2.2 Business development

Use and definition of relevant financial performance measures

In order to ensure the clear and transparent presentation of United Internet’s business trend, the Group’s Annual Financial Statements and Interim Financial Statements include key financial performance measures – in addition to the disclosures required by International Financial Reporting Standards (IFRS) – such as EBITDA, the EBITDA margin, EBIT, the EBIT margin, and free cash flow.

United Internet defines these measures as follows:

- EBIT: Earnings before interest and taxes represents the operating result disclosed in the statement of comprehensive income.

- EBIT margin: Presents the ratio of EBIT to sales.

- EBITDA: Earnings before interest, taxes, depreciation, and amortization are calculated as EBIT/operating result plus the depreciation and amortization (disclosed in the Consolidated Financial Statements) of intangible assets and property, plant, and equipment, as well as assets capitalized in the course of company acquisitions.

- EBITDA margin: Presents the ratio of EBITDA to sales.

- Free cash flow: Calculated as cash flow from operating activities (disclosed in the consolidated financial statement), less capital expenditure for intangible assets and property, plant, and equipment, plus payments from the disposal of intangible assets and property, plant, and equipment.

Insofar as necessary for a clear and transparent presentation, these indicators are adjusted for special items and disclosed as “key operating figures” (e.g., operating EBITDA, operating EBIT and operating EPS).

Such special items usually refer solely to those effects capable of restricting the validity of the key financial performance measures with regard to the Group’s financial and earnings performance – due to their nature, frequency, and/or magnitude. All special items are presented and explained for the purpose of reconciliation from the unadjusted key financial figures to the key operating figures in the relevant section of the financial statements.

One-off amounts (such as one-offs for integration projects) or other effects (e.g., from regulation topics or growth initiatives) in the fiscal years 2020 and 2021 are not adjusted but are disclosed – if there were any – in the respective sections.

Currency-adjusted sales and earnings figures are calculated by converting sales and earnings figures with the average exchange rates of the comparative period, instead of the current period.

Actual and forecast development 2021

United Internet AG maintained its growth trajectory in the fiscal year 2021 and reached its forecast of March 2021 and its upgrade of August 2021.

Forecast development

United Internet published its guidance for the fiscal year 2021 together with its Annual Financial Statements 2020 and adjusted it during 2021 as follows:

Forecast 2021 | Increase of forecast | |

Sales | approx. € 5.5 billion | approx. € 5.6 billion |

EBITDA | approx. € 1.22 billion(1) | approx. € 1.25 billion(1) |

(1) This figure includes initial costs of approx. € 30 million (prior year: approx. € 14 million) for the 5G network rollout of 1&1 and an amount of approx € 40 million for the product and sales drive of IONOS; EBITDA forecast excluding a non-period positive effect of € 39.4 million

Actual development

In the fiscal year 2021, consolidated sales roseby 5.2%, from € 5.367 billion in the previous year to € 5.646 billion and were thus above the last forecast (August guidance: approx. € 5.6 billion) and well above the original forecast (March guidance: approx. € 5.5 billion).

Without consideration of a (non-period) positive effect on earnings (€ +39.4 million) in connection with the conclusion of the national roaming agreement with Telefónica, and additionally adjusted for a positive non-cash valuation effect from derivatives (€+ 4.9 million), operating EBITDA for the Group in the fiscal year 2021 amounted to € 1.259 billion and was thus slightly above the last forecast (August guidance: approx. € 1.25 billion) and at the same time well above the original forecast (March guidance: approx. € 1.22 billion).

EBITDA includes initial costs of € 37.9 million for the construction of 1&1’s 5G network (March guidance: approx. € 30 million), as well as € 36.8 million for a product and sales drive of IONOS (March guidance: approx. € 40 million).

Summary: actual and forecast development of business in 2021

Forecast 2021 | Increase of forecast | Actual | |

Sales | approx. € 5.5 billion | approx. € 5.6 billion | € 5.646 billion |

EBITDA | approx. € 1.22 billion | approx. € 1.25 billion | € 1.259 billion |

Further information on the above mentioned (non-period) positive effect on earnings is provided in chapter 2 “Economic report” under “Legal conditions / significant events”.

Development of divisions and segments

The Group’s operating activities are divided into the two business divisions Access and Applications, which in turn are divided into the segments Consumer Access and Business Access, as well as Consumer Applications and Business Applications.

Details on the business models of the individual segments are presented in chapter 1.1 “Business model”.

Consumer Access segment

In addition to preparations for the establishment of its own mobile communications network, the Consumer Access segment once again focused on adding further valuable broadband and mobile internet contracts in the fiscal year 2021. The total number of fee-based contracts in the Consumer Access segment rose by a further 600,000 contracts to 15.43 million in 2021. Broadband connections decreased by 70,000 to 4.24 million, while mobile internet contracts increased by 670,000 to 11.19 million.

Development of Consumer Access contracts in the fiscal year 2021

in million | Dec. 31, 2021 | Dec. 31, 2020 | Change |

Consumer Access, total contracts | 15.43 | 14.83 | + 0.60 |

thereof Mobile Internet | 11.19 | 10.52 | + 0.67 |

thereof broadband connections | 4.24 | 4.31 | - 0.07 |

Development of Consumer Access contracts in the fourth quarter of 2021

in million | Dec. 31, 2021 | Sept. 30, 2021 | Change |

Consumer Access, total contracts | 15.43 | 15.27 | + 0.16 |

thereof Mobile Internet | 11.19 | 11.01 | + 0.18 |

thereof broadband connections | 4.24 | 4.26 | - 0.02 |

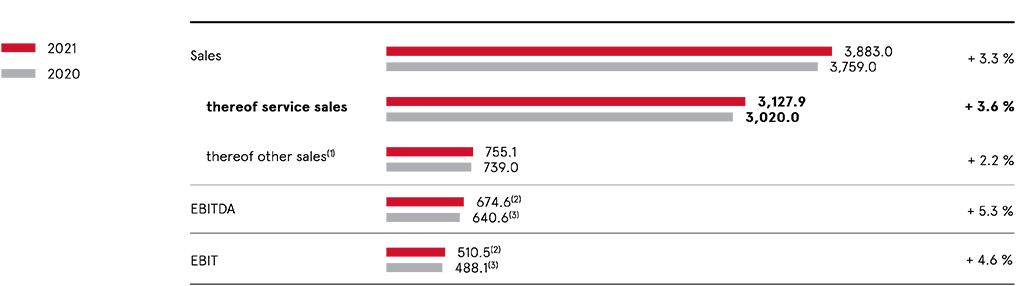

Sales of the Consumer Access segment roseby3.3% in 2021, from € 3,759.0 million in the previous year to € 3,883.0 million.

High-margin service revenues – which represent the core business of this segment – improved by 3.6% from € 3,020.0 million to € 3,127.9 million. Low-margin other revenues (mostly smartphone sales) rose by 2.2% from € 739.0 million to € 755.1 million.

EBITDA improved strongly from € 601.2 million in the previous year (excluding write-off of VDSL contingents still available (EBITDA and EBIT effect 2020: € -129.9 million)) to € 714.0 million and EBIT from € 448.7 million to € 549.9 million. Key earnings figures for 2021 include a (non-period) positive effect on earnings from the fiscal year 2020 totaling € 39.4 million, of which the third quarter of 2020 accounted for € 19.2 million and the fourth quarter of 2020 for € 20.2 million. On February 15, 2021, 1&1 accepted Telefónica Germany’s improved offer – following review by the EU Commission – for national roaming and thus also retroactively as of July 1, 2020 for the related MBA MVNO advance services. The prices offered include annually decreasing data prices again, similar to the pricing mechanisms in the first five years of the MBA MVNO agreement. The offer accepted by 1&1 was transposed into a long-term national roaming agreement with Telefónica on May 21, 2021.

Since the conclusion of the national roaming agreement, 1&1 is also entitled to decrease or increase the ordered advance service capacities within contractually agreed ranges. This has resulted in positive effects for cost of sales.

Details on the above mentioned special items are also provided in chapter 2 “Economic report” under “Legal conditions / significant events”.

After allocating the above mentioned effects to the respective periods, operatingsegment EBITDA improved by 5.3% from € 640.6 million in the previous year to € 674.6 million. Operating EBITDA includes initial costs for the construction of the Company’s own 5G network of € -37.9 million (prior year: € -13.9 million).

Operatingsegment EBITDA was also burdened by these costs and – due to increased depreciation and amortization – rose less strongly by 4.6% from € 488.1 million to € 510.5 million.

There was a corresponding improvement in the operatingEBITDA margin from 17.0% to 17.4% and in the operatingEBIT margin from 13.0% to 13.1%.

The number of employees in this segment fell slightly by 0.8% to 3,167 (prior year: 3,191).

Key sales and earnings figures in the Consumer Access segment (in € million)

(1) Mainly hardware sales

(2) Excluding the non-period positive effect on earnings attributable to the second half of 2020 (EBITDA and EBIT effect: € +39.4 million)

(3) Including the non-period positive effect on earnings in 2021 attributable to the second half of 2020 (EBITDA and EBIT effect: € +39.4 million); excluding write-off of VDSL contingents that are still available (EBITDA and EBIT effect: € -129.9 million)

Quarterly development; change over prior-year quarter

in € million | Q1 2021 | Q2 2021 | Q3 2021 | Q4 2021 | Q4 2020 | Change |

Sales | 965.9 | 950.3 | 964.3 | 1,002.5 | 966.2 | + 3.8% |

thereof service sales | 762.2 | 779.5 | 794.1 | 792.1 | 762.3 | + 3.9% |

thereof other sales(1) | 203.7 | 170.8 | 170.2 | 210.4 | 203.9 | + 3.2% |

EBITDA | 168.4(2) | 168.6(3) | 176.9 | 160.7 | 162.8(4) | - 1.3% |

EBIT | 128.9(2) | 129.3(3) | 134.9 | 117.4 | 123.2(4) | - 4.7% |

(1) Mainly hardware sales

(2) Excluding the non-period positive effect on earnings from the second half of 2020 (EBITDA and EBIT effect: € +34.4 million)

(3) Excluding the non-period positive effect on earnings from the second half of 2020 (EBITDA and EBIT effect: € +5.0 million)

(4) Including the non-period positive effect on earnings in 2021, partly attributable to the fourth quarter of 2020 (EBITDA and EBIT effect: € +20.2 million); excluding non-cash write-off of VDSL contingents still available (EBITDA and EBIT effect: € -129.9 million)

Multi-period overview: Development of key sales and earnings figures

in € million | 2017 | 2018 | 2019 | 2020 | 2021 |

Sales | 2,781.6 | 3,600.8 | 3,647.5 | 3,759.0 | 3,883.0 |

thereof service sales | 2,631.0 | 2,854.4 | 2,943.0 | 3,020.0 | 3,127.9 |

thereof other sales(1) | 150.6 | 746.4 | 704.5 | 739.0 | 755.1 |

EBITDA | 541.2(2) | 719.3 | 686.6 | 640.6(3) | 674.6(4) |

EBITDA margin | 19.5% | 20.0% | 18.8% | 17.0% | 17.4% |

EBIT | 471.4(2) | 560.6 | 536.1 | 488.1(3) | 510.5(4) |

EBIT margin | 16.9% | 15.6% | 14.7% | 13.0% | 13.1% |

(1) Mainly hardware sales

(2) Excluding the extraordinary income from revaluation of Drillisch shares (EBITDA and EBIT effect: € +303.0 million) and excluding restructuring charges in offline sales (EBITDA and EBIT effect: € -28.3 million)

(3) Including the non-period positive effect on earnings in 2021 attributable to the second half of 2020 (EBITDA and EBIT effect: € +39.4 million); excluding write-off of VDSL contingents that are still available (EBITDA and EBIT effect: € -129.9 million)

(4) Excluding the non-period positive effect on earnings attributable to the second half of 2020 (EBITDA and EBIT effect: € +39.4 million)

In addition to its good operating results, further progress was achieved with the planned mobile communications network in 2021. After its successful bid for two frequency blocks of 2 x 5 MHz in the 2 GHz band and five frequency blocks of 10 MHz in the 3.6 GHz band during the 5G spectrum auction in 2019, 1&1 concluded long-term agreements in the fiscal year 2021 and now has all key elements in place to drive forward the rollout of its own 5G mobile communications network and thus extend its added value in this market – as in its landline market.

These agreements include the national roaming agreement between 1&1 and Telefónica concluded on May 21, 2021, which secures nationwide mobile coverage for 1&1 customers during the construction phase of its own network through shared use of the Telefónica network, as well as the partnership announced on August 4, 2021 between 1&1 and Rakuten for the joint construction of Europe’s first fully virtualized mobile network based on the innovative OpenRAN technology. In addition, 1&1 signed an intercompany agreement with its affiliate 1&1 Versatel on December 9, 2021, which in particular provides the access network (especially fiber-optic cables) and data centers for operating 1&1’s mobile network on a rental basis, and on the same date an agreement was concluded with Vantage Towers AG, one of Europe’s leading companies for radio tower infrastructure, which among other things includes the renting of Vantage antenna locations and the installation of 1&1’s 5G high-performance antennas by Vantage.

Further information on the above mentioned agreements is also provided in chapter 2 “Economic report” under “Legal conditions / significant events”.

In the fiscal year 2021, activities were also dominated by measures for the expansion of long-term fixed network coverage. These include DSL and VDSL connections, but in future also an increasing number of fiber-optic household connections (fiber-to-the-home/FTTH). In this connection, 1&1 AG entered into an agreement with its affiliate 1&1 Versatel regarding the long-term purchase of FTTH and VDSL complete packages including voice and IPTV as of April 1, 2021. At the same time, 1&1 Versatel entered into an agreement with Deutsche Telekom on the use of its FTTH and VDSL connections for households. These enable 1&1 Versatel to provide FTTH/VDSL complete packages for 1&1, as 1&1 Versatel’s nationwide fiber-optic transport network is largely connected to the local broadband networks of Deutsche Telekom.

Further information on the above mentioned agreements is also provided in chapter 2 “Economic report” under “Legal conditions / significant events”.

Business Access segment

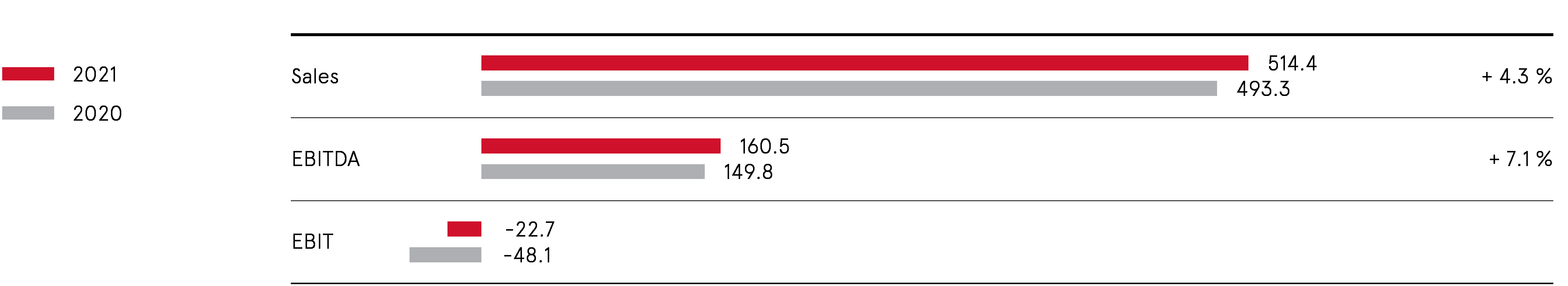

Despite the almost complete absence of one-off revenues (€ 9.4 million in 2020 vs. € 0.6 million in 2021), sales in the Business Access segment rose by 4.3% in the fiscal year 2021, from € 493.3 million in the previous year to € 514.4 million. At the same time, segment EBITDA improved by 7.1% from € 149.8 million in the previous year to € 160.5 million. This figure includes a one-off burden of € 1.1 million in connection with the new advance service agreement with Deutsche Telekom. Despite this one-off burden, the EBITDA margin rose from 30.4% to 31.2%.

Although burdened by high writedowns for network infrastructure, segment EBIT improved from € -48.1 million in the previous year to € -22.7 million.

The number of employees in this segment rose by 4.2% to 1,238 in 2021 (prior year: 1,188).

Key sales and earnings figures in the Business Access segment

Quarterly development; change over prior-year quarter

in € million | Q1 2021 | Q2 2021 | Q3 2021 | Q4 2021 | Q4 2020 | Change |

Sales | 128.3 | 130.1 | 124.3 | 131.7 | 126.7 | + 3.9% |

EBITDA | 38.2 | 40.9 | 39.7 | 41.7 | 35.5 | + 17.5% |

EBIT | -6.9 | -4.5 | -6.1 | -5.3 | -13.5 | |

Multi-period overview: Development of key sales and earnings figures

in € million | 2017 | 2018 | 2019 | 2020 | 2021 |

Sales | 447.9 | 465.9 | 476.6 | 493.3 | 514.4 |

EBITDA | 81.5 | 72.6 | 147.2 | 149.8 | 160.5 |

EBITDA margin | 18.2% | 15.6% | 30.9% | 30.4% | 31.2% |

EBIT | -40.2 | -58.1 | -51.2 | -48.1 | -22.7 |

EBIT margin | - | - | - | - | - |

Consumer Applications segment

In the Consumer Applications segment, the number of fee-based pay accounts (contracts)rose by 100,000 to 2.47 million in the fiscal year 2021. Ad-financed free accounts increased by 0.92 million to 40.32 million. The total number of Consumer Applications accounts therefore increased by 1.02 million to 42.79 million.

Development of Consumer Applications accounts in the fiscal year 2021

in million | Dec. 31, 2021 | Dec. 31, 2020 | Change |

Consumer Applications, total accounts | 42.79 | 41.77 | + 1.02 |

thereof with Premium Mail subscription | 1.72 | 1.63 | + 0.09 |

thereof with Value-Added subscription | 0.75 | 0.74 | + 0.01 |

thereof free accounts | 40.32 | 39.40 | + 0.92 |

Development of Consumer Applications accounts in the fourth quarter of 2021

in million | Dec. 31, 2021 | Sept. 30, 2021 | Change |

Consumer Applications, total accounts | 42.79 | 41.74 | + 1.05 |

thereof with Premium Mail subscription | 1.72 | 1.70 | + 0.02 |

thereof with Value-Added subscription | 0.75 | 0.75 | 0.00 |

thereof free accounts | 40.32 | 39.29 | + 1.03 |

In the fiscal year 2021, activities in the Consumer Applications segment continued to focus on the establishment of data-driven business models. In addition to the further increase in customer accounts, this transformation is also reflected in the growing success of the segment’s key financial figures.

Sales of the Consumer Applications segment, for example, improved by 10.8% from € 251.8 million in the previous year to € 279.1 million in the fiscal year 2021.

EBITDA improved from € 100.7 million in the previous year to € 122.5 million and EBIT from € 79.0 million to € 99.9 million. The segment’s key earnings figures include a non-cash positive valuation effect from derivatives of € 4.9 million (prior year: insignificant). Adjusted for this valuation effect, operating segment EBITDA rose by 16.8% from € 100.7 million to € 117.6 million and operating segment EBIT by 20.3% from € 79.0 million to € 95.0 million.

As a result, there were also significant improvements in the EBITDA margin from 40.0% to 42.1% and in the EBIT margin from 31.4% to 34.0%.

The number of employees in this segment was largely unchanged at 1,004 (prior year: 1,005).

Key sales and earnings figures in the Consumer Applications segment (in € million)

(1) Excluding a non-cash valuation effect from derivatives (EBITDA and EBIT effect: € +4.9 million)

Quarterly development; change over prior-year quarter

in € million | Q1 2021 | Q2 2021 | Q3 2021 | Q4 2021 | Q4 2020 | Change |

Sales | 65.3 | 68.9 | 65.9 | 79.0 | 70.9 | + 11.4% |

EBITDA | 25.7(1) | 29.5(1) | 25.3(1) | 37.1(1) | 31.2 | + 18.9% |

EBIT | 20.3(1) | 23.7(1) | 19.6(1) | 31.4(1) | 24.6 | + 27.6% |

(1) Excluding a non-cash valuation effect from derivatives (EBITDA and EBIT effect: € +0.2 million in Q1 2021; € +0.7 million in Q2 2021; € +2.1 million in Q3 2021; € +1.9 million in Q4 2021)

Multi-period overview: Development of key sales and earnings figures

in € million | 2017 | 2018 | 2019 | 2020 | 2021 |

Sales(1) | 284.2 | 274.2 | 247.2 (255.0) | 251.8 | 279.1 |

EBITDA | 124.0 | 112.8 | 103.6 | 100.7 | 117.6(2) |

EBITDA margin | 43.6% | 41.1% | 41.9% | 40.0% | 42.1% |

EBIT | 112.1 | 100.8 | 85.9 | 79.0 | 95.0(2) |

EBIT margin | 39.4% | 36.8% | 34.7% | 31.4% | 34.0% |

(1) Sales in 2019 after changing from gross to net presentation of third-party marketing revenues in 2020; the gross amount disclosed in 2019 is shown in brackets; 2017 - 2018 reported unchanged on a gross statement

(2) Excluding a non-cash valuation effect from derivatives (EBITDA and EBIT effect: € +4.9 million)

Business Applications segment

The number of fee-based Business Applications contracts was increased by a further 330,000 contracts in the fiscal year 2021. This growth resulted from 200,000 contracts in Germany and 130,000 contracts abroad. As a result, the total number of contracts rose to 8.78 million. This growth includes around 7,500 contracts from the takeover of we22 (consolidated since February 1, 2021).

Development of Business Applications contracts in the fiscal year 2021

in million | Dec. 31, 2021 | Dec. 31, 2020 | Change |

Business Applications, total contracts | 8.78 | 8.45 | + 0.33 |

thereof in Germany | 4.26 | 4.06 | + 0.20 |

thereof abroad | 4.52 | 4.39 | + 0.13 |

Development of Business Applications contracts in the fourth quarter of 2021

in million | Dec. 31, 2021 | Sept. 30, 2021 | Change |

Business Applications, total contracts | 8.78 | 8.69 | + 0.09 |

thereof in Germany | 4.26 | 4.21 | + 0.05 |

thereof abroad | 4.52 | 4.48 | + 0.04 |

Sales of the Business Applications segment rose by 12.0% in the fiscal year 2021, from € 948.6 million in the previous year to € 1,062.8 million, and thus passed the 1-billion-euro-mark for the first time. The Sedo business (domain trading platform and domain parking) contributed 5.2 percentage points to this sales growth.

As expected, segment EBITDA fell by 4.0% from € 328.3 million to € 315.3 million due to the “investments” made by IONOS amounting to € -36.8 million for the announced product and sales drive focusing on cloud business and further international expansion.

Segment EBIT was also burdened by these investments and decreased more strongly by 6.5% from € 229.2 million to € 214.2 million due to higher depreciation and amortization.

There was a corresponding decline in the EBITDA margin and EBIT margin from 34.6% to 29.7% and from 24.2% to 20.2%, respectively.

The number of employees in this segment rose by 10.1% to 3,998 in 2021 (prior year: 3,631). This strong increase was mainly due to the takeover of we22 AG and its approx. 160 employees (as of February 1, 2021), as well as the significant increase in headcount in the segment’s international business.

Key sales and earnings figures in the Business Applications segment (in € million)

Quarterly development; change over prior-year quarter

in € million | Q1 2021 | Q2 2021 | Q3 2021 | Q4 2021 | Q4 2020 | Change |

Sales | 256.2 | 258.2 | 260.5 | 287.9 | 241.3 | + 19.3% |

EBITDA | 79.2 | 84.1 | 78.9 | 73.1 | 73.7 | - 0.8% |

EBIT | 54.1 | 60.0 | 53.9 | 46.2 | 50.2 | - 8.0% |

Multi-period overview: Development of key sales and earnings figures

in € million | 2017 | 2018 | 2019 | 2020 | 2021 |

Sales | 762.1 | 841.8 | 890.6 | 948.6 | 1,062.8 |

EBITDA | 247.3 | 290.4 | 306.2 | 328.3 | 315.3 |

EBITDA margin | 32.4% | 34.5% | 34.4% | 34.6% | 29.7% |

EBIT | 175.4 | 202.1 | 201.4(1) | 229.2 | 214.2 |

EBIT margin | 23.0% | 24.0% | 22.6% | 24.2% | 20.2% |

(1) Excluding trademark writeups Strato (EBIT effect: € +19.4 million)

In addition to its successful operating business, IONOS continued to strengthen its position with the acquisition of we22 AG in early 2021. we22 develops software for the creation, maintenance, and hosting of websites. The company is best-known for its white-label website builder CM4all. With over 25 language versions, CM4all has been an essential part of the product offering of over 50 hosting providers worldwide since 2000. Under its Web4Business brand, we22 also offers website creation and online marketing services for small businesses and freelancers in Germany. we22's products and services will also be made available to IONOS customers in the future. CM4all will continue to be offered as a white-label solution for other internet providers and business customers.

Group investments

United Internet continued to optimize its investment portfolio in the fiscal year 2021.

In the course of these optimization measures, United Internet acquired a 40% stake in Kublai GmbH and in this connection contributed the shares it held in the (at that time still) listed Tele Columbus AG to Kublai. In the Business Applications segment, a 25.10% stake in Stackable GmbH was acquired (via IONOS SE).

Significant changes in investments

Investment in Kublai and contribution of Tele Columbus shares

As the former anchor investor in Tele Columbus AG, United Internet AG announced on December 21, 2020 that, together with Morgan Stanley Infrastructure Partners, it would provide sustained support for the implementation of Tele Columbus’s Fiber Champion strategy.

In a first step, Kublai GmbH (a bidding company backed by Morgan Stanley) submitted a voluntary public takeover offer for Tele Columbus shares. After the successful completion of the takeover bid, United Internet contributed its Tele Columbus shares to Kublai in April 2021 and raised its stake in Kublai to 40%.

After closing the transaction and the delisting of Tele Columbus, Kublai currently holds around 94.8% of the Tele Columbus shares.

In addition, 1&1 has signed a binding preliminary agreement with Tele Columbus to use the latter’s cable/fiber-optic network as a pre-service for its broadband products, enabling it to tap further target groups via fiber-optic and, for the first time, also via cable connections.

Investment in Stackable

In December 2021, the United Internet subsidiary IONOS SE acquired a 25.10% stake in Stackable GmbH as part of a strategic partnership.

Stackable was founded by Sönke Liebau and Lars Franke in Wedel, Schleswig-Holstein, in 2020. It has developed an open source-based platform for analyzing and processing large data volumes. Stackable’s software can be used in the cloud, on the premises, or as a hybrid.

Unlike other Big Data solutions, the company’s software platform is a free and open distribution of numerous open source projects for modern data platforms. It is based on the “Infrastructure as Code” concept: users do not have to worry about the hardware platform on which their Big Data applications run.

IONOS is already using Stackable’s Big Data platform for internal applications and is planning a managed Stackable offering for its cloud customers in 2022.

IONOS and Stackable are also collaborating on the European cloud initiative Gaia-X. Both companies are consortium members of the MARISPACE-X project funded by the German Federal Ministry for Economic Affairs and Energy.

In addition to its (fully consolidated) core operating companies, and the above mentioned new investments, United Internet had the following other minority shareholdings as of December 31, 2021.

Minority holdings in partner companies

In July 2013, United Internet acquired a stake in Open-Xchange AG (main activity: e-mail and collaboration solutions). United Internet has already been working successfully with the company for many years in its Applications business. As of December 31, 2021, United Internet’s share of voting rights amounted to 25.39%. Due to realignments and restructuring by the new management, sales of Open-Xchange fell slightly in the fiscal year 2021. As a result, EBITDA is also expected to be slightly negative.

In April 2014, United Internet acquired a stake in uberall GmbH (main activity: online listings). In addition, uberall and IONOS agreed a long-term cooperation contract for the use of uberall solutions. As of December 31, 2021, the share of voting rights held by United Internet amounted to 25.10%. The decrease in the investment compared to a stake of 27.56% as of December 31, 2020 resulted on the one hand from a funding round held in 2021 which also included new shareholders, and on the other hand from the takeover of US competitor Momentfeed Inc. which also involved the granting of new shares. There was also a corresponding improvement in the company’s EBITDA, although it remained slightly negative as a result of the expansion of business in the USA.

In April 2017, United Internet acquired a stake in rankingCoach International GmbH (main activity: online marketing solutions). In addition to the equity stake, rankingCoach and IONOS signed a long-term cooperation agreement for IONOS SE to use the online marketing solutions of rankingCoach as part of its hosting and cloud products marketed in Europe and North America. As of December 31, 2021, the share of voting rights amounted to 31.52%. rankingCoach also achieved a noticeable increase in sales in its fiscal year 2021. There was also an improvement in the company’s EBITDA – although it also remained slightly negative.

Following the contribution of affilinet GmbH to AWIN in October 2017, United Internet also holds a stake in AWIN AG (main activity: affiliate marketing). Several United Internet subsidiaries are currently working together with AWIN and using the company’s affiliate network as part of their marketing mix. As of December 31, 2021, United Internet’s share of voting rights amounted to 20.00%. AWIN once again closed its fiscal year 2021 with strong sales growth and a further improved and strongly positive EBITDA result.

Share and dividend

Share

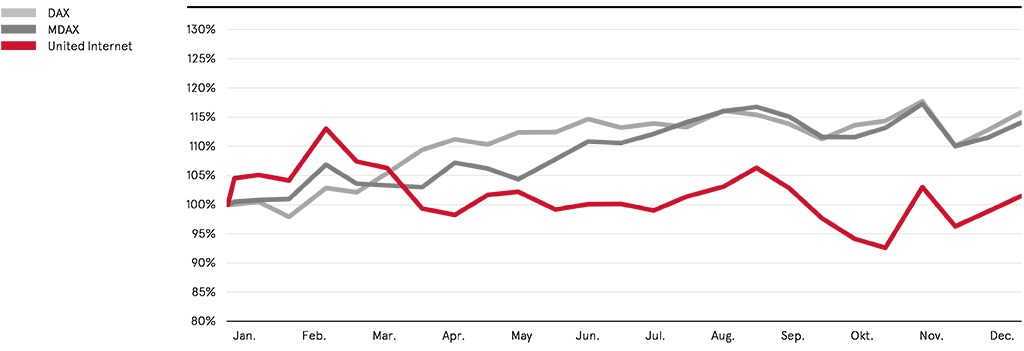

In the fiscal year 2021, the United Internet share price rose only slightly by 1.5% to € 34.94 as of December 31, 2021 (December 31, 2020: € 34.43). The share thus performed much worse than its comparative indices, which grew strongly year on year (DAX +15.8%; MDAX +14.1%).

Share performance 2021, indexed

The market capitalization of United Internet AG rose from around € 6.68 billion in the previous year to around € 6.78 billion as of December 31, 2021.

In the fiscal year 2021, average daily trading via the XETRA electronic computer trading system amounted to around 230,000 shares (prior year: around 414,000) with an average value of € 8.1 million (prior year: € 13.4 million).

Multi-period overview: share performance (in €; all stock exchange figures are based on Xetra trading)

2017 | 2018 | 2019 | 2020 | 2021 | |

Closing price | 57.34 | 38.20 | 29.28 | 34.43 | 34.94 |

Performance | + 54.6% | -33.4% | -23.4% | + 17.6% | + 1.5% |

Year-high | 59.17 | 59.80 | 40.42 | 43.88 | 39.34 |

Year-low | 37.01 | 34.14 | 24.21 | 20.76 | 31.63 |

Average daily turnover | 19,666,155 | 19,261,114 | 16,415,087 | 13,355,218 | 8,149,290 |

Average daily turnover (units) | 418,771 | 404,956 | 522,809 | 414,786 | 233,717 |

Number of shares (units) | 205 million | 205 million | 205 million | 194 million | 194 million |

Market value | 11.75 billion | 7.83 billion | 6.00 billion | 6.68 billion | 6.78 billion |

EPS(1) | 3.06 | 0.94 | 2.13 | 1.55 | 2.23 |

Adjusted EPS(2) | 2.02 | 1.96 | 1.88 | 1.87 | 2.10 |

(1) EPS from continued operations

(2) EPS from continued operations and without special items

Share data

Share type | Registered common stock |

Notional share of capital stock | € 1.00 |

German Securities Identification Number (WKN) | 508903 |

International Securities Identification Number (ISIN) | DE0005089031 |

Ticker symbol Xetra | UTDI |

Reuters ticker symbol | UTDI.DE |

Bloomberg ticker symbol | UTDI.GR |

Segment | Prime Standard |

Index | MDAX, TecDAX |

Sector | Software |

Shareholder structure (as of: February 16, 2022)

Shareholder | Shareholding |

Ralph Dommermuth | 50.26% |

United Internet (treasury stock) | 3.75% |

Flossbach von Storch | 4.99% |

Allianz Global Investors | 4.99% |

BlackRock | 3.34% |

Wellington | 3.06% |

Free float | 29.61% |

Presentation of the total positons shown above based on the most recent notification of voting rights in accordance with Sections 33 ff. of the German Securities Trading Act. Accordingly, only voting rights notifications that have reached at least the first notification threshold of 3% are taken into account. In addition, any directors' dealings announcements available to the Company have been taken into account accordingly.

Dividend

United Internet’s dividend policy aims to pay a dividend to shareholders of approx. 20-40% of adjusted consolidated net income after minority interests (adjusted consolidated net income attributable to the “shareholders of United Internet AG” – according to the consolidated statement of comprehensive income), provided that funds are not needed for further Company development.

At the (virtual) Annual Shareholders' Meeting of United Internet AG held on May 27, 2021, the proposal of the Management Board and Supervisory Board to pay a dividend of € 0.50 per share (prior year: € 0.50) for the fiscal year 2020, was approved with a majority of 99.91% of votes cast. As a consequence, a total of € 93.6 million (prior year: € 93.6 million) was distributed on June 1, 2021. The payout ratio was therefore 26.7% of the adjusted consolidated net income after minority interests for 2020 (€ 351.0 million) and thus – in view of the investments due to be made in the Company’s own mobile communications network – within the medium range of the dividend policy.

For the fiscal year 2021, the Management Board of United Internet AG will propose to the Supervisory Board a dividend of € 0.50 per share (prior year: € 0.50). The Management Board and Supervisory Board will discuss this dividend proposal at the Supervisory Board meeting on March 16, 2022 (and thus after the preparation deadline for this Management Report). The Annual Shareholders' Meeting of United Internet AG on May 19, 2022 will then vote on whether to adopt the joint proposal of the Management Board and Supervisory Board.

On the basis of around 186.7 million shares with dividend entitlement (as of December 31, 2021), the total dividend payment for fiscal year 2021 would amount to € 93.4 million. The dividend payout ratio would therefore be 23.8% of adjusted consolidated net income after minority interests for 2021 (€ 392.4 million) and thus lie – in view of the investments due to be made in the Company’s own mobile communications network – within the lower range of the dividend policy. Based on the closing price of the United Internet share on December 31, 2021, the dividend yield would be 1.4%.

Multi-period overview: dividend development

For 2017 | For 2018 | For 2019 | For 2020 | For 2021(1) | |

Dividend per share (in €) | 0.85 | 0.05 | 0.50 | 0.50 | 0.50 |

Dividend payment (in € million) | 169.9 | 10.0 | 93.9 | 93.6 | 93.4 |

Payout ratio | 26.2% | 5.3% | 22.2% | 32.2% | 22.4% |

Adjusted payout ratio(2) | 42.1% | 2.5% | 23.6% | 26.7% | 23.8% |

Dividend yield(3) | 1.5% | 0.1% | 1.7% | 1.5% | 1.4% |

(1) Subject to approval of Supervisory Board and Annual Shareholders' Meeting 2022

(2) Without special items

(3) As of: December 31

Annual Shareholders' Meeting 2021

The (virtual) Annual Shareholders' Meeting of United Internet AG was held in Frankfurt am Main on May 27, 2021. A total of 71.26% of capital stock (or 73.83% of capital stock less treasury shares) was represented. The shareholders adopted all resolutions on the agenda requiring voting with large majorities.

Capital stock and treasury shares

In an ad-hoc disclosure issued on August 6, 2021, United Internet AG announced its intention to launch a new share buyback program with a volume of up to € 160 million. The program commenced on August 10, 2021 and was to expire no later than on April 30, 2022. On September 13, 2021, the Management Board of United Internet AG resolved to prematurely suspend the share buyback program on expiry of September 13, 2021. In the course of the share buyback program, the Company purchased a total of 514,972 treasury shares at an average price of € 36.35 and with a total volume of € 18.7 million.

As at the balance sheet date of December 31, 2021, United Internet AG therefore held 7,284,109 treasury shares (approx. 3.75% of the capital stock of 194,000,000 shares) – compared to 6,769,137 treasury shares as at December 31, 2020.

Investor Relations

Continuous and transparent corporate communication with all capital market participants is important for United Internet. The Company aims to provide all target groups with timely information without discrimination. To this end, the Management Board and the Investor Relations department continued their regular discussions with institutional and private investors in the fiscal year 2021. However, the coronavirus pandemic meant that this intensive exchange was not possible to the same extent or in the same way as before. The capital market was informed via the quarterly statements, half-year financial report and annual report, press and analyst conferences, as well as via various webcasts, whereby all conferences were held virtually. This was also the case for the Annual Shareholders' Meeting, for the second year in a row. The Company’s management and Investor Relations department explained the Company’s strategy and financial results in numerous one-on-one discussions at the Company’s offices in Montabaur, as well as at virtual roadshows with mainly European and North American investors.

Apart from one-on-one meetings, shareholders and potential future investors can also receive the latest news around the clock via the Company’s extensive and bilingual website (www.united-internet.de). In addition to the publication dates of financial reports, the dates and venues of investor conferences and roadshows are made publicly available at https://www.united-internet.de/investor-relations/finanzkalender.html. Online versions of the Annual Report and Sustainability Report are also provided on the corporate website.

Personnel report

As a telecommunications and internet company, United Internet is subject to the defining characteristics of the industry: rapid change, short innovation cycles, and fierce competition. United Internet AG has risen to these challenges with great success over many years now. One of the key factors for the success and growth of the United Internet Group are its dedicated and highly competent employees and executives with their entrepreneurial and autonomous approach to work. The Company therefore attaches great importance to a sustainable and balanced strategy across all aspects of its HR activities: from employee recruitment, to targeted entry-level and vocational training formats, tailored skills training programs, support with individual career paths, through to sustainable management development programs, and the long-term retention of executives, high potentials and top performers.

United Internet AG was once again recognized as a top employer in 2021. Based on an independent study of the “Top Employers Institute”, United Internet received the “TOP Employers Germany” award – as in the preceding years. Certification is only awarded to organizations which offer staff attractive working conditions. Assessment is based on career opportunities, employer benefits, and working conditions, as well as training and development opportunities.

Headcount and personnel expenses

In the highly competitive market for skilled workers in the ICT sector, United Internet once again succeeded in recruiting top staff for its key positions and thus meeting the needs of its growing business. In addition to targeted employer branding, partnerships with education and training providers, and the positive impact of the Company’s product brands, our successful recruitment efforts center around a candidate-friendly, highly competitive acquisition and selection process.

In the fiscal year 2021, the number of employees increased year on year by 3.5%, or 337 employees, to 9,975 (prior year: 9,638). This increase was mainly due to the Business Applications segment as a result of the takeover of we22 AG and its approx. 160 employees (as of February 1, 2021), as well as the significant increase in headcount in the segment’s international business.

Headcount in Germany rose by 3.4%, or 270 employees, to 8,199 as of December 31, 2021 (prior year: 7,929). The number of employees at the Group’s non-German subsidiaries grew by 3.9%, or 67 employees, to 1,776 (prior year: 1,709).

Multi-period overview: headcount development by location(1); year-on-year change

2017 | 2018 | 2019 | 2020 | 2021 | Change | |

Employees, total | 9,414 | 9,093 | 9,374 | 9,638 | 9,975 | + 3.5% |

thereof in Germany | 7,890 | 7,567 | 7,761 | 7,929 | 8,199 | + 3.4% |

thereof abroad | 1,524 | 1,526 | 1,613 | 1,709 | 1,776 | + 3.9% |

(1) Active employees as December 31 of the respective fiscal year

From the segment perspective, there were 3,167 employees in the Consumer Access segment (prior year: 3,191), 1,238 in the Business Access segment (prior year: 1,188), 1,004 in the Consumer Applications segment (prior year: 1,005), and 3,998 in the Business Applications segment (prior year: 3,631). A further 568 people were employed at the Group’s headquarters (Corporate/HQ) (prior year: 623).

Multi-period overview: headcount development by segment(1) ; year-on-year change

2017 | 2018 | 2019 | 2020 | 2021 | Change | |

Employees, total | 9,414 | 9,093 | 9,374 | 9,638 | 9,975 | + 3.5% |

thereof Consumer Access | 3,457 | 3,150 | 3,163 | 3,191 | 3,167 | - 0.8% |

thereof Business Access | 1,069 | 1,095 | 1,184 | 1,188 | 1,238 | + 4.2% |

thereof Consumer Applications | 961 | 947 | 1,007 | 1,005 | 1,004 | - 0.1% |

thereof Business Applications | 3,586 | 3,355 | 3,416 | 3,631 | 3,998 | + 10.1% |

thereof Corporate/HQ | 341 | 546 | 604 | 623 | 568 | - 8.8% |

(1) Active employees as December 31 of the respective fiscal year

Personnel expenses rose by 9.0% to € 645.4 million in the fiscal year 2021 (prior year: € 592.3 million). The personnel expense ratio thus amounted to 11.4% (prior year: 11.0%).

Multi-period overview: development of personnel expenses; year-on-year change

in € million | 2017 | 2018 | 2019 | 2020 | 2021 | Change |

Personnel expenses | 489.0 | 538.8 | 552.8 | 592.3 | 645.4 | + 9.0% |

Personnel expense ratio | 11.6% | 10.5% | 10.6% | 11.0% | 11.4% | |

Sales per employee, based on annual average headcount, amounted to approx. € 576k in fiscal year 2021 (prior year: approx. € 565k).

Diversity

Respect for diversity is a core aspect of United Internet’s corporate culture. The reason for this is simple: only a workforce that mirrors the many different facets of society offers the best possible conditions for creativity and productivity, and makes employees – and the organization itself – unique. This unique diversity creates an incomparable wealth of potential ideas and innovations, increasing the Company’s competitiveness and providing opportunities for all.

All United Internet employees are to be treated with respect and should receive the same opportunities, regardless of their nationality, ethnic origin, religion, ideological beliefs, gender and gender identity, age, disability, or sexual orientation and identity. Each employee should be able to find the area of activity and function in which they can make the most of their individual potential and talents.

Multi-period overview: employees by gender(1)

2017 | 2018 | 2019 | 2020 | 2021 | |

Women | 31% | 32% | 32% | 32% | 33% |

Men | 69% | 68% | 68% | 68% | 67% |

(1) Active employees as December 31 of the respective fiscal year

The average age of the United Internet Group’s employees at the end of fiscal year 2021 was around 40 (prior year: 39).

Multi-period overview: employee age profile(1)

2017 | 2018 | 2019 | 2020 | 2021 | |

24% | 26% | 23% | 23% | 22% | |

30 – 39 | 36% | 38% | 34% | 33% | 33% |

40 – 49 | 27% | 25% | 27% | 27% | 27% |

≥ 50 | 13% | 11% | 16% | 17% | 18% |

(1) Active employees as December 31 of the respective fiscal year

Employees of United Internet AG work in an international environment at over 30 sites around the world.

Multi-period overview: employees by country(1)

2017 | 2018 | 2019 | 2020 | 2021 | |

Employees, total | 9,414 | 9,093 | 9,374 | 9,638 | 9,975 |

thereof Germany | 7,890 | 7,567 | 7,761 | 7,929 | 8,199 |

thereof France | 3 | 3 | 3 | 3 | 4 |

thereof UK | 232 | 216 | 233 | 251 | 251 |

thereof Austria | 5 | 37 | 43 | 44 | 65 |

thereof Philippines | 366 | 351 | 360 | 395 | 392 |

thereof Poland | 251 | 270 | 309 | 299 | 333 |

thereof Romania | 174 | 176 | 195 | 217 | 229 |

thereof Spain | 319 | 331 | 330 | 340 | 381 |

thereof USA | 174 | 142 | 140 | 160 | 121 |

(1) Active employees as December 31 of the respective fiscal year

For further information on topics such as “HR Strategy and HR Organization”, “Training and Education”, “Diversity and Equal Opportunities” and “Occupational Health and Safety”, please refer to the chapter “United Internet as an Employer” in the Sustainability Report 2021 of United Internet AG, which will be published in April 2022 (at https://www.united-internet.de/en/investor-relations/publications/reports.html).

Liquidity and finance

The Group’s financial strategy is primarily geared to the strategic business plans of its operating business units. In order to provide sufficient flexibility for further growth, United Internet therefore constantly monitors trends in funding opportunities arising on the financial markets. Various options for funding and potential for optimizing existing financial instruments are regularly reviewed. The main focus is on ensuring sufficient liquidity and the financial independence of the Group at all times. In addition to its own financial strength, the Group maintains sufficient liquidity reserves with core banks. The flexible use of these liquidity reserves enables efficient management of Group liquidity, optimal debt management to reduce interest costs, and the avoidance of negative interest on deposits.

At the end of the reporting period on December 31, 2021, the Group’s bank liabilities amounted to € 1,822.7 million (prior year: € 1,466.1 million) and mainly comprise promissory note loansand syndicated loans.

Promissory note loans

As in 2014 and 2017, United Internet successfully placed a promissory note loan (“Schuldscheindarlehen”) in its fiscal year 2021. As the transaction was significantly oversubscribed, the Company decided to raise the originally planned placement volume to an ultimate amount of € 750 million. The proceeds from this transaction are used for general company funding. The five tranches in total with terms from July 2024 to July 2027 were placed at the issuance amount and are 100% repayable. By placing mainly fixed-interest tranches, the Group naturally hedged the risk of rising interest rates and optimized the maturity profile with maturities of up to six years. The average interest rate is 0.79% p.a. The new promissory note loan is not tied to any so-called covenants.

At the end of the reporting period on December 31, 2021, total liabilities from promissory note loanswith maximum terms until July 2027 amounted to € 1,297.5 million (prior year: € 547.5 million).

Syndicated loan facilities & syndicated loans

On December 21, 2018, a banking syndicate granted United Internet AG a revolving syndicated loan facility totaling € 810 million until January 2025. In the fiscal year 2020, the Company made use of a contractually agreed prolongation option and extended the term of the revolving syndicated loan facility for the period from January 2025 to January 2026. A credit facility of € 690 million was agreed for this prolongation period. As of December 31, 2021, € 250 million of the revolving syndicated loan facility had been drawn (prior year: € 550 million). As a result, funds of € 560 million (prior year: € 260 million) were still available to be drawn from the credit facility as at the balance sheet date.

A syndicated loan totaling € 200 million still outstanding in the previous year was paid back on schedule in August 2021.

In addition, bilateral credit agreements with several banks totaling € 170 million (prior year: € 0) are available to the Company. The terms expire at the latest on January 31, 2023. These bilateral credit agreements were used in full as at the balance sheet date.

Furthermore, various bilateral credit facilities of € 375 million (prior year: € 280 million) are available to the Company. These have been granted in part until further notice and in part have terms until July 2, 2023. Drawings of € 100 million (prior year: € 165 million) had been made from the credit facilities as at the end of the reporting period.

At the end of the reporting period on December 31, 2021, United Internet therefore had free credit lines totaling € 835 million (prior year: € 375 million).

Further disclosures on the various financial instruments, drawings, interest rates, and maturities are provided under note 31 of the Notes to the Consolidated Financial Statements.

Downloads