2.3 Position of the Group

Earnings position

In the fiscal year 2019, the total number of fee-based customer contracts in the United Internet Group was raised by 890,000 to 24.74 million contracts. Ad-financed free accounts rose by 590,000 to 37.59 million.

Consolidated sales grew by 1.8% in the fiscal year 2019, from € 5,102.9 million in the previous year to € 5,194.1 million. In the course of its ongoing integration measures in the Consumer Access segment, United Internet adjusted the disclosed sales figures of a Group subsidiary of 1&1 Drillisch acquired in 2017, which previously recognized revenue-reducing effects as cost of sales, and brought it in line with standard Group disclosure methods in the fourth quarter of 2019. To aid comparability, revenue and cost of sales figures for the fiscal year 2018 were also adjusted. As a result, disclosed revenue and cost of sales figures for the previous year in the Consumer Access segment and at Group level were both reduced by € 27.9 million. This merely resulted in a reclassification between these two items in the statement of comprehensive income. The adjustment has no effect on the key earnings figures (EBITDA and EBIT) of the segment or the Group.

This at first glance only moderate growth was due in particular to fluctuations during the year in (low-margin) hardware sales (€ -41.9 million compared to the previous year) in the Consumer Access segment. Sales were also influenced by the ad space reduction initiated in April 2018 as part of a repositioning of the Consumer Applications segment (€ -25.4 million; prior year: € -17.0 million). Sales outside Germany improved by 8.0% from € 401.0 million to € 433.0 million.

Due to additional costs for wholesale purchases, the cost of sales rose from € 3,350.1 million (65.7% of sales) in the previous year to € 3,427.0 million (66.0% of sales). There was a corresponding decrease in the gross margin from 34.3% to 34.0%. This resulted in a 0.8% increase in gross profit from € 1,752.8 million to € 1,767.1 million.

Largely as a result of increased marketing expenses in connection with rebranding in the Business Applications segment, there was a disproportionate rise in sales and marketing expenses from € 678.2 million (13.3% of sales) in the previous year to € 741.8 million (14.3% of sales). By contrast, administrative expenses fell from € 218.9 million in the previous year (4.3% of sales) to € 205.9 million (4.0% of sales).

Multi-period overview: Development of key cost items

in € million | 2015 | 2016 | 2017 | 2018 | 2019 |

Cost of sales | 2,437.2 | 2,461.8 | 2,691.1 | 3,350.1 | 3,427.0 |

Cost of sales ratio | 65.6% | 64.6% | 64.0% | 65.7% | 66.0% |

Gross margin | 34.4% | 35.4% | 36.0% | 34.3% | 34.0% |

Selling expenses | 557.2 | 521.2 | 638.3 | 678.2 | 741.8 |

Selling expenses ratio | 15.0% | 13.7% | 15.2% | 13.3% | 14.3% |

Administrative expenses | 182.2 | 182.9 | 185.1 | 218.9 | 205.9 |

Administrative expenses ratio | 4.9% | 4.8% | 4.4% | 4.3% | 4.0% |

Other operating expenses fell from € 24.0 million to € 17.0 million, while other operating income rose from € 77.9 million to € 102.9 million. Impairment losses on receivables and contract assets amounted to € 94.2 million (prior year: € 98.5 million).

Consolidated EBITDA was positively influenced by the initial application of IFRS 16 (€ +87.0 million) in the fiscal year 2019. In addition to the one-off expenses already announced (€ -3.2 million; prior year: € -25.1 million), the regulatory decisions to reduce retail tariffs for calls and text messages to other EU countries as of May 15, 2019 (€-5.6 million) and to increase subscriber line charges as of July 1, 2019 (€ -8.8 million), as well as initial costs in connection with the planning and preparation of the 5G mobile communications network (€ -5.7 million), there were opposing effects in the Consumer Access segment in particular from additional costs (€ -83.1 million) for wholesale purchases after the time-limited adjustment mechanism of a wholesale agreement expired at the end of 2018. Contrary to original expectations, the expired arrangement could not be compensated for by a price reduction during the reporting period. However, the corresponding wholesale prices are the subject of several arbitration proceedings initiated by 1&1 Drillisch which it expects to result in binding decisions on the requested permanent price adjustments. On October 24, 2019, 1&1 Drillisch received the draft arbitration report on the first price adjustment proceedings (Price Review 1), initiated with effect from September 2017, which rejected 1&1 Drillisch’s application for the retroactive reduction of wholesale prices as of this date. The consequence of the draft arbitration report was that the financial figures for 2017 and – at least for the time being – the 2018 and 2019 results of 1&1 Drillisch would not be improved by price reductions. Moreover, the aforementioned price increase remained valid – at least for the time being – due to the expiry of the time-limited contractual adjustment mechanism at the end of 2018. In the final expert opinion received on December 19, 2019, the decision announced in the draft version was confirmed.

Apart from these additional costs, future investments (implemented as planned), such as the repositioning of the Consumer Applications segment (€ -24.3 million; prior year: € -15.9 million) and increased marketing expenses in the Business Applications segment (€ -26.7 million), had an initial negative effect on earnings. Increased marketing expenses included a one-off amount of € -19.2 million for rebranding measures (prior year: one-offs of € -16.6 million for integration projects). All in all, EBITDA rose by 5.4% in fiscal year 2019, from € 1,201.3 million to € 1,265.7 million (according to IFRS 16). Like-for-like growth according to IFRS 15 amounted to -1.9%.

Key earnings figures “below EBITDA” were influenced by various special items in the fiscal years 2018 and 2019.

- The special item “Impairment charges Tele Columbus 2018” results from the impairment of shares in Tele Columbus AG held by United Internet and disclosed in the result from associated companies. In the fiscal year 2018, it had a negative effect on EBT, net income and EPS.

- The special item “Impairment reversals Tele Columbus 2019” results from the impairment reversal of shares in Tele Columbus AG held by United Internet and disclosed in the result from associated companies. In the fiscal year 2019, it had a positive effect on EBT, net income and EPS.

- The special item “Trademark writeups STRATO 2019” results from trademark writeups on the STRATO brand and had a positive effect on EBIT, EBT, net income and EPS in the fiscal year 2019.

Reconciliation of EBIT, EBT, net income and EPS with figures adjusted for special items

in € million; EPS in € | Fiscal year 2019 | Fiscal year 2018 |

EBIT | 811.1 | 811.0 |

Trademark writeups STRATO 2019 | - 19.4 |

|

EBIT before special items (operating) | 791.7 | 811.0 |

EBT | 779.7 | 561.9 |

Trademark writeups STRATO 2019 | - 19.4 |

|

Impairment reversals Tele Columbus 2019 | - 18.5 |

|

Impairment charges Tele Columbus 2018 |

| + 203.8 |

EBT before special items (operating) | 741.8 | 765.7 |

Net income | 539.0 | 312.1 |

Trademark writeups STRATO 2019 | - 13.5 |

|

Impairment reversals Tele Columbus 2019 | - 18.5 |

|

Impairment charges Tele Columbus 2018 |

| + 203.8 |

Net income before special items (operating) | 507.0 | 515.9 |

Net income "Shareholders United Internet" | 423.9 | 188.8 |

Trademark writeups STRATO 2019 | -9.0 |

|

Impairment reversals Tele Columbus 2019 | -18.5 |

|

Impairment charges Tele Columbus 2018 |

| + 203.8 |

Net income "Shareholders United Internet" before special items (operating) | 396.4 | 392.6 |

EPS | 2.13 | 0.94 |

Trademark writeups STRATO 2019 | - 0.05 |

|

Impairment reversals Tele Columbus 2019 | - 0.09 |

|

Impairment charges Tele Columbus 2018 |

| + 1.02 |

EPS before special items (operating) | 1.99 | 1.96 |

Without consideration of the above mentioned opposing special items, the key performance measures EBIT, EBT, net income and EPS for the fiscal year 2019 developed as follows:

Due to the above mentioned burdens on earnings and one-offs, consolidated operating EBIT of € 791.7 million was down on the previous year (€ 811.0 million) and virtually unaffected by IFRS 16 accounting.

The same applies to operating earnings before taxes (EBT) and operating net income, which were also below the like-for-like figures of the previous year at € 741.8 million (prior year: € 765.7 million) and € 507.0 million (prior year: € 515.9 million), respectively.

By contrast, operating net income attributable to shareholders of United Internet AG improved from € 392.6 million to € 396.4 million.

There was a corresponding increase in operating EPS from € 1.96 to € 1.99.

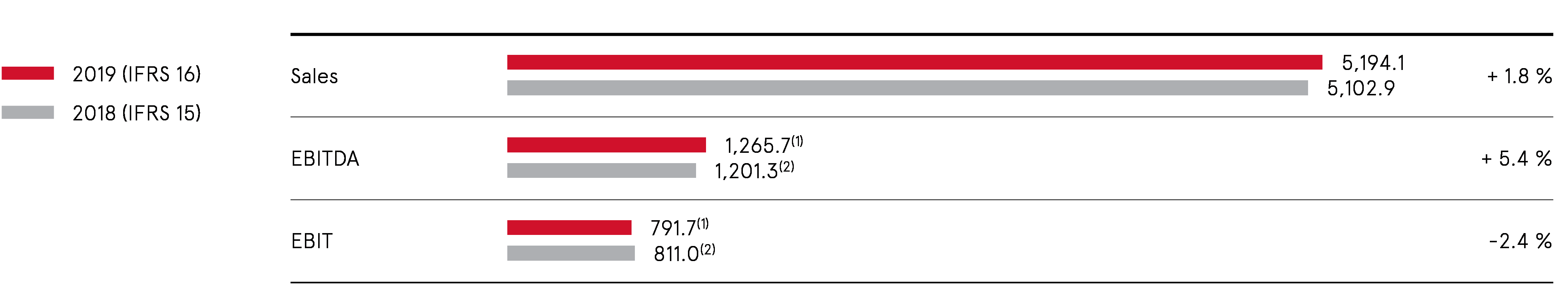

Key sales and earnings figures of the Group (in € million)

(1) Including one-off expenses for integration and rebranding projects (EBITDA and EBIT effect: € -22.4 million); excluding trademark writeups for STRATO (EBIT effect: € +19.4 million)

(2) Including one-off expenses for integration projects (EBITDA and EBIT effect: € -41.7 million)

Quarterly development; change on prior-year quarter

in € million | Q1 2019 | Q2 2019 | Q3 2019 | Q4 2019 | Q4 2018 | Change |

Sales | 1,276.5 | 1,280.0 | 1,298.5 | 1,339.1 | 1,302.5 | + 2.8% |

EBITDA | 299.7(1) | 330.3(2) | 314.0(3) | 321.7(4) | 326.7(5) | - 1.5% |

EBIT | 181.1(1) | 209.7(2) | 196.8(3) | 204.1(4) | 228.2(5) | - 10.6% |

(1) Including one-off expenses for integration and rebranding projects (EBITDA and EBIT effect: € -9.1 million)

(2) Including one-off expenses for integration and rebranding projects (EBITDA and EBIT effect: € -6.9 million)

(3) Including one-off expenses for integration and rebranding projects (EBITDA and EBIT effect: € -2.9 million)

(4) Including one-off expenses for integration and rebranding projects (EBITDA and EBIT effect: € -3.5 million); excluding trademark writeups STRATO (EBIT effect: € +19.4 million)

(5) Including one-off expenses for integration projects (EBITDA and EBIT effect: € -20.5 million)

Multi-period overview: development of key sales and earnings figures

in € million | 2015 | 2016 | 2017 | 2018 | 2019 |

Sales | 3,715.7 | 3,808.1 | 4,206.3 | 5,102.9 | 5,194.1 |

EBITDA | 757.2(1) | 835.4 | 979.6(2) | 1,201.3(3) | 1,265.7(4) |

EBITDA margin | 20.4% | 21.9% | 23.3% | 23.5% | 24.4% |

EBIT | 541.7(1) | 642.7 | 704.0(2) | 811.0(3) | 791.7(4) |

EBIT margin | 14.6% | 16.9% | 16.7% | 15.9% | 15.2% |

(1) Without one-off income from sale of Goldbach shares and part of stake in virtual minds (EBITDA and EBIT effect: € +14.0 million)

(2) Without extraordinary income from revaluation of Drillisch shares (EBITDA and EBIT effect: € +303.0 million) and revaluation of ProfitBricks shares (EBITDA and EBIT effect: € +16.1 million), as well as without M&A transaction costs (EBITDA and EBIT effect: € -17.1 million), without restructuring charges in offline sales (EBITDA and EBIT effect: € -28.3 million) and without trademark writedowns STRATO (EBIT effect: € -20.7 million)

(3) Including one-off expenses for integration projects (EBITDA and EBIT effect: € -41.7 million)

(4) Including one-off expenses for integration and rebranding projects (EBITDA and EBIT effect: € -22.4 million); excluding trademark writeups STRATO (EBIT effect: € +19.4 million)

Group’s financial position

Thanks to the positive trend in earnings, operative cash flow rose from € 889.5 million in the previous year to € 935.0 million in the fiscal year 2019.

Cash flow from operating activities in the fiscal year 2019 rose strongly from € 482.3 million in the previous year to € 828.9 million. This increase was mainly due to high prepayments to pre-service providers and a simultaneously strong increase in inventories in the previous year.

Cash flow from investing activities amounted to € 87.2 million in the reporting period (prior year: € -350.9 million). This resulted mainly from disbursements of € 252.8 million for capital expenditures (prior year: € 271.8 million). There was an opposing effect in particular from the sale of associated companies (mainly from concluding the sale of virtual minds shares already prepared in 2018) amounting to € 35.6 million (of which gain on disposal: € 21.5 million) as well as from the sale of financial assets (mainly Rocket Internet shares) totaling € 303.7 million. In addition to the aforementioned capital expenditures, cash flow from investing activities in the previous year was also shaped by the purchase of shares in affiliated companies (World4You), as well as a subsequent cash outflow from the sale of yourfone Shop GmbH.

United Internet’s free cash flow is defined as cash flow from operating activities, less capital expenditures, plus payments from disposals of intangible assets and property, plant, and equipment. As a result of the strong increasein cash flow from operating activities and lower capital expenditures, free cash flow rose from € 254.6 million (without consideration of a tax payment of € 34.7 million from fiscal year 2016) to € 607.0 million (without consideration of tax payments from fiscal year 2017 and previous years of € 22.1 million). With the initial application of the accounting standard IFRS 16, the redemption share of lease liabilities is disclosed in cash flow from financing activities as of fiscal year 2019. After deducting the cash flow item “Redemption of finance lease liabilities and rights of use” (€ -111.0 million), free cash flow amounted to € 496.0 million.

Cash flow from financing activities in the fiscal year 2019 was dominated by the purchase of treasury shares totaling € 373.6 million (prior year: € 0), net loan repayments totaling € 200.8 million (prior year: € 22.9 million), the redemption of frequency liabilities totaling € 61.3 million (prior year: € 0), the redemption of lease liabilities totaling € 111.0 million (prior year: € 25.9 million), which increased strongly as a result of IFRS 16 accounting, the dividend payment of United Internet AG totaling € 10.0 million (prior year: € 170 million), dividend payments to minority shareholders (especially the dividend of 1&1 Drillisch AG) totaling € 2.6 million (prior year: € 75.4 million), and payments to minority shareholders (especially in connection with the increased stake in 1&1 Drillisch) totaling € 98.4 million (prior year: € 15.4 million).

Cash and cash equivalents amounted to € 117.6 million as of December 31, 2019, compared to € 58.1 million on the same date in the previous year.

Multi-period overview: Development of key cash flow figures

in € million | 2015 | 2016 | 2017 | 2018 | 2019 |

Operative cash flow | 554.5 | 644.2 | 656.4 | 889.5 | 935.0 |

Cash flow from operating activities | 533.2(2) | 587.0(3) | 655.7(4) | 482.3 | 828.9 |

Cash flow from investing activities | -766.0 | -422.7 | -897.7 | -350.9 | 87.2 |

Free cash flow(1) | 300.5(2) | 423.0(3) | 424.4(4) | 254.6(5) | 496.0(6) |

Cash flow from financing activities | 23.1 | -43.2 | 312.2 | -312.6 | -857.6 |

Cash and cash equivalents on December 31 | 84.3 | 101.7 | 238.5 | 58.1 | 117.6 |

(1) Free cash flow is defined as cash flow from operating activities, less capital expenditures, plus payments from disposals of intangible assets and property, plant and equipment

(2) 2015 without consideration of a capital gains tax refund (net: € 242.7 million) and including an income tax payment originally planned for the fourth quarter of 2015 (around € 100.0 million)

(3) 2016 without consideration of the aforementioned income tax payment (€ 100.0 million)

(4) 2017 without consideration of a capital gains tax refund originally planned for the fourth quarter of 2016 (€ 70.3 million)

(5) 2018 without consideration of a tax payment from fiscal year 2016 (€ 34.7 million)

(6) 2019 without consideration of tax payments from fiscal year 2017 and previous years (€ -22.1 million); incl. the repayment portion of lease liabilities (€ 111.0 million), which have been reported under cash flow from financing activities since the financial year 2019 (IFRS 16)

Group’s asset position

In the fiscal year 2018, United Internet carried out a detailed impact assessment on accounting pursuant to IFRS 16. In summary, the effects as of January 1, 2019 from the initial application of IFRS 16 with respect to lessee contracts previously accounted for as operating leases are as follows: the Group's balance sheet total increased by approximately € 275 million as of January 1, 2019. The capitalization of right-of-use assets amounting to approximately € 275 million is opposed by the recognition of lease liabilities in almost the same amount, which were offset against deferred prepayments for leases.

The balance sheet total rose in total from€ 8.174 billion as of December 31, 2018 to € 9.086 billion on December 31, 2019. This increase is mainly due to the initial recognition of the acquired 5G spectrum, resulting in intangible assets of € 1,070.2 million and other financial liabilities of € 1,008.9 million as of December 31, 2019. Under IFRS regulations, intangible assets resulting from the acquisition are to be carried at cost and other financial liabilities at fair value.

Current assets increased slightly from € 1,364.7 million as of December 31, 2018 to € 1,371.2 million on December 31, 2019. Cash and cash equivalents disclosed under current assets increased from € 58.1 million to € 117.6 million due to closing-date effects. Trade accounts receivable fell from € 351.4 million to € 346.0 million. The item contract assets rose from € 427.0 million to € 507.8 million and includes current claims against customers due to accelerated revenue recognition from the application of IFRS 15. Inventories decreased from € 89.6 million to € 79.3 million. Current prepaid expenses rose from € 224.8 million to € 237.0 million and mainly comprise the short-term portion of expenses relating to contract acquisition and contract fulfillment according to IFRS 15. Other financial assets decreased from € 72.8 million to € 48.1 million and income tax claims from € 129.6 million to € 21.5 million.

Non-current assets increased strongly from € 6,809.2 million as of December 31, 2018 to € 7,715.2 million on December 31, 2019. Due to the earnings contribution of investments, shares in associated companies decreased from € 206.9 million to € 196.0 million. As a result of the sale of previously held shares in Rocket Internet SE, other financial assets fell from € 348.0 million to € 90.4 million. Largely as a result of the initial application of IFRS 16, property, plant, and equipment increased from € 818.0 million to € 1,118.2 million. Intangible assets rose strongly from € 1,244.6 million to € 2,167.4 million due to the above mentioned initial recognition of the acquired 5G spectrum. Goodwill remained almost unchanged at € 3,616.5 million. The item contract assets was also virtually unchanged at € 174.3 million and includes non-current claims against customers due to accelerated revenue recognition from the application of IFRS 15. Prepaid expenses decreased from € 341.2 million to € 284.3 million and mainly include the long-term portion of expenses relating to contract acquisition and contract fulfillment, as well as prepayments in connection with long-term purchasing agreements. Deferred tax assets of € 10.4 million were largely unchanged.

Current liabilities fell from € 1,299.7 million as of December 31, 2018 to € 1,269.0 million on December 31, 2019. Due to closing-date effects, current trade accounts payable decreased from € 557.7 million to € 475.5 million. Short-term bank liabilities rose from € 206.2 million to € 243.7 million as a result of reclassifying non-current to current liabilities in accordance with the maturity profile of liabilities. Income tax liabilities decreased from € 187.9 million to € 91.7 million. The item current contract liabilities was largely unchanged at € 149.9 million and mainly includes payments received from customer contracts for which the performance has not yet been completely rendered. The increase in current other financial liabilities from € 124.1 million to € 239.4 million results mainly from the initial application of IFRS 16.

Non-current liabilities increased strongly from € 2,352.6 million as of December 31, 2018 to € 3,202.6 million on December 31, 2019. Long-term bank liabilities fell significantly from € 1,733.0 million to € 1,494.6 million. Deferred tax liabilities decreased from € 389.8 million to € 351.8 million. The item non-current contract liabilities was virtually unchanged at € 34.9 million and mainly includes payments received from customer contracts for which the performance has not yet been completely rendered. The increase in non-current other financial liabilities from € 87.0 million to € 1,247.5 million resulted mainly from the above mentioned acquisition of 5G spectrum as well as from their initial recognition according to IFRS 16.

The Group’s equity capital rose from € 4,521.5 million as of December 31, 2018 to € 4,614.7 million on December 31, 2019. Due to the even stronger increase in the balance sheet total, however, the equity ratio declined from 55.3% to 50.8%.

On August 14, 2019, the Management Board of United Internet AG resolved to launch a new share buyback program. The decision was approved by the Supervisory Board. United Internet AG thus utilized the authorization issued by the Company’s Annual Shareholders’ Meeting of May 18, 2017 to buy back treasury shares representing up to 10% of the Company's capital stock at the time of the resolution or, if the amount is lower, at the time of exercising the authorization. The authorization was issued for the period up to September 18, 2020 and had not been previously utilized. In the course of the new share buyback program, up to six million Company shares (corresponding to approx. 2.93% of capital stock at the time) were to be bought back. The volume of the share buyback program amounted to € 192.0 million in total. The program was launched on August 16, 2019 and is to be completed by March 31, 2020 at the latest by buying shares back via the stock exchange. In the course of this share buyback program, which was prematurely ended with effect from the end of December 9, 2019, a total of 3,919,999 shares were acquired at an average share price of € 29.38 and with a total volume of € 115.2 million.

At the same time as the termination of the aforementioned share buyback program, the Company’s Management Board resolved – with the approval of the Supervisory Board – to make a public share buyback offer to the shareholders of United Internet AG for a total of up to 9,000,000 shares at a price per share of € 29.65. Concurrently, Rocket Internet SE irrevocably undertook to accept United Internet AG's public share buyback offer for 8,135,804 shares held by Rocket Internet SE. In the event of an oversubscription of the Company's public share buyback offer, a proportional allocation was to be made to Rocket Internet SE. With its public share buyback offer, United Internet AG once again made use of the authorization granted by the Annual Shareholders' Meeting of May 18, 2017. In the course of the public share buyback offer of United Internet AG, a total of 8,715,524 shares were tendered to the Company by the end of the acceptance period at a price of € 29.65 and with a total volume of € 258.4 million.

As of December 31, 2019, United Internet held 17,338,513 treasury shares (December 31, 2018: 4,702,990). This corresponded to approx. 8.46% of capital stock at the time of € 205,000,000 (December 31, 2018: 2.29%).

On September 5, 2019, the United Internet subsidiary 1&1 Drillisch signed an agreement with the German Federal Ministry of Transport and Digital Infrastructure (BMVI) and the German Federal Ministry of Finance (BMF) regarding the construction of mobile communication sites in so-called “not-spots”. 1&1 Drillisch is thus helping to close existing supply gaps and improve the provision of mobile communications in rural regions by building hundreds of base stations. In return, 1&1 Drillisch benefits from an agreement that allows it to pay for the acquired 5G spectrum in installments. As a result, the license fees which were originally to be paid to the German government in 2019 and 2024 can now be spread over the period up to 2030. The credit line of originally € 2.8 billion arranged to finance the highest bids of the spectrum auction, among other things, was thus no longer required and has been “returned”. The agreement with the ministries is in line with 1&1 Drillisch’s long-term financing strategy, which is geared toward paying the major share of expenses for the construction of its own mobile communications network from current revenue.

The Group’s net bank liabilities (i.e., the balance of bank liabilities and cash and cash equivalents) fell strongly from € 1,881.1 million as of December 31, 2018 to € 1,620.8 million on December 31, 2019.

Multi-period overview: development of relative indebtedness

| 2015 | 2016 | 2017 | 2018 | 2019 |

Net bank liabilities(1) / | 1.88 | 1.98 | 1.37 | 1.57 | 1.28 |

Net bank liabilities(1) / | 3.63 | 3.88 | 4.04 | 7.39 | 3.27 |

(1) Net bank liabilities = balance of bank liabilities and cash and cash equivalents

(2) Free cash flow without consideration of a capital gains tax refund (net) of € 242.7 million (2015), an income tax payment originally due in the fourth quarter of 2015 of around € 100.0 million (2016), a capital gains tax refund originally planned for the fourth quarter of 2016 of € 70.3 million (2017), a tax payment from fiscal year 2016 of € 34.7 million (2018) and tax payments from fiscal year 2017 and previous years of € -22.1 million (2019); Free cash flow 2019 incl. the repayment portion of lease liabilities of € 111.0 million, which have been reported under cash flow from financing activities since the financial year 2019 (IFRS 16)

Further details on the objectives and methods of the Group’s financial risk management are provided under point 43 of the Notes to the Consolidated Financial Statements.

Multi-period overview: development of key balance sheet items

in € million | 2015 | 2016 | 2017 | 2018 | 2019 | ||||

Total assets | 3,885.4 | 4,073.7 | 7,605.2 | 8,173.8 | 9,088.3 | ||||

Cash and cash equivalents | 84.3 | 101.7 | 238.5 | 58.1 | 117.6 | ||||

Shares in associated companies | 468.4 | 755.5(1) | 418.0(1) | 206.9(1) | 196.0 | ||||

Other financial assets | 449.0 | 287.7(2) | 333.7(2) | 348.1(2) | 90.4(2) | ||||

Property, plant and equipment | 665.2 | 655.0 | 747.4(3) | 818.0 | 1,118.2(3) | ||||

Intangible assets | 389.5 | 369.5 | 1,408.4(3) | 1,244.6 | 2,167.4(4) | ||||

Goodwill | 1,100.1 | 1,087.7 | 3,564.1(5) | 3,612.6(5) | 3,616.5 | ||||

Liabilities due to banks | 1,536.5 | 1,760.7(6) | 1,955.8(6) | 1,939.1 | 1,738.4 | ||||

Capital stock | 205.0 | 205.0 | 205.0 | 205.0 | 205.0 | ||||

Equity | 1,149.8 | 1,197.8 | 4,048.7(7) | 4,521.5(7) | 4,614.7 | ||||

Equity ratio | 29.6% | 29.4% | 53.2% | 55.3% | 50.8% | ||||

(1) Increase due to investment in Tele Columbus (2016); decrease due to takeover and consolidation of ProfitBricks and Drillisch (2017); decrease due to Tele Columbus impairment charges (2018)

(2) Decrease due to subsequent valuation of shares in listed companies (2016); increase due to subsequent valuation of shares in listed companies (2017); increase due to subsequent valuation of shares in listed companies (2018); decrease due to sale of Rocket Internet shares (2019)

(3) Increase due to STRATO, ProfitBricks and Drillisch takeovers (2017); increase due to initial application of IFRS 16 (2019)

(4) Increase due to initial recognition of acquired 5G frequencies (2019)

(5) Increase due to STRATO, ProfitBricks and Drillisch takeovers (2017); increase due to World4You takeover (2018)

(6) Increase due to Tele Columbus investment (2016); increase due to STRATO takeover and increased stakes in Drillisch and Tele Columbus (2017)

(7) Increase due to consolidation effects in connection with the investment of Warburg Pincus in the Business Applications segment and takeover of STRATO (2017); transitional effects from initial application of IFRS 15 (2018)

Management Board’s overall assessment of the Group’s business situation

Economic growth in the main target countries of the United Internet Group during the reporting period was slower than in the previous year and also below expectations. GDP in Germany – United Internet’s most important market – grew by just 0.6%, compared to 1.5% in the previous year. With sales growth of 2.0%, the German ICT market also fell short of its prior-year growth rate of 2.2%.

With organic growth of 890,000 customer contracts to 24.74 million, a 1.8% increase in sales to € 5.194 billion and an improvement in EBITDA of 5.4% to € 1.266 billion, United Internet enjoyed further growth in fiscal year 2019 – despite some unexpected burdens on sales and earnings – and was ultimately also able to meet the targets it set itself.

This positive performance – especially when compared with the weakening macroeconomic and sector trends – highlights the benefits of United Internet’s business model based predominantly on electronic subscriptions with fixed monthly payments and contractually fixed terms. This ensures stable and predictable revenues and cash flows, offers protection against cyclical influences and provides the financial scope to win new customers, expand existing customer relationships, and grasp opportunities in new business fields and new markets – organically or via investments and acquisitions.

In the fiscal year 2019, the Company once again invested heavily in gaining and expanding customer relationships, as well as in developing new products – thus laying the basis for future growth. In addition to strengthening the foundations for its operational business, United Internet also successfully participated – via 1&1 Drillisch – in the 5G spectrum auction ending on June 12, 2019 and purchased two frequency blocks of 2 x 5 MHz in the 2 GHz band and five frequency blocks of 10 MHz in the 3.6 GHz band. By acquiring these frequencies, the foundation was laid for a successful and permanent positioning of the 1&1 Drillisch Group as Germany’s fourth mobile network provider. The Company intends to use this basis to establish a powerful mobile communications network.

The financial position of United Internet AG remained strong in fiscal year 2019. Free cash flow adjusted for tax effects remained high at € 607.0 million, or € 496.0 million after leasing (like-for-like prior-year figure: € 254.6 million). This once again underlines the Group’s ability to generate very healthy levels of cash while at the same time achieving stable and qualitative growth. Against this backdrop, the Company plans to finance the development of its own mobile communications network largely from current revenue.

As of the reporting date for the Annual Financial Statements 2019, and at the time of preparing this Management Report, the Management Board believes that the United Internet Group as a whole is well placed for its further development. It regards the financial position and performance – subject to possible special items – as positive and is optimistic about the Group’s future prospects.