Shares at year-end (units) | 205 million | 205 million | 205 million | 205 million | 205 million |

Market value at year-end | 10.44 billion | 7.61 billion | 11.75 billion | 7.83 billion | 6.00 billion |

EPS(1) | 1.80 | 0.86 | 3.06 | 0.94 | 2.13 |

Adjusted EPS(2) | 1.73 | 2.11 | 2.02 | 1.96 | 1.99 |

(1) EPS from continued operations

(2) EPS from continued operations and without special items: 2015 without effects from sale of Goldbach shares and part of stake in virtual minds (EPS effect: € +0.07); 2016 without negative one-off effect from impairment (EPS effect: € -1.25); 2017 without net positive one-off effects from valuation topics, transaction and restructuring costs, writedowns on brands, writedowns on financial assets / Rocket impairment charges, financing costs and one-off tax effects (EPS effect: € +1.04); 2018 without negative effect from Tele Columbus impairment charges (EPS effect: € -1.02); 2019 without positive effects from reversal of impairments Tele Columbus (EPS effect: € +0.09) and trademark writeups STRATO (EPS effect: € +0.05)

Share data

| |

Share type | Registered common stock |

Notional share of capital stock | 1.00 € |

German Securities Identification Number (WKN) | 508903 |

International Securities Identification Number (ISIN) | DE0005089031 |

Ticker symbol Xetra | UTDI |

Reuters ticker symbol | UTDI.DE |

Bloomberg ticker symbol | UTDI.GR |

Segment | Prime Standard |

Index | MDAX, TecDAX |

Sector | Software |

Shareholder structure

Shareholder | Shareholding |

Ralph Dommermuth | 40.24% |

United Internet (treasury stock) | 8.46% |

Allianz Global Investors | 5.52% |

Flossbach von Storch | 5.01% |

BlackRock | 3.48% |

Free float | 37.29% |

As of December 31, 2019; figures based on the last respective notification of voting rights

Dividend

United Internet’s dividend policy aims to pay a dividend to shareholders of approx. 20-40% of adjusted consolidated net income after minority interests (adjusted consolidated net income attributable to the “shareholders of United Internet AG” – according to the consolidated statement of comprehensive income), provided that funds are not needed for further Company development.

On January 24, 2019, the Group subsidiary 1&1 Drillisch AG announced that it intended to apply to the German Federal Network Agency (“Bundesnetzagentur”) for admission to take part in the auction on the allocation of mobile frequencies (“5G spectrum auction”) and, in the event of a successful acquisition of spectrum at the auction, to establish and operate a 5G mobile network. The applicant was Drillisch Netz AG, a wholly-owned subsidiary of 1&1 Drillisch AG. Following admission by the Bundesnetzagentur on February 25, 2019, the 5G spectrum auction started on March 19, 2019.

Against the background of the 5G spectrum auction still ongoing at the time, and the necessary additional investments in the event of a successful acquisition of spectrum at the auction, the Management Board and Supervisory Board announced on March 27, 2019 that the dividend proposal at the Annual Shareholders' Meeting on May 23, 2019 would take into account the outcome of the ongoing auction on the allocation of mobile frequencies. Accordingly, a dividend of € 0.05 per United Internet share was proposed for the event that United Internet’s subsidiary 1&1 Drillisch AG had successfully acquired spectrum at the auction by May 20, 2019.

As of May 20, 2019, the 5G spectrum auction had still not ended and – despite its historically long duration – it was still unclear on expiry of the deadline (May 20, 2019) whether 1&1 Drillisch AG would acquire spectrum at the auction.

As the Company had already announced on May 7, 2019, in this event the Management Board and Supervisory Board resolved and announced on May 20, 2019 to make a dividend proposal of € 0.05 per share at the Annual Shareholders' Meeting. This precautionary measure was taken to ensure that the necessary additional investments could be made if 1&1 Drillisch was able to successfully bid for frequencies before the end of the 5G spectrum auction. The dividend proposal was based on the minimum dividend as prescribed by section 254 (1) of the German Stock Corporation Act (AktG).

At the Company’s Annual Shareholders' Meeting on May 23, 2019, the proposal of the Management Board and Supervisory Board to pay a dividend of € 0.05 (prior year: € 0.85) per share for the fiscal year 2018 was approved with a majority of 99.8% of votes cast. A total dividend payment of € 10.0 million (prior year: € 170.0 million) was made on May 28, 2019. The payout ratio was thus 2.5% of the adjusted consolidated net income after minority interests for 2018 (€ 392.6 million).

For the fiscal year 2019, the Management Board of United Internet AG will propose to the Supervisory Board a dividend of € 0.50 per share (prior year: € 0.05). The Management Board and Supervisory Board will discuss this dividend proposal at the Supervisory Board meeting on March 25, 2020 (and thus after the preparation deadline for this Management Report). The Annual Shareholders' Meeting of United Internet AG 2020 will then vote on whether to adopt the joint proposal of the Management Board and Supervisory Board. In view of the corona crisis, the exact date of the Annual Shareholders' Meeting originally planned for May 20, 2020 is currently still open.

On the basis of around 187.7 million shares with dividend entitlement (as of December 31, 2019), the total dividend payment for fiscal year 2019 would amount to € 93.9 million. The dividend payout ratio would therefore amount to 23.7% of adjusted consolidated net income after minority interests for 2019 (€ 396.4 million) and thus lie – in view of the investments due to be made in the Company’s own mobile communications network – within the lower range targeted by its dividend policy. Based on the closing price of the United Internet share on December 31, 2019, the dividend yield would be 1.7%.

Multi-period overview: dividend development

| For 2015 | For 2016 | For 2017 | For 2018 | For 2019(1) |

Dividend per share (in €) | 0.70 | 0.80 | 0.85 | 0.05 | 0.50 |

Dividend payment (in € million) | 142.9 | 161.3 | 169.9 | 10.0 | 93.9 |

Payout ratio | 39.0% | 90.0% | 26.2% | 5.3% | 22.2% |

Adjusted payout ratio(2) | 39.0% | 37.2% | 42.1% | 2.5% | 23.7% |

Dividend yield(3) | 1.4% | 2.2% | 1.5% | 0.1% | 1.7% |

(1) Subject to approval of Supervisory Board and Annual Shareholders' Meeting 2020

(2) Without special items: writedowns on financial assets / Rocket impairment charges (2016); net positive one-off effects from non-cash-effective valuation topics, transaction and restructuring costs, writedowns on brands, writedowns on financial assets / Rocket impairment charges, financing costs, one-off tax effects, and discontinued operations (2017); impairment charges on Tele Columbus shares (2018); reversal of impairment charges on Tele Columbus shares and trademark writeups on STRATO (2019)

(3) As of: December 31

Annual Shareholders' Meeting 2019

The Annual Shareholders' Meeting of United Internet AG was held in Frankfurt am Main on May 23, 2019. A total of 81.11% of capital stock (or 83.02% of capital stock less treasury shares) was represented. The shareholders adopted all resolutions on the agenda requiring voting with large majorities.

Capital stock and treasury shares

On August 14, 2019, the Management Board of United Internet AG resolved to launch a new share buyback program. The decision was approved by the Supervisory Board. United Internet AG thus utilized the authorization issued by the Company’s Annual Shareholders’ Meeting of May 18, 2017 to buy back treasury shares representing up to 10% of the Company's capital stock at the time of the resolution or, if the amount is lower, at the time of exercising the authorization. The authorization was issued for the period up to September 18, 2020 and had not been previously utilized.

In the course of the new share buyback program, up to six million Company shares (corresponding to approx. 2.93% of capital stock at the time) were to be bought back. The volume of the share buyback program amounted to € 192.0 million in total. The program was launched on August 16, 2019 and is to be completed by March 31, 2020 at the latest by buying shares back via the stock exchange. In the course of this share buyback program, which was prematurely ended with effect from the end of December 9, 2019, a total of 3,919,999 treasury shares were acquired at an average share price of € 29.38 and with a total volume of € 115.2 million.

At the same time as the termination of the aforementioned share buyback program, the Company’s Management Board resolved – with the approval of the Supervisory Board – to make a public share buyback offer to the shareholders of United Internet AG for a total of up to 9,000,000 shares at a price per share of € 29.65. Concurrently, Rocket Internet SE irrevocably undertook to accept United Internet AG's public share buyback offer for 8,135,804 shares held by Rocket Internet SE. In the event of an oversubscription of the Company's public share buyback offer, a proportional allocation was to be made to Rocket Internet SE. With its public share buyback offer, United Internet AG once again made use of the authorization granted by the Annual Shareholders' Meeting of May 18, 2017. In the course of the public share buyback offer of United Internet AG, a total of 8,715,524 shares were tendered to the Company by the end of the acceptance period at a price of € 29.65 and with a total volume of € 258.4 million.

As of December 31, 2019, United Internet held 17,338,513 treasury shares (December 31, 2018: 4,702,990). This corresponded to approx. 8.46% of capital stock at the time of € 205,000,000 (December 31, 2018: 2.29%).

Investor Relations

In the fiscal year 2019, the Management Board and Investor Relations department of United Internet AG once again provided institutional and private investors with regular and comprehensive information. It was provided to the capital market via the quarterly statements, half-year financial report and annual report, press and analyst conferences, as well as via various webcasts. The Company’s management and Investor Relations department explained the Company’s strategy and financial results in numerous one-on-one discussions at the Company’s offices in Montabaur, as well as at roadshows and conferences in Germany, France, UK, Spain, Switzerland, and the USA. Over 20 national and international investment banks are in contact with the Company’s Investor Relations department and publish regular studies and comments on the Company’s progress and share performance. Apart from such one-on-one meetings, shareholders and potential future investors can also receive the latest news on the Company around the clock via the Company’s website (www.united-internet.de).

Liquidity and finance

The Group’s financial strategy is primarily geared to the strategic business plans of its operating business units. In order to provide sufficient flexibility for further growth, United Internet therefore constantly monitors trends in funding opportunities arising on the financial markets. Various options for funding and potential for optimizing existing financial instruments are regularly reviewed. The main focus is on ensuring sufficient liquidity and the financial independence of the Group at all times. In addition to its own financial strength, the Group maintains sufficient liquidity reserves with core banks. The flexible use of these liquidity reserves enables efficient management of Group liquidity, optimal debt management to reduce interest costs, and the avoidance of negative interest on deposits.

As of December 31, 2019, the Group’s bank liabilities amounted to € 1,738.4 million (prior year: € 1,939.1 million) and mainly comprise promissory note loansand syndicated loans.

Promissory note loans

At the end of the reporting period on December 31, 2019, total liabilities from promissory note loans with maximum terms until March 2025 amounted to € 835.5 million (prior year: € 835.5 million).

Syndicated loan facilities & syndicated loans

The Company has made use of a contractually agreed prolongation option and extended the term of its revolving syndicated loan facility totaling € 810 million agreed on December 21, 2018, by one year (originally five years) from January 2024 to January 2025.

As of December 31, 2019, € 700 million of the revolving syndicated loan facility had been drawn (prior year: € 700 million). As a result, funds of € 110 million (prior year: € 110 million) were still available to be drawn from the credit facility.

At the end of the reporting period on December 31, 2019, a syndicated loan totaling € 200 million redeemable on maturity with a term ending in August 2021 was also outstanding (prior year: € 200 million). The syndicated loan totaling € 200 million with a term until August 2019 was redeemed on schedule from current cash flow. Together with the above mentioned drawings from the revolving syndicated loan facility, total liabilities from syndicated loan facilities and syndicated loans outstanding as of the reporting period amounted to € 900 million.

In addition, a bilateral credit facility of € 200 million is available to the Company. The facility has been granted until further notice. No drawings had been made from the credit facility as at the end of the reporting period.

As of December 31, 2019, United Internet therefore had free credit lines totaling € 310 million.

The funding arranged by 1&1 Drillisch AG to participate in the 5G spectrum auction was returned in full due to an agreement made with the German government in September 2019 to pay for the acquired frequencies in installments.

Further disclosures on the various financial instruments, drawings, interest rates, and maturities are provided under point 31 of the Notes to the Consolidated Financial Statements.