Growth opportunities

In view of the dynamic market development of fiber-optic connections, mobile internet, and cloud applications, our growth opportunities are clearly apparent: universally accessible, increasingly powerful broadband connections are enabling new and more sophisticated cloud applications. These internet-based programs for end users and companies will remain our growth drivers over the coming years – both as stand-alone products in our Applications division as well as in combination with landline and mobile access products in our Access division.

With our many years of experience as an access and applications provider, our expertise in software development, the operation of networks and data centers, marketing, sales, and customer support, as well as our strong and well-known brands, and our customer relationships with millions of private users, freelancers, and small companies in Germany and abroad, we are well placed to fully exploit the expected market growth in our business fields.

Access division

In the Access division, our operations are pooled in the two segments Consumer Access and Business Access.

Consumer Access segment

The Consumer Access segment comprises our landline-based broadband products as well as our mobile internet products for private users (including the respective applications, such as home networks, online storage, telephony, or IPTV).

These internet access products are offered to our customers as subscription contracts with fixed monthly fees (and variable, volume-based charges) as well as contractually fixed terms.

With the broadband products of the 1&1 brand (especially VDSL/vectoring and fiber-optic connections), we are one of Germany’s leading suppliers.

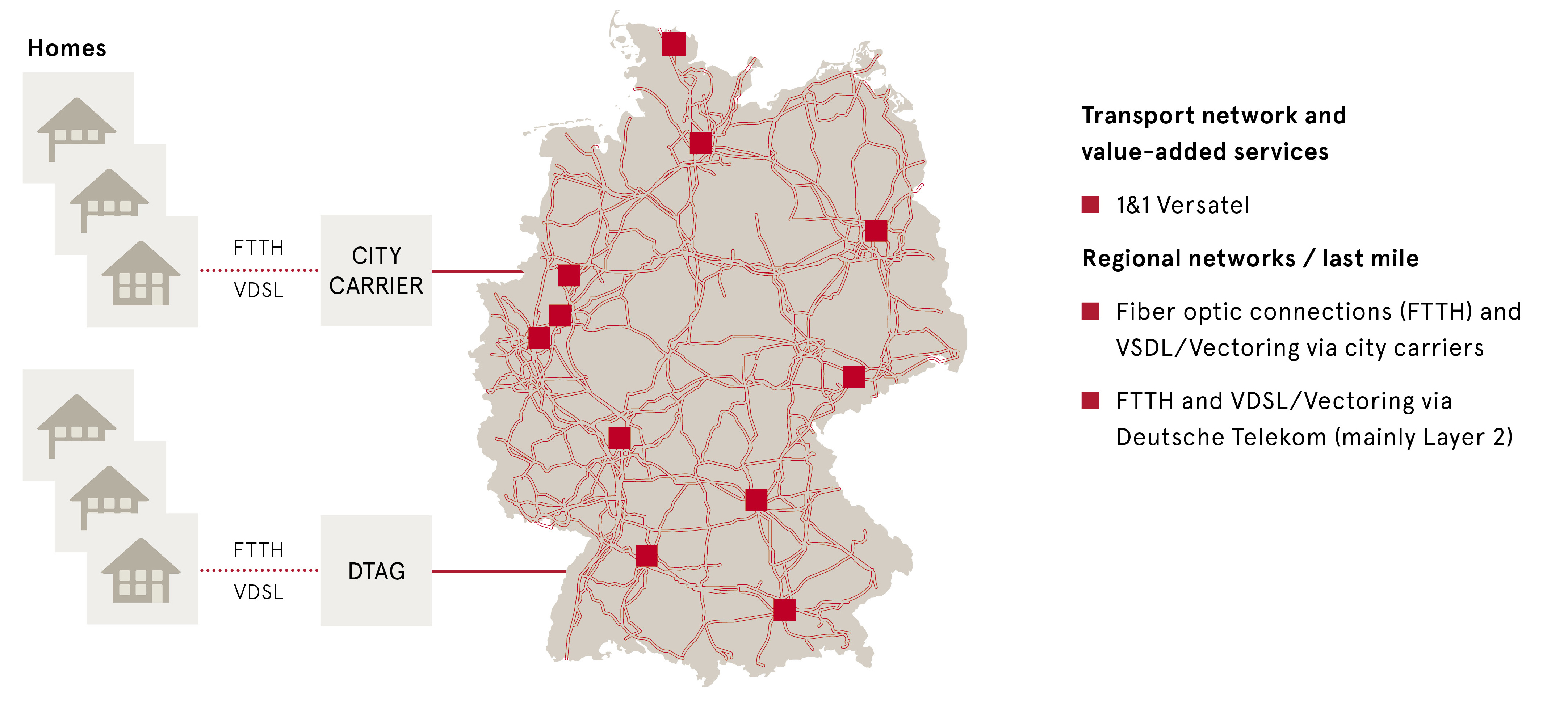

We use 1&1 Versatel’s own fiber-optic network as the transport network, and for both VDSL/vectoring connections and direct fiber-optic connections (FTTH) we use city carriers and Deutsche Telekom (mainly Layer-2) for the “last mile”. In the case of business with ADSL connections (currently being phased out), further advance service providers are used.

Landline infrastructure for private customers

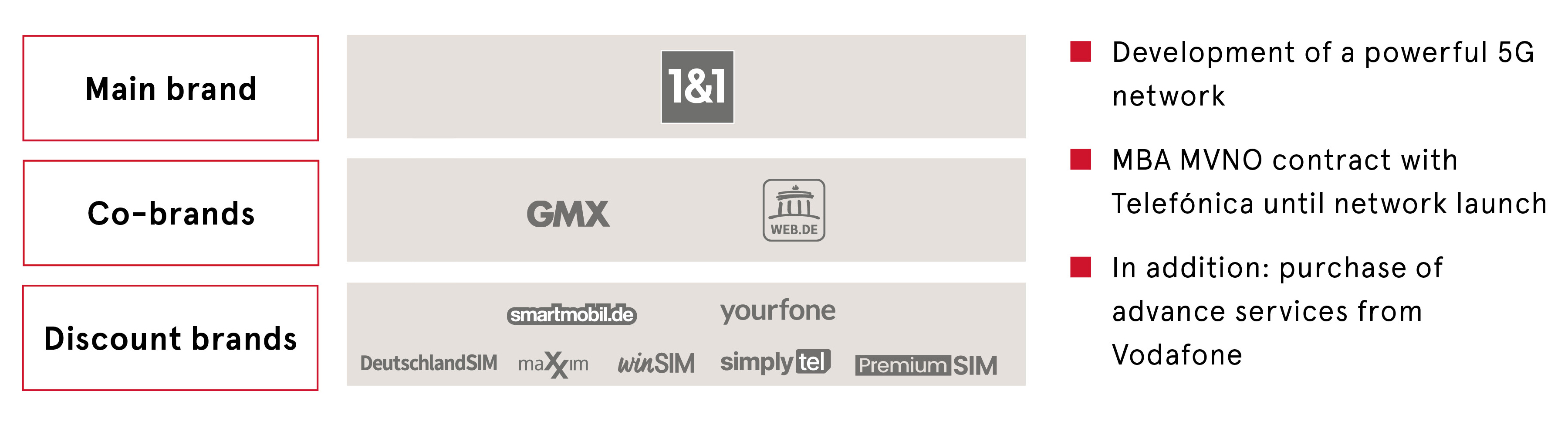

With our mobile internet products, we are the leading Mobile Virtual Network Operator (MVNO) in Germany.

We are the only MBA MVNO in Germany with long-term and guaranteed rights to up to 30% of the used network capacity of Telefónica Germany and thus have extensive access to one of the largest mobile communications networks. In addition to our privileged access to the Telefónica network, we also source mobile advance services from Vodafone.

These purchased network services are enhanced with end-user devices of major manufacturers, as well as self-developed applications and services in order to differentiate us from the competition.

Our mobile internet products are marketed via the premium brand 1&1, as well as discount brands like yourfone and smartmobile.de, which enable us to target a wide range of specific user groups in the mobile communications market.

As part of the planned rollout of a powerful 5G mobile communications network – and following our successful bid for two frequency blocks of 2 x 5 MHz in the 2 GHz band and five frequency blocks of 10 MHz in the 3.6 GHz band during the 5G spectrum auction in 2019 – we concluded long-term agreements in the fiscal years 2021 and 2022 and now have the key prerequisites in place to drive forward the rollout of the 1&1 mobile network and thus extend our added value in this market segment – as in the landline segment. Operations of the 1&1 mobile network were launched on December 28, 2022 with “1&1 5G at home” – a product positioned as an alternative to conventional DSL, cable internet, or fiber-optic house connections. Smartphone tariffs are set to follow in the third quarter of 2023, together with the scheduled provision of national roaming by Telefónica. National roaming is a standard procedure used in the rollout of new mobile networks that enables customers to surf and make calls without interruption during the construction phase of the new network – also in areas not yet covered. This is achieved by automatically using the roaming partner’s antennas in these areas.

Our brands

In addition to preparations for the establishment of its own mobile communications network, the Consumer Access segment once again focused on adding further valuable broadband and mobile internet contracts in the fiscal year 2022. Contract growth was significantly slowed by the effects of the amended German Telecommunications Act (“Telekommunikationsgesetz” -TKG), which came into force on December 1, 2021. The modernized legislation focuses on the faster rollout of FTTH and mobile networks as well as consumer protection. For example, the legislature has enshrined in law for the first time the right of citizens to high-speed internet connections and is encouraging faster network rollout with new framework conditions and simplified approval procedures. In the interests of consumer protection, the terms of contracts in particular have been regulated. As a result, contracts can now be terminated with one month’s notice at any time after expiry of the minimum contract term (generally 24 months), unless the customer expressly agrees to a contract extension.

In 2022, these legal changes (shortening of subsequent contract terms in the extension period) led to a year-on-year decline in contract growth for United Internet’s Consumer Access segment from shift effects (resulting from the shifting of contract terminations to an earlier date). This had the effect of reducing 1&1’s contract growth by -250,000 contracts in 2022.

The total number of fee-based contracts in the Consumer Access segment rose by a further 350,000 contracts (+600,000 operating growth less -250,000 contracts due to the TKG effect) to 15.78 million in 2022. Broadband connections decreased by 140,000 (-50,000 operating and -90,000 contracts due to the TKG effect) to 4.10 million, while mobile internet contracts increased by 490,000 (+650,000 operating less -160,000 contracts due to the TKG effect) to 11.68 million.

Development of Consumer Access contracts in fiscal year 2022

Consumer Access, total contracts | 15.78 | 15.43 | + 0.35 |

thereof Mobile Internet | 11.68 | 11.19 | + 0.49 |

thereof broadband connections | 4.10 | 4.24 | - 0.14 |

in million | Dec. 31, 2022 | Dec. 31, 2021 | Change |

In view of our strong brands, innovative products, customer-oriented services, flexible pricing policy, and our excellent value for money, we believe the Consumer Access segment is also very well positioned for the future. In addition to the construction of our 1&1 mobile communications network, the Consumer Access segment will focus in particular on marketing mobile internet products and winning high-quality customer relationships in the fiscal year 2023.

Business Access segment

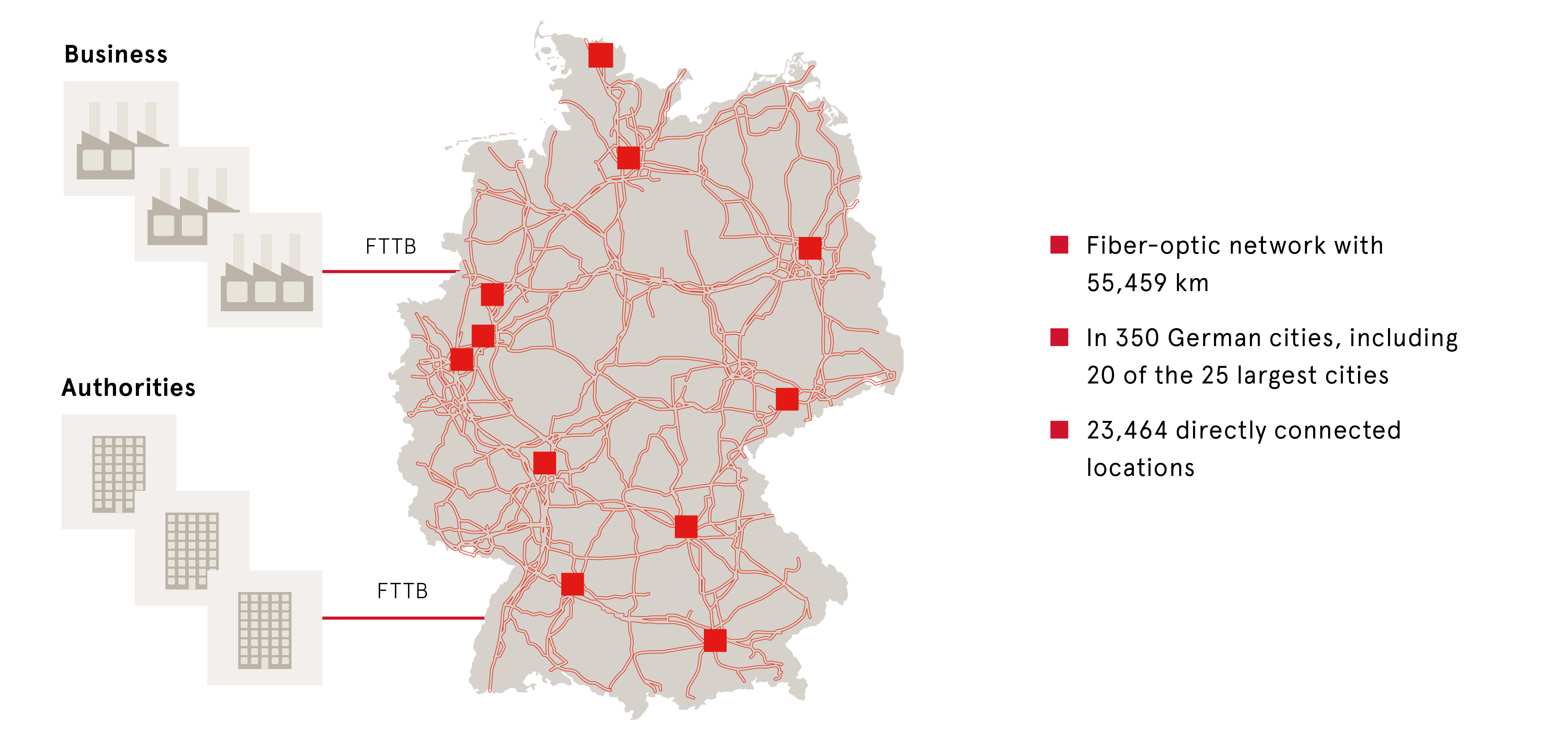

In the Business Access segment, we offer a wide range of telecommunication products and solutions for business customers via the 1&1 Versatel brand.

The core of 1&1 Versatel’s business model is a modern fiber-optic network with a length of over 55,000 km, which is one of the largest networks in Germany a nd is constantly being expanded.

Via this network, 1&1 Versatel offers its business customers telecommunication products – from fiber-optic direct connections to tailored ICT solutions (voice, data, and network solutions). In addition, the 1&1 fiber-optic network is used for infrastructure services (wholesale) for national and international carriers and ISPs (Internet Service Providers).

The fiber-optic network directly connects commercial buildings and local authority sites (FTTB = fiber-to-the-building).

Fiber-optic infrastructure for business customers

In the fiscal year 2022, the key topics in the Business Access segment were the expansion of the fiber-optic network and the addition of further sites. The network was expanded from 52,574 km in the previous year to a length of 55,459 km, while the number of connected sites increased from 21,738 to 23,464.

In 2023, the Business Access segment will continue to expand its fiber-optic network and connect further locations. In addition, the business customer and wholesale business are to be further developed.

The development of the German telecommunications market is of particular importance for the Access division. The industry association Bitkom forecasts that the market’s moderate growth of the previous year will continue. Specifically, the market is likely to grow by 0.9% (prior year: 1.3%) to € 69.5 billion in 2023.

Sales of end-user devices such as smartphones are likely to grow by 2.3% (prior year: 1.8%) to € 12.1 billion thanks to rising demand for high-quality devices in the premium segment and devices with 5G capabilities.

By contrast, business with telecommunications services is stagnating, with sales of € 49.7 billion according to Bitkom calculations – corresponding to minimal growth of 0.1% (prior year: 0.3%). According to Bitkom estimates, sales of telecommunications services are unlikely to grow at present – despite higher bandwidths, more data volumes and rising usage – in view of the current fierce price competition.

Market forecast: telecommunications market in Germany

Sales | 69.5 | 68.9 | + 0.9% |

in € billion | 2023e | 2022 | Change |

Source: Bitkom, January 2023

Applications division

The Applications division comprises United Internet’s activities in the two segments Consumer Applications and Business Applications.

Consumer Applications segment

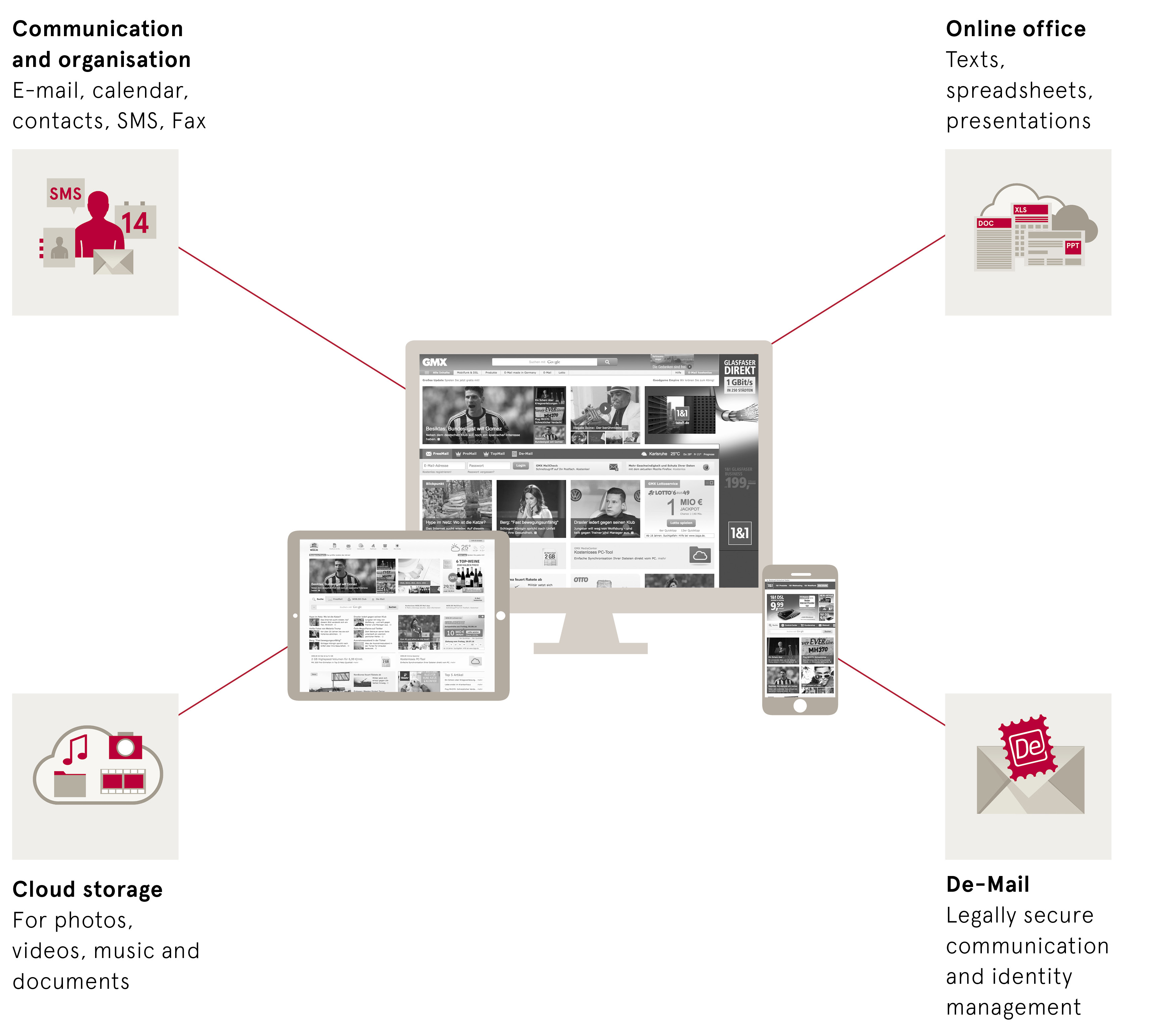

Our applications for home users are pooled in the Consumer Applications segment. These mainly comprise Personal Information Management applications (e-mail, to-do lists, appointments, addresses) and online storage (cloud), as well as domains, website solutions tailored to consumer needs, and office software.

By steadily expanding our portfolio, we have developed the GMX and WEB.DE brands – the most widely used e-mail providers in Germany for many years now – from pure e-mail service providers into complete command centers for communication, information, and identity management.

From e-mail service to command center for communication, information, and identity management

Our consumer applications are nearly all developed in-house and run at the Group’s own data centers. The products are offered as fee-based subscriptions (pay accounts) or in the form of ad-financed accounts (free accounts). These free accounts are monetized via classic – but increasingly also via data-driven – online advertising, which is marketed by United Internet Media.

Our ad-financed applications and fee-based consumer applications are marketed actively via the GMX and WEB.DE brands primarily in Germany, Austria, and Switzerland, where we are among the leading players.

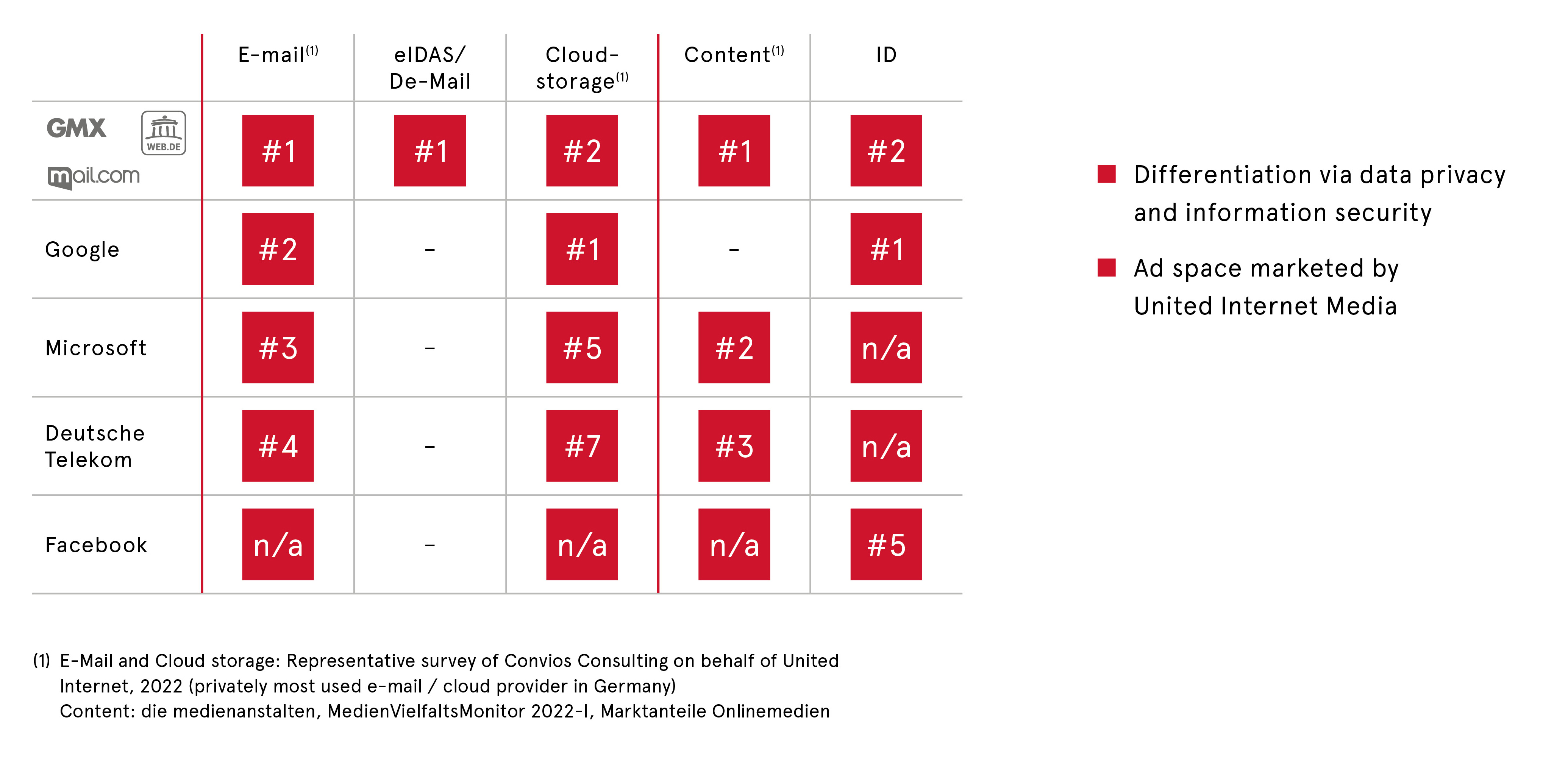

Market standing in Germany

Since the acquisition of the US provider mail.com, we have been driving our international expansion in this segment. In addition to the USA, mail.com targets other countries, such as the UK, France, and Spain.

Activities in the Consumer Applications segment focused on the establishment of data-driven business models and expansion of customer relationships in 2022. The number of fee-based pay accounts (contracts) rose by 120,000 to 2.64 million. Ad-financed free accounts increased by 40,000 to 40.31 million. The total number of Consumer Applications accounts therefore increased by 160,000 to 42.95 million.

Development of Consumer Applications accounts in fiscal year 2022

Consumer Applications, total accounts | 42.95 | 42.79 | + 0.16 |

thereof with Premium Mail subscription | 1.89 | 1.77 | + 0.12 |

thereof with Value-Added subscription | 0.75 | 0.75 | 0.00 |

thereof free accounts | 40.31 | 40.27 | + 0.04 |

in million | Dec. 31, 2022 | Dec. 31, 2021 | Change |

With its strong and specialized brands, constantly growing portfolio of cloud applications, and already established business relationships with millions of home users, our Consumer Applications segment is well positioned to exploit emerging opportunities in the cloud computing market for home users, as well as in the advertising-oriented big data business.

In the fiscal year 2023, the key topics will be the further expansion of data-driven business models and a focus on fee-based premium products.

Business Applications segment

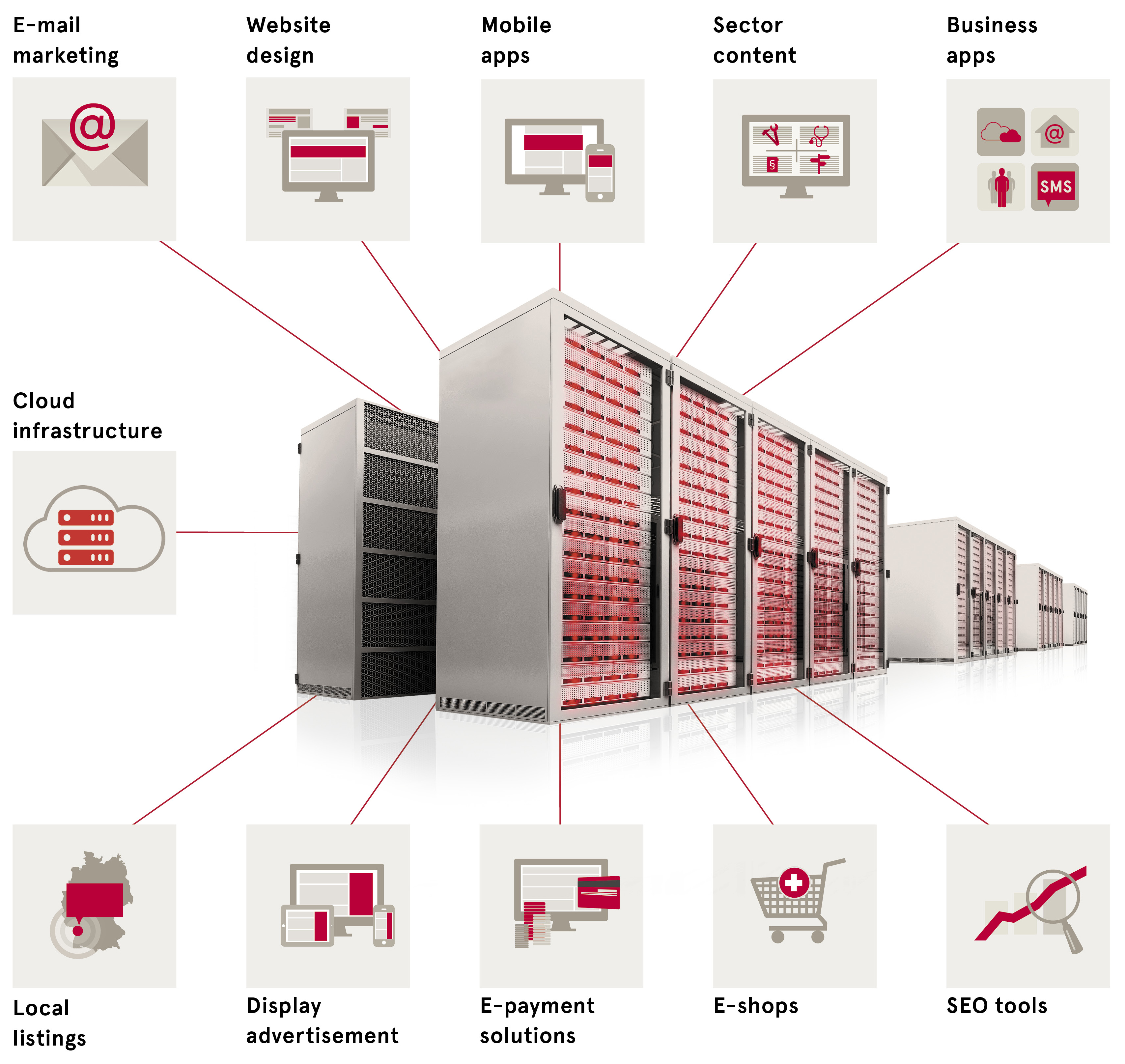

In the Business Applications segment, we open up online business opportunities for freelancers and SMEs, while also helping them to digitize their processes. We do this by offering a comprehensive range of powerful applications, such as domains, websites, web hosting, servers, e-shops, group work, online storage (cloud), and office software, which our customers can use via subscription agreements. In addition, cloud solutions and cloud infrastructure are offered.

Based on our tried and tested, million-selling hosting packages, our product range has been expanded over the past few years with the addition of numerous cloud-based e-business solutions.

From web host to e-business solutions provider

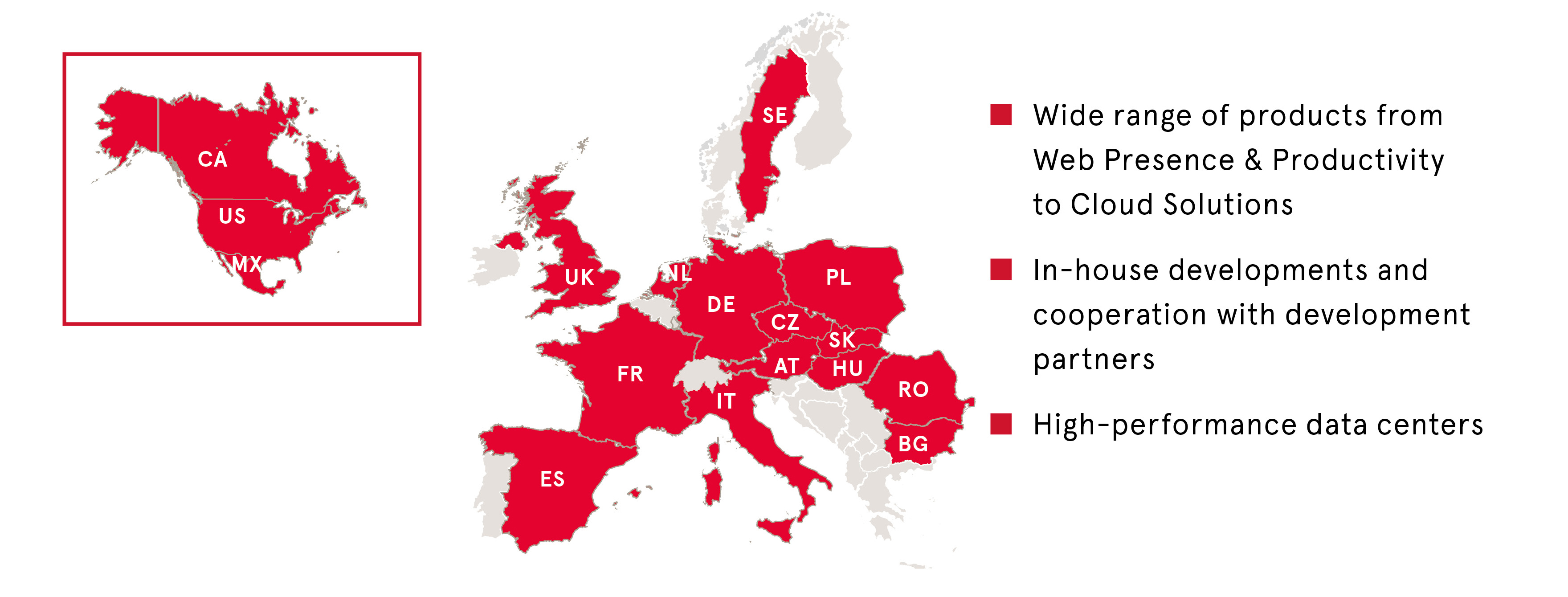

Our business applications are developed at in-house development centers or in cooperation with partner firms. We are also a leading global player in this segment with activities in various European countries (Germany, France, the UK, Spain, Portugal, Italy, the Netherlands, Austria, Poland, Hungary, Romania, Bulgaria, Czech Republic, Slovakia, and Sweden), as well as in North America (Canada, Mexico, USA).

International footprint

Our business applications are marketed to specific target groups via the differently positioned brands IONOS, Arsys, Fasthosts, home.pl, InterNetX, STRATO, united-domains, and World4You. In addition, we offer our customers professional services in the field of active domain management via the Sedo brand, while we22 offers other hosting suppliers a white-label website builder for the creation of high-quality websites.

In 2022, the Business Applications segment focused on the sale of additional features to existing customers (e.g., further domains, e-shops, and business apps), as well as the acquisition of new customer relationships. The total number of fee-based contracts for business applications increased by 260,000 contracts, resulting from 170,000 new contracts in Germany and 90,000 abroad. The total number of contracts therefore rose to 9.04 million.

Development of Business Applications contracts in the fiscal year 2022

Business Applications, total contracts | 9.04 | 8.78 | + 0.26 |

thereof in Germany | 4.43 | 4.26 | + 0.17 |

thereof abroad | 4.61 | 4.52 | + 0.09 |

in million | Dec. 31, 2022 | Dec. 31, 2021 | Change |

With our strong and specialized brands, a steadily growing portfolio of cloud applications, and existing relationships with millions of home users, freelancers, and small businesses, we are also well positioned in our Business Applications segment. We aim to further exploit the opportunities offered by the cloud computing market for business clients – in Germany and abroad. As well as raising brand awareness, the segment will continue to focus on expanding business with existing customers and gaining new high-quality customer relationships in 2023. It also aims to expand its cloud business in particular.

The trend toward the increasing use of cloud applications is working in favor of our Applications division – both for Consumer and Business Applications.

Following the strong growth of 2022 (18.8%), Gartner forecasts global growth for public cloud services of 20.7% from USD 490.33 billion to USD 591.79 billion in 2023.

Market forecast: global cloud computing

Global sales of public cloud services | 591.79 | 490.33 | + 20.7% |

thereof Application Infrastructure Services (PaaS) | 136.41 | 110.68 | + 23.2% |

thereof Application Services (SaaS) | 195.21 | 167.11 | + 16.8% |

thereof Business Process Services (BPaaS) | 65.15 | 60.13 | + 8.3% |

thereof Desktop as a Service (DaaS) | 3.10 | 2.54 | + 22.0% |

thereof Management and Security Services | 41.68 | 34.14 | + 22.1% |

thereof System Infrastructure Services (IaaS) | 150.25 | 115.74 | + 29.8% |

in $ billion | 2023e | 2022 | Change |

Source: Gartner, Public Cloud Services, Worldwide, 2020-2026, 3Q22 Update, October 2022

There are also opportunities for the refinancing of free applications via advertising. After a 12.0% increase in online advertising in 2022, PricewaterhouseCoopers also expects further growth in 2023 with an increase in total market volume (mobile advertising and desktop advertising) of 8.2% to € 14.53 billion.

Market forecast: online advertising in Germany (mobile advertising & desktop advertising)

Online advertising revenues | 14.53 | 13.43 | + 8.2% |

in € billion | 2023e | 2022 | Change |

Source: PricewaterhouseCoopers, German Entertainment and Media Outlook 2022 – 2026, August 2022